This  week, 25 companies raised $447 million ($362 million equity; $85 million debt). That’s the highest weekly number of companies funded since we began tracking in August 2014. It was a broad mix of sub-sectors, from crypto (Ripple) to alt-lending (Argon, eProdigy, Bitbond), payments (Wepay, Face++), fraud protection (Feedzai), personal finance tools (Credit Sesame, Planwise) and more.

week, 25 companies raised $447 million ($362 million equity; $85 million debt). That’s the highest weekly number of companies funded since we began tracking in August 2014. It was a broad mix of sub-sectors, from crypto (Ripple) to alt-lending (Argon, eProdigy, Bitbond), payments (Wepay, Face++), fraud protection (Feedzai), personal finance tools (Credit Sesame, Planwise) and more.

The nearly half-billion this week brings the May total to $1.6 billion. And so far this year, more than $7 billion has been invested in the fintech sector. You can see the weekly reports here.

It was also a record week for Finovate alumni fundings with 9 companies raising $161 million (look further down the page for full details):

- WePay $40 million

- Actiance $28 million

- Ripple $28 million

- EDO Interactive $20 million

- Feedzai $17.5 million

- Credit Sesame $16 million

- PayItSimple $10 million (line of credit)

- Planwise $750,000

- Bitbond $670,000

eProdigy Finance

Tools and programs for alt-lending to businesses

HQ: New York City, New York

Latest round: $100 million Private Equity

Total raised: $100 million

Tags: Lending, credit, underwriting, SMB

Source: Crunchbase

Argon Credit

Online consumer alt-credit

HQ: Chicago, Illinois

Latest round: $75 million debt

Total raised: $85.1 million ($5.1 million equity; $80 million debt)

Tags: Credit, underwriting, consumer, P2P, peer-to-peer, marketplace lending, personal loans

Source: Crunchbase

WePay

Payment services for online marketplaces

HQ: Palo Alto, California

Latest round: $40 million Series D

Total raised: $74.2 million

Tags: Payments, platforms, SMB, Finovate alum

Source: Finovate

Actiance

Enterprise communications platform

HQ: Redwood City, California

Latest round: $28 million

Total raised: $43.6 million

Tags: Analytics, enterprise, Finovate alum

Source: Finovate

Ripple Labs

Open source payment network

HQ: San Francisco, California

Latest round: $28 million

Total raised: $37 million

Tags: Cryptocurrency, virtual currency, currency exchange, Open Coin, Finovate alum

Source: Finovate

Face++

Payments via facial recognition

HQ: Bejing, China

Latest round: $25 million

Total raised: $47 million

Tags: Mobile payments, security, biometrics, Alibaba (customer)

Source: NFC World

EDO Interactive

Card-linked rewards and offers

HQ: Nashville, Tennessee

Latest round: $20 million

Total raised: $93.5 million

Tags: Merchant-funded rewards, debit cards, credit cards, advertising, Finovate alum

Source: FT Partners

Feedzai

Fraud-protection solutions for the enterprise

HQ: San Mateo, California

Latest round: $17.5 million Series B

Total raised: $22 million

Tags: Security, fraud protection, big data, Finovate alum

Source: Finovate

Credit Sesame

Credit reports and debt management

HQ: Mountain View, California

Latest round: $16 million Series D

Total raised: $35.4 million

Tags: Credit, credit scores, debt management, Finovate alum

Source: Finovate

Stride Health

Health insurance selection

HQ: San Francisco, California

Latest round: $13 million Series A

Total raised: $15.4 million

Tags: Insurance, lead gen, cost comparison, marketplace

Source: Crunchbase

Justworks

Payroll and benefits platform

HQ: New York City, New York

Latest round: $13 million

Total raised: $20 million

Tags: Payments, SMB, enterprise, HR, payroll

Source: FT Partners

PayItSimple

Financing at the point-of-sale

HQ: Herzliya, Israel

Latest round: $10 million Debt

Total raised:$10+ million

Tags: Credit, underwriting, POS, merchants, SMB, Finovate alum

Source: Finovate

Stox

Financial data for consumers

HQ: Vancouver, BC, Canada

Latest round: $8 million Series A

Total raised: $8 million

Tags: Investing, analytics, data

Source: Crunchbase

Palico

Online network for private equity community

HQ: New York City, New York

Latest round: $7.3 million

Total raised: $7.3 million

Tags: Investing, social network, private equity, institutional investors

Source: Crunchbase

YCharts

Investment analytics

HQ: Chicago, Illinois

Latest round: $6 million

Total raised: $14.7 million

Tags: Investing, data analytics, charting

Source: Crunchbase

Zeek

Giftcard and retail voucher marketplace

HQ: Tel Aviv, Israel

Latest round: $3 million Series A

Total raised: $3 million

Tags: Prepaid cards, gift cards

Source: Crunchbase

digitalBTC

Virtual currency

HQ: Bentley, Australia

Latest round: $2.8 million

Total raised: $2.8 million

Tags: Bitcoin, cryptocurrency

Source: Crunchbase

Funding Options

Financing search & matching service for businesses

HQ: London, United Kingdom

Latest round: $1.9 million ($6.5 million valuation)

Total raised: $1.9 million

Tags: lending, lead gen, SMB

Source: FT Partners

Planwise

Home buying tools

HQ: San Francisco, California

Latest round: $750,000

Total raised: $1.6 million

Tags: Mortgage, real estate, debt management, refi, Finovate alum

Source: Finovate

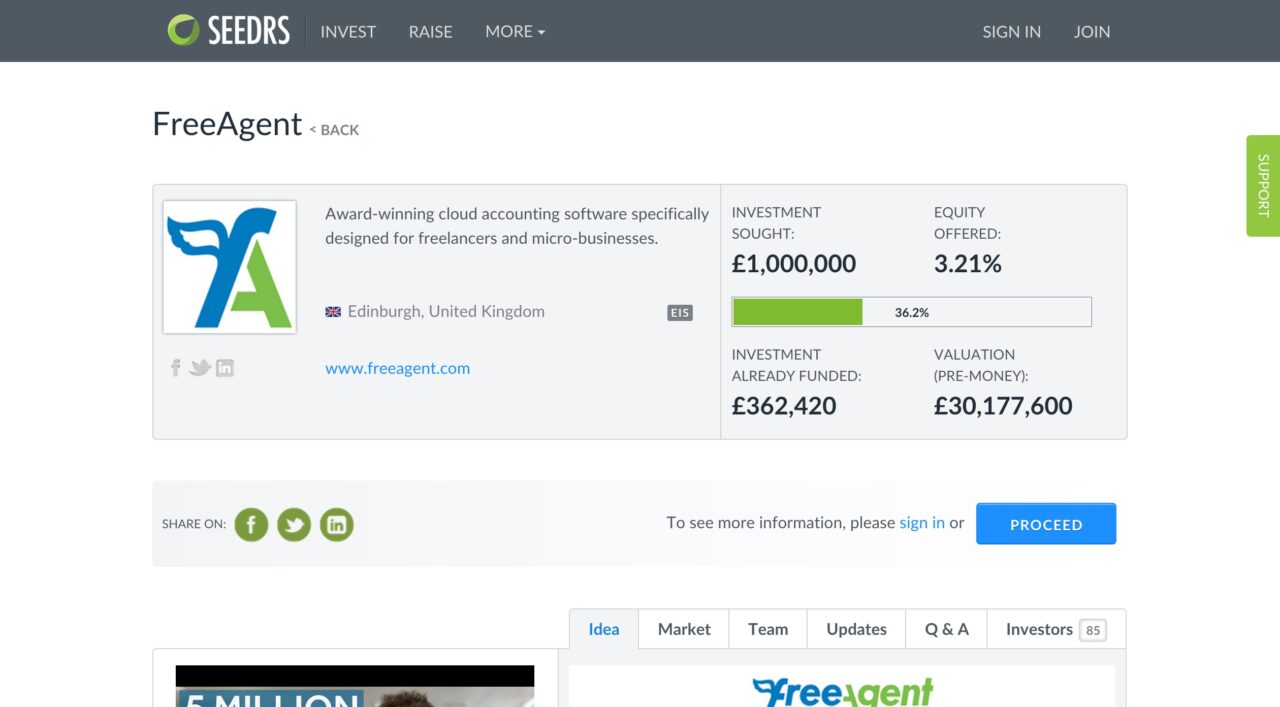

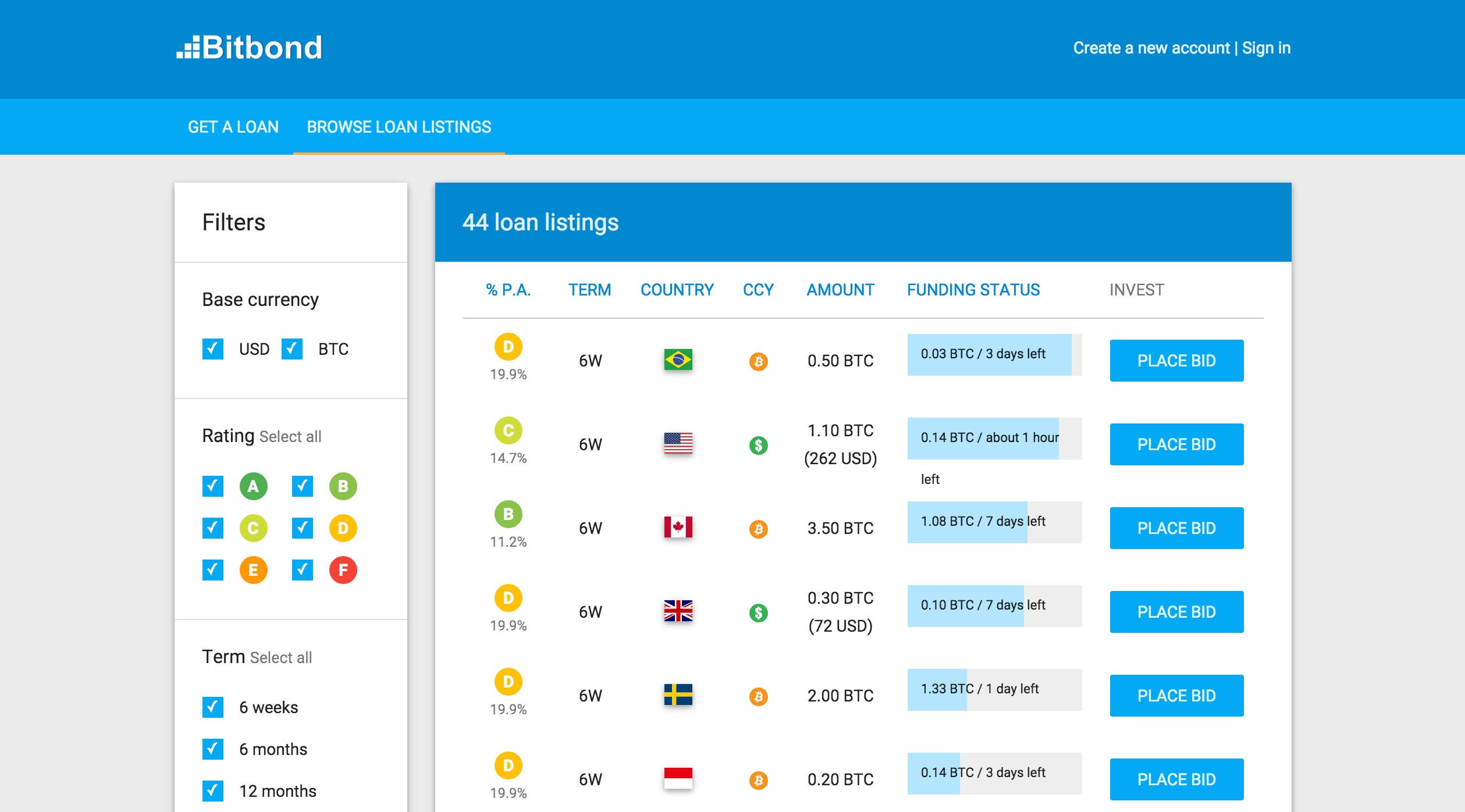

Bitbond

Bitcoin-denominated P2P lending

HQ: Berlin, Germany

Latest round: $670,000

Total raised: $900,000

Tags: P2p, peer-to-peer lending, underwriting, Bitcoin, Finovate alum

Source: Finovate

Magick

Online financial and FX trading

HQ: Copenhagen, Denmark

Latest round: $300,000

Total raised: Unknown

Tags: Trading, investing, FX, currency trading

Source: FT Partners

Public Fund Investing Tracking & Reporting (PFITR, LLC)

Public fund accounting and analytics

HQ: St. Louis, Missouri

Latest round: $50,000

Total raised: $800,000

Tags: Accounting, investing

Source: Crunchbase

Oradian

Microfinance solutions provider

HQ: Zagreb, Croatia

Latest round: Undisclosed Seed

Total raised: Unknown

Tags: P2P, underbanked, financial inclusion

Source: FT Partners

Pro Securities LLC (no website)

Alt-stock exchange

Old Bridge, New Jersey

Latest round: Undisclosed sale of 25% of company to Overstock

Total raised: Unknown

Tags: Investing, trading, Overstock (investor)

Source: FT Partners

Tilt (formerly CrowdTilt)

Money collection and management for groups

HQ: San Francisco, California

Latest round: Undisclosed at $400 million valuation

Total raised: $37+ million

Tags: Crowdfunding, social money management, P2P, peer-to-peer

Source: FT Partners

The biggest surprise in our look at first-quarter funding is that the $677 million amassed by 29 Finovate alums was more than 20% of the $3.2 billion invested in the entire worldwide fintech sector.

The biggest surprise in our look at first-quarter funding is that the $677 million amassed by 29 Finovate alums was more than 20% of the $3.2 billion invested in the entire worldwide fintech sector.

If you live in the U.S., you may be looking forward to spending your long Memorial Day weekend catching up on Finovate demo videos in your backyard theatre.

If you live in the U.S., you may be looking forward to spending your long Memorial Day weekend catching up on Finovate demo videos in your backyard theatre.

week, 25 companies raised $447 million ($362 million equity; $85 million debt). That’s the highest weekly number of companies funded since we began tracking in August 2014. It was a broad mix of sub-sectors, from crypto (Ripple) to alt-lending (Argon, eProdigy, Bitbond), payments (Wepay, Face++), fraud protection (Feedzai), personal finance tools (Credit Sesame, Planwise) and more.

week, 25 companies raised $447 million ($362 million equity; $85 million debt). That’s the highest weekly number of companies funded since we began tracking in August 2014. It was a broad mix of sub-sectors, from crypto (Ripple) to alt-lending (Argon, eProdigy, Bitbond), payments (Wepay, Face++), fraud protection (Feedzai), personal finance tools (Credit Sesame, Planwise) and more.