As of October, Expensify isn’t just for expense management anymore.

This week, the company announced that it has added a new service that will enable Expensify users to leverage the platform to pay their bills, as well. For free.

“A little known fact is that Expensify was never intended to be an expense reporting company: it was always intended to be a platform for all things accounts payable and receivable,” company founder and CEO Dave Barrett wrote. “Expenses, invoices, bills — they’re all slight variations on the same thing. But the variations are so slight, there’s really no reason to Frankenstein together a bunch of financial tools to cover all your needs: Expensify is a one-stop shop for everything you need to run your back office.”

All Expensify users need to do in order to take advantage of the new service is to have their vendors send their invoices to:

Expensify will SmartScan the invoices, present them to the payer, and then send payments to the vendors from the payer’s business bank account. Expensify will also ensure that the transaction is accurately and promptly noted in the company’s accounting system, as well.

The goal is to show how Expensify serves as a small business platform rather than just an expense management solution. After all, that’s how Expensify treats it. “We’ve got hundreds of employees split between several international subsidiaries,” Barrett wrote, “thousands of vendors scattered around the world in multiple currencies, a hundred thousand customers spanning dozens of countries — and we run the whole business on Expensify.”

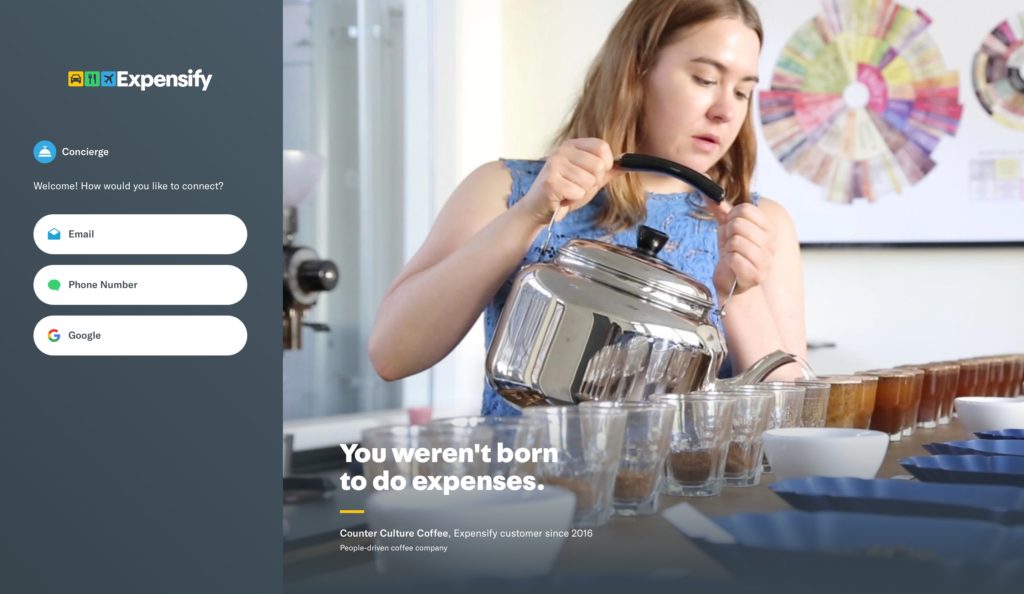

A long time Finovate alum, San Francisco, California-based Expensify has demonstrated its technology and its solutions at both our developers conference, FinDEVr, as well as at our Finovate events. Over the summer, the company unveiled its Concierge Travel solution, a virtual travel assistant that helps travelers build their itineraries and plan their trips – free of charge.

Expensify has raised more than $38 million in funding from investors including OpenView, PJC, Redpoint. The company began the year with the launch of its corporate card, the Expensify Card, that offers a special reward called Karma Points. Cardholders can use these points to make charitable donations to one of five partnering philanthropic organizations. Expensify also will donate 10% of all revenue from the card to charity, During the COVID-19 health crisis, donations are being directed to the Expensify.org/hunger fund.