With news of its Samsung Gear 2 deployment, has Wallaby become the Fitbit of personal finance?

This connection between physical health and financial health may not be as far-fetched as it seems. In my conversation with Wallaby CEO Matthew Goldman last week, he pointed to the way that wearable technology had dovetailed with, if not helped enabled, a growing interest in personal health.

It is true that, in many ways, financial health has been left behind in this “quantified self” movement. But as more people begin to see their financial health (for example, reducing debt) as integral to their physical health (for example, reducing stress), there is a great opportunity for companies to tailor solutions to these newly (financially) conscious consumers.

In part, this is the wager Wallaby Financial has made when it comes to the still-nascent wearable technology market. With Samsung Gear 2, Wallaby is making its third foray into this industry, having deployed versions of its free PFM app and credit card aggregation cloud wallet in both Pebble (a wristband device) and Google Glass.

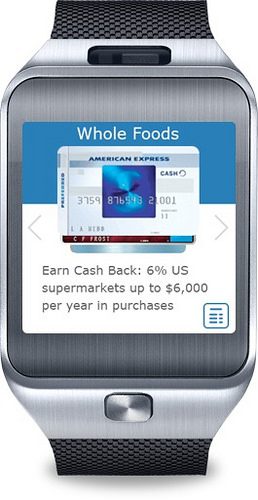

What does Wallaby for Samsung Gear 2 do? Samsung Gear 2 is a 4GB, Bluetooth-enabled, 512MB RAM smartwatch with a 1.6-inch screen. The smart watch features a gyroscope, accelerometer, compass, music player, and heart rate monitor and, like most wearables, requires an accompanying smart device (a Samsung device in this case) in order to work.

Available in Wild Orange, Gold Brown, and Charcoal Black, Samsung Gear 2 retails for $299.99.

Wallaby for Samsung Gear 2 will enable users to optimize credit card rewards, review their card balances, and check other personal finance information on the fly and in real-time. Matthew highlights the notion of “personal finance information” as opposed to “personal finance management” to underscore the challenges of bringing the Wallaby solution to the smart watch.

“What is used the most? What is the critical thing you need to know?” were the questions that have guided Matthew and his team’s efforts to bring a robust PFM app to wearables with divergent form factors (wristwatch versus glass, for example). This is why he refers to the wearable app as delivering “personal financial information” such as checking balances and credit availability, as well as optimizing rewards and offers, rather than remaking the entire PFM experience – functionality and all – on a screen that is little more than 1.5 inches.

But interestingly, this choice is nothing new for Wallaby, which decided early on that rather than be a Mint clone, there was room for a personal finance solution that focused on those personal finance issues that are most immediate and most critical for the average consumer. “If you’re shopping at a store,” Matthew said. “You don’t need access to six-months of budget data. You need to know if you’ve got the available credit to make the purchase.”

Making the purchasing experience that much easier has always been a part of Wallaby’s project. Asserting both that “people hate to budget” and that “people hate to pay,” Matthew explained how Wallaby’s solution responded to both pain points. “Budgeting is like dieting” he said. “Maybe you can’t stop a person from making a purchase. But you can drive consumers toward better financial choices, such as taking greater advantage of credit card rewards and offers.”

And the move toward wearables could help deal with the aversion to the payment process. “U.S. culture doesn’t talk about payment details. People want to conduct the commerce, but not the payment,” Matthew said. But he then pointed to innovations like the Apple Store. “They are bringing the payment experience out from behind the counter,” he said, and merging payment more seamlessly into the shopping/commerce experience.

To the extent that a wearable device like the Samsung Gear 2 could become a major component of payment authentication, the Wallaby app is in just the right place – even if it has arrived a bit early for the masses. “Wearables are going to be the thing,” Matthew said confidently, pointing to Google’s recent decision to open up Google Glass to developers and the likelihood of Apple launching a wearable device (an iWatch, potentially) sooner than later.

Matthew conceded that the technology is “still extremely niche,” which makes it challenging to understand the potential market.

Going forward, Wallaby is looking to leverage the enormous amount of consumer data the company is analyzing. The goal is to help consumers make ever more exacting financial choices when it comes to pay. “The trick,” Matthew said, “is to enable that experience in everything: mobile, card, wearable, and online.”

Wallaby Metrics

- Founded: 2011

- Headquarters: Pasadena, California

- Founders: Matthew Goldman (CEO), Todd Zino (CTO)

- Solutions

- Funding: $1.5 million

- Founders Fund

- Karlin Ventures

- Lion Wells Capital

- Mucker Capital

- Quotidian Ventures

- WI Harper Group

See Wallaby’s FinovateSpring 2013 demo video

here. Developers and others looking to partner with Wallaby can learn more about the company’s APIs and Partner Plus program

here.

Views: 730