- Data access and control firm Cinchy received $14.5 million in funding this week.

- The series B round was led by Forgepoint Capital and brings Cinchy’s total funding to $24.2 million.

- As part of the investment, Forgepoint Managing Director Leo Casusol and Senior Associate Reynaldo Kirton will join Cinchy’s Board of Directors.

Cinchy, a fintech that is focused on helping firms set their data free, announced this week it received $14.5 million in a Series B funding round. This brings the Canada-based company’s total funding to $24.2 million.

Led by Forgepoint Capital, the investment brings Forgepoint’s Managing Director Leo Casusol will join Cinchy’s Board of Directors. The firm’s Senior Associate Reynaldo Kirton joins the board as an advisor.

Cinchy was founded in 2017 to leverage data fabric to help banks access data from apps and other silos and assemble it within an easy-to-access data network. Today’s investment will help the company seize a recent spike in demand for data fabric and data mesh solutions.

“Our mission is to liberate and harness the power of data, giving it back to teams and organizations to accelerate digital transformation and growth,” said Cinchy CEO and Co-Founder Dan DeMers. “This latest round of funding helps us expand our team and release new offerings that include pre-built dataware solutions designed to help organizations instantly liberate both trapped data and siloed SaaS applications.”

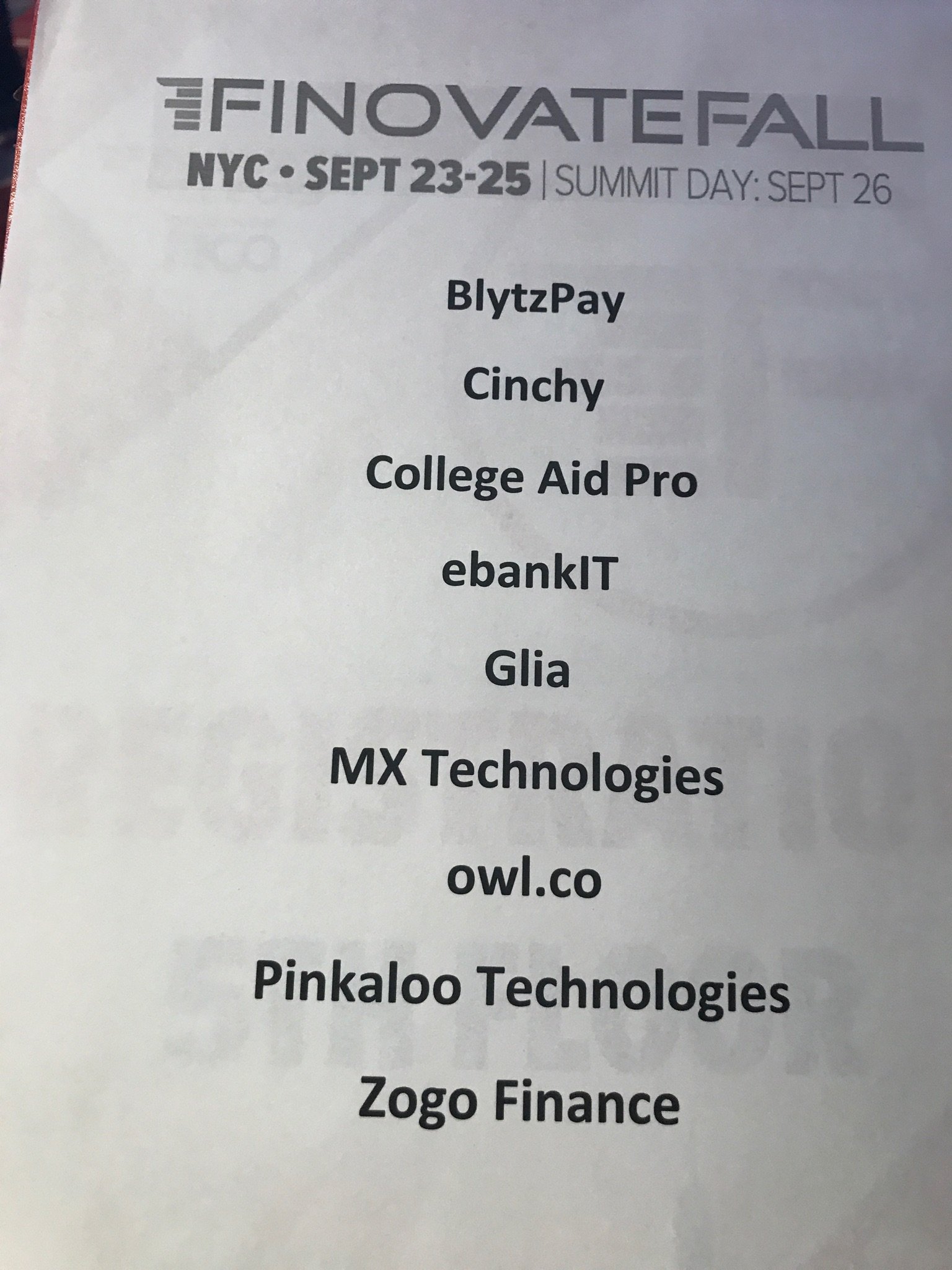

Cinchy– whose clients include TD bank, Colliers International, AIS, and Natixis– has been named a Deloitte Technology Fast 50 Company to Watch and a Top Growing Canadian Company by The Globe and Mail. The company most recently demoed at FinovateFall 2021 and won best of show for its demo at FinovateFall 2019.