After a slow start, fundings picked up and finished the week at $160 million raised by 18 fintech companies. That compares to the blistering (and unsustainable) weekly pace of 20 fundings and $575 million in August. Last year during the first week of September 2o companies raised $275 million.

After a slow start, fundings picked up and finished the week at $160 million raised by 18 fintech companies. That compares to the blistering (and unsustainable) weekly pace of 20 fundings and $575 million in August. Last year during the first week of September 2o companies raised $275 million.

Last week’s total disclosed amount raised was $158.3 million, of which $17 million was known to be debt. Three companies did not disclose funding amounts.

——-

Unicorn hunting

I completely agree that the term “unicorn” is overused, but it’s still an easy way to communicate an important valuation hurdle. Last week, The New York Times published an article, sourced from CB Insights, predicting the next 50 unicorns. It comes as no surprise that eight (17%) were fintech companies, including four Finovate alums (Betterment, Coinbase, Wealthfront, ZenPayroll) and four others (Avant, Collective Health, Raise, and Zuora). We’ll update our near-unicorn list (published 22 July) to include ZenPayroll, Collective Health and Raise.

——–

Here are the fundings from 29 Aug to 4 Sep 2015 by size:

Prospa

Australian alt-lender to small businesses

HQ: Sydney, Australia

Latest round: $60 million Series B

Total raised: $60+ million

Tags: Lending, loans, commercial, underwriting, online, SMB

Source: Crunchbase

Shift Payments

Debit card with universal currency access

HQ: San Francisco, California

Latest round: $50 million

Total raised: $50.1 million

Tags: Payments, digital currency, loyalty points, prepaid cards, debit, Y Combinator, Dwolla (partner)

Source: FT Partners

Remitly

Mobile remittance service

HQ: Seattle, Washington

Latest round: $12 million Debt

Total raised: $35 million ($23 million equity; $12 million debt)

Tags: Payments, remittances, P2P payments, mobile, Silicone Valley Bank (lender)

Source: GeekWire

InVenture

Mobile loan underwriting for the unbanked

HQ: Santa Monica, California

Latest round: $10 million

Total raised: $11.2 million

Tags: Lending, credit, consumer, loans, underwriting, unbanked, underbanked

Source: FT Partners

QuanTemplate

Data analytics for the insurance industry

HQ: London, England, United Kingdom

Latest round: $8.0 million

Total raised: $8.0 million

Tags: Insurance, reinsurance, analytics, big data, BI

Source: FT Partners

Electronic Payments

Payment processing

HQ: Calverton, New York

Latest round: $5 million Debt

Total raised: Unknown

Tags: Payments, acquiring, cards, POS, point-of-sale

Source: FT Partners

Quovo

Portfolio analytics and management tools

HQ: New York City, New York

Latest round: $4.8 million

Total raised: $6.2 million

Tags: Investing, trading, wealth management, analytics

Source: FT Partners

Questis

Financial coaching as an employee benefit

HQ: Charleston, South Carolina

Latest round: $2 million Seed

Total raised: $2 million

Tags: Personal financial management, advice, PFM, retirement planning, employee benefits, insurance

Source: WhoGotFunded

Bux

Easy mobile trading for consumers

HQ: Amsterdam, Netherlands

Latest round: $1.9 million

Total raised: $1.9 million

Tags: Investing, gamification, stocks, share trading, mobile, Ayondo (partner)

Source: Crunchbase

MoneyBrilliant

Money management geared towards women

HQ: Darlinghurst, Australia

Latest round: $1.5 million

Total raised: $1.5 million

Tags: Consumer, PFM, personal, financial management, budgeting

Source: Crunchbase

Paymium

Bitcoin exchange

HQ: Paris, France

Latest round: $1.1 million

Total raised: $1.1 million

Tags: Payments, cryptocurrency,

Source: WhoGotFunded

FattMerchant

Payment processor

HQ: Orlando, Florida

Latest round: $850,000

Total raised: Unknown

Tags: Acquiring, SMB, merchants, cards

Source: WhoGotFunded

Mobetize

Mobile wallet and point-of-sale

HQ: Reno, Nevada

Latest round: $750,000

Total raised: $2.1 million

Tags: Payments, mobile, mPOS, merchants, wallet, SMB, consumer

Source: FT Partners

Xendit

Mobile wallet

HQ: San Francisco, California

Latest round: $285,000

Total raised: $400,000

Tags: Payments, remittances, funds transfer, P2P payments, Y Combinator

Source: WhoGotFunded

Wirate

Equity crowdfunding platform

HQ: France

Latest round: $110,000

Total raised: Unknown

Tags: Investing, P2P, person-to-person, marketplace

Source: WhoGotFunded

Kash

ACH at the point-of-sale

HQ: Waterloo, Canada

Latest round: Undisclosed

Total raised: $2+ million

Tags: Payments, API, merchants, mobile, SMB, acquiring, ACH, developers

Source: FT Partners

Platform Black

P2P invoice and supply chain finance

HQ: Basingstoke, England, United Kingdom

Latest round: Undisclosed

Total raised: Unknown

Tags: SMB, financing, credit, factoring, accounts receivables, crowdfunding, peer-to-peer

Source: InsiderMedia

Verifacto

Connecting auto dealers, lenders, insurers and consumers

HQ: Norcross, Georgia

Latest round: Undisclosed Series A

Total raised: Unknown

Tags: Indirect lending, automobiles, car dealers, installment loans, insurance

Source: FT Partners

——

Graphic licensed from 123rf.com

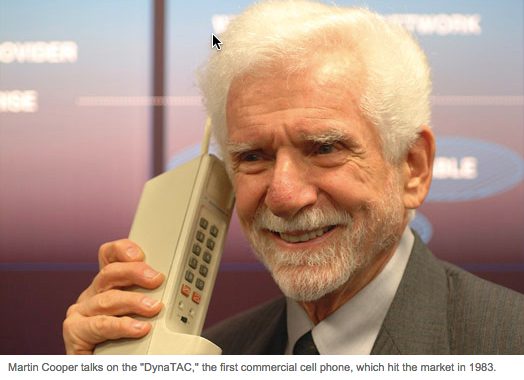

FinDEVr Previews highlight companies that will present their latest developer tools, platforms, and integrations at FinDEVr 2015 San Francisco on 6/7 October. Pick up your ticket before Friday, 11 September, and save $100 on an early bird ticket!