![]() Monitise announced a deal with Virgin Money that will bring a host of mobile banking solutions to the UK-based retail bank.

Monitise announced a deal with Virgin Money that will bring a host of mobile banking solutions to the UK-based retail bank.

Alumni News– December 5, 2014

Greater Fort Wayne Business Weekly takes a look at Allied Payment Network and PicturePay.

Greater Fort Wayne Business Weekly takes a look at Allied Payment Network and PicturePay.

- Capital Resorts announces collaboration with Access Development.

- Bank of Georgia buys Georgian arm of Ukranian-based PrivatBank for $51 million USD.

- Live Mint features BankBazaar in a column on financial product aggregators.

- Huffington Post interviews Lisa Pearson, CMO of Bazaarvoice.

- Dwolla releases new apps for Android, iOS, and Windows.

- Finovate Debuts: SAS Games Helps Kids Save for College by Playing Games.

- ThreatMetrix Protected 10 of the Top 20 Online Retailers Against Fraud During Cyber Week.

- Segmint partners with fan and consumer engagement software company, Phizzle, to deliver 1-to-1 engagements.

- Credit Karma transitions to the VantageScore 3.0 Score provided by TransUnion.

- ID.me to authenticate Connect.gov users.

- Muthoot Finance picks FIS for ATM managed services, video surveillance, and network connectivity and switching.

SocietyOne Closes $20 Million Series B Funding Round

Australian P2P lending company, SocietyOne, closed a Series B funding round this week. The amount is officially undisclosed, but according to the Australian Financial Review, the round totals $20 million ($25 million AUD). This new installment comes just 10 months after it closed an $8.5 million round.

Contributors to the new round include Consolidated Press Holdings (CPH), News Corp Australia and Australian Capital Equity. Reinventure, the Westpac-funded venture capital manager that took a $5 million equity stake in SocietyOne in February, also helped furnish the round. Reinventure contributed another $5 million to this week’s Series B round.

The funding comes amid the buzz surrounding Lending Club’s IPO. The California-based company is expected to start trading on the NYSE next week at $10 to $12 per share valuing it at more than $4 billion (see our previous coverage here).

Lending Club’s success bodes well for SocietyOne. James Packer, a representative from SocietyOne’s new investors states, “We have seen first-hand the power of technology in reshaping the media industry and I am excited about the potential of technology, led by the team at SocietyOne, to help reshape the financial services industry in Australia.”

SocietyOne’s ClearMatch technology uses risk-based pricing to offer borrowers a rate that is up to 5% lower than bank loans. It debuted ClearMatch at FinovateAsia 2012 where it won Best of Show.

Alumni News– December 4, 2014

Intelligent Environments awarded Fairbanking certification. See Intelligent Environments demo at FinovateEurope 2015 in February.

Intelligent Environments awarded Fairbanking certification. See Intelligent Environments demo at FinovateEurope 2015 in February.

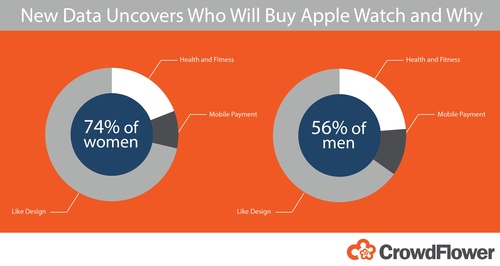

- Finovate Debuts: CrowdFlower helps businesses harness online data workers.

- Xsolla partners with BitPay to bring bitcoin payments to gaming. See Xsolla at FinovateEurope in London.

- MasterCard partners with Gates Foundation to launch innovation lab in Nairobi, Kenya.

- App Annie unveils Audience Intelligence, a solution mobile app publishers can use to learn demographic data from users.

- Access Development partners with Oklahoma Education Association.

- Yueyu Fu, co-founder and CPO at Rippleshot interviewed at Benzinga Fintech Awards.

- Intuit’s Quickbook Online Accountant is now available in the U.S.

- Ripple to plug its real-time settlement protocol into Earthport’s payments hub.

- Braintree is now rolling out its One Touch payment service outside the U.S.

- Finovera mobile app now available on Android and iOS.

- eGift Card feature added to Wipit-powered Boost Mobile.

- SocietyOne Closes Undisclosed Series B Funding Round.

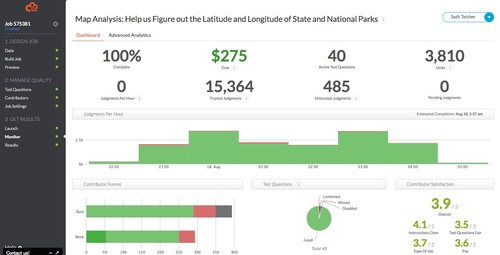

Finovate Debuts: CrowdFlower Helps Businesses Harness Online Data Workers

The Finovate Debuts series introduces new Finovate alums. CrowdFlower won Best of Show in its Finovate debut last September at FinovateFall 2014. The company’s platform automates the management of online data workers, making it easier and faster for data scientists to maintain quality control over both the process and the result.

CrowdFlower is a data-enrichment platform that enables data scientists to easily and accurately collect, clean, and label data from an online workforce.

- Founded in 2009

- Headquartered in San Francisco, California

- Raised $29 million in funding

- Operates with more than 80 employees and more than 5 million contributors

- Backed by investors including Bessemer Venture Partners and Trinity Ventures

- Customers include Bloomberg, eBay, Intuit, LinkedIn, and Microsoft

- Lukas Biewald is founder and CEO

Alumni News– December 3, 2014

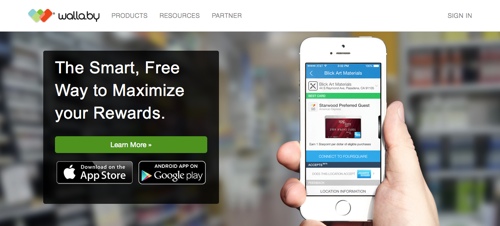

Wallaby Financial has been acquired by Bankrate.

Wallaby Financial has been acquired by Bankrate.

- iQuantifi announces million-dollar angel investment.

- LendingTree unveils its small business loan marketplace with loans from $5,000 to $1 million.

- Young Adult Money explains how to invest using Motif Investing.

- Betterment reaches 50,000 customer milestone.

- SK Planet promotes its Bluetooth Low Energy powered mileage app, Syrup, in Seoul.

- True Potential announces the launch of 15 new, open-ended investment company funds in Q1 2015.

- Bank of South Pacific to deploy ACI Proactive Risk Manager from ACI Worldwide to help protect against fraud.

- Klarna to invest $100 million over the next three years to launch its payments systems in the U.S.

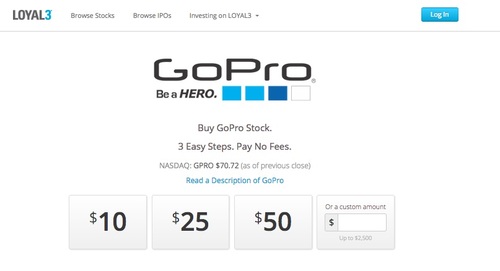

- Finovate Debuts: Loyal3’s Stock Investments Democratizes Access to Stocks and IPOs.

- Entrepreneurial Finance Lab gets a new look.

- Pymnts features conversation with Currency Cloud’s Chief Commercial Officer on how they modernize money movement.

- Coinbase now enables some customers to hold USD balances in their Coinbase wallets.

- Financial Times: Early investors to make big gains on Lending Club IPO.

- Time names Braintree’s Venmo as 1 of the top 10 apps of 2014.

- Bionym rebrands to Nymi.

- Blockchain issued a .SSL certification.

- TechVibes features Trulioo’s new design.

iQuantifi Announces Million Dollar Angel Investment

Virtual financial planning innovator and self-described “robo-advisor” iQuantifi has raised $1 million in its angel round. CEO and founder Tom White said that the investment represents a major show of support for his company’s technology.

“iQuantifi helps users identify, prioritize and achieve their financial goals, via real-time, dynamic advice,” he said. “We are very excited to have raised this angel round and we see the investor interest as validation of our cloud-based, robo-planning software platform.”

Finovate Debuts: Loyal3’s Stock Investments Democratizes Access to Stocks and IPOs

The Finovate Debuts series introduces new Finovate alums. Today’s feature is Loyal3, which demonstrated its mobile IPO investment platform at FinovateFall 2014.

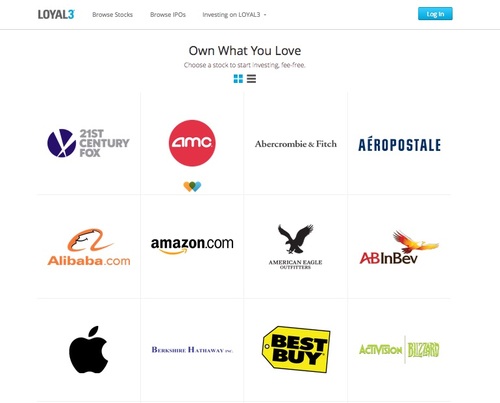

Loyal3’s stock marketplace makes it easy to invest in stocks and IPOs. The simple user interface and lack of fees appeal to novice investors. It can also serve as a great tool for those looking to invest in IPOs at the same time and price as institutional investors.

Stats:

- Founded October 2008

- 130 employees

- $75+ million in funding

Stock investing

Users start by browsing the 64 company stocks available on the platform.

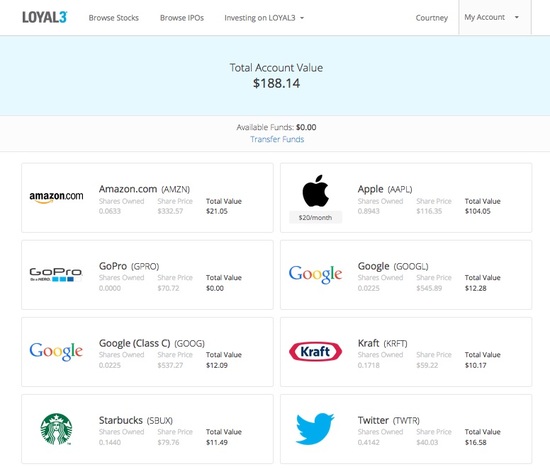

Stocks can be purchased in $10 increments. This fractional ownership allows for more diversification at a lower buy-in. If investors are feeling bullish, they have the option to purchase as much as $2,500 of a single stock.

The portfolio below shows a total of $188 divided among eight different stocks, including Apple and Amazon, which have notoriously high share prices.

Aside from the fractional share feature, Loyal3 also has:

- Zero fees to buy and sell stock

- No minimum account balances

- Easy-to-open brokerage account

- Automatic monthly investments that prompt recurring stock purchases

One of the ways Loyal3 is able to provide fee-free stock trades is by submitting orders in a batch at the end of the day. Because of the delay, the price quoted at the time the order is placed is not always the final purchase price.

IPO investing

Loyal3 offers access to IPOs at the same price and time as large investors and institutions.

Here’s how it works:

1) Reserve an IPO stock

Users choose the amount of stock they would like to purchase. However, since shares are limited, investors may not receive the full amount.

2) Confirm order

After the price of the IPO is determined, Loyal3 sends SMS and email notifications to investors and gives them two hours to confirm or cancel their order. They can invest as little as $10 and as much as $10,000 per IPO.

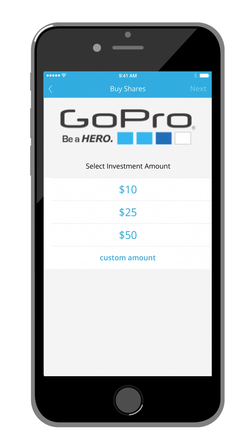

Mobile

Loyal3 launched its mobile interface at FinovateFall 2014. It provides on-the-go access to stock trading and instant IPO notifications.

Wallaby Financial Acquired by Bankrate

One of the innovators in the field of credit card reward optimization, Wallaby Financial has been acquired by online personal finance publisher, Bankrate. Terms were not disclosed.

Wallaby founder and CEO Matthew Goldman sees many advantages to being a part of Bankrate. “Their massive consumer audience, leading distribution partnerships, and financial resources will allow Wallaby to help millions of Americans acquire and use the right financial products,” he said.

Alumni News– December 2, 2014

Compass Plus TranzAxis now supports Futurex hardware security modules.

Compass Plus TranzAxis now supports Futurex hardware security modules.

- Coinbase introduces USD Wallets, enabling users to store U.S. dollar balances.

- TradeKing unveils new features for its new LIVE platform.

- Forbes column on disruption in traditional money exchange features Azimo, TransferWise, and CurrencyFair.

- CrowdFlower announces support for eight new languages and enhanced support for another four.

- CEO and co-founder of Trustev Pat Phelan wins MSL Cork Business Person of the Year award.

- Linqto, Crowd Curity, Xignite, and CUneXus win Future of Money & Technology Summit Startup Showcase.

- TickSmith adds Amazon Web Services version of its financial big data platforms.

- The New Daily features SocietyOne as a premium P2P lending option.

- The Chicago Tribune considers Lending Club’s impending IPO.

- Google Cloud Platform now PCI compliant, enabling developers to hold, process, and exchange credit card information.

Narrative Science Raises $10 Million in Round Led by USAA

Narrative Science has raised $10 million in new funding in a round led by USAA. The round included participation from previous investors Battery Ventures, Jump Capital, and Sapphire Ventures (formerly SAP Ventures), and brings the company’s total capital to more than $32 million. According to VentureWire, the investment gives Narrative Science a valuation of $100 million.

Narrative Science CEO Stuart Frankel said “our relationship with USAA will allow both companies to deliver highly-scalable solutions that will turn mountains of financial data into information that can be easily understood and acted on by millions of people.”

“Will people lose their jobs due to technology such as Quill? It’s possible. But the reality is that the technology provides substantial benefits to both organizations and individuals. And in my opinion, those that embrace this technology will hold a competitive advantage in their market sector.”

Alumni News– December 1, 2014

TechCrunch takes a look at PayPal’s plans for bitcoin integration.

TechCrunch takes a look at PayPal’s plans for bitcoin integration.

- Zopa to provide financing for Flowgroup customers.

- Azimo introduces £1 money transfers to Lithuania.

- MasterCard announces launch of MasterPass in UAE.

- Call capture technology from NICE Systems now compatible with Speakerbus iTurrent dealer board.

- FreeAgent named “Practice Software Product of the Year” at 2014 British Accountancy Awards.

- Zopa takes additional step to authenticate users.

- Adelaide Bank signs Sandstone Technology to deliver new loan origination system.

- Check Point Software launches Check Point Capsule to protect business data and mobile devices, everywhere.

- Crain’s Cleveland Business features Segmint in the hot fintech market.

- Maybank Singapore updates Tagit-powered mobile banking app.

- Bank Technology News Report: TD Bank to Use Moven’s Money Management Software.