Many people closely track their spending because they have to. They live paycheck to paycheck and there is no choice. A few track it because they are masters of control, and they love the sense of order that results from processing each transaction. But almost no one tracks spending for fun or fulfillment.

Many people closely track their spending because they have to. They live paycheck to paycheck and there is no choice. A few track it because they are masters of control, and they love the sense of order that results from processing each transaction. But almost no one tracks spending for fun or fulfillment.

If a bank, card issuer, or fintech startup cracks that barrier into entertainment, they would surely be en route to fame and fortune (or at least a demo slot at Finovate). If I knew how to make expense tracking fun, I wouldn’t be writing about it here. I’d turn it into a startup, or at least a consulting practice.* So for what it’s worth, here’s my five-point plan for making banking fun.**

1. Go all-in on mobile

This is probably obvious to most readers. But I still encounter people who still believe that money management is best done on a desktop. True, it’s easier to design for the big screen, and real keyboards are nice, but it’s just NOT how people interact with digital providers today. For example, 76% of Facebook’s and 88% of Twitter’s ad revenue last quarter was on mobile (source). What more do you need to know?

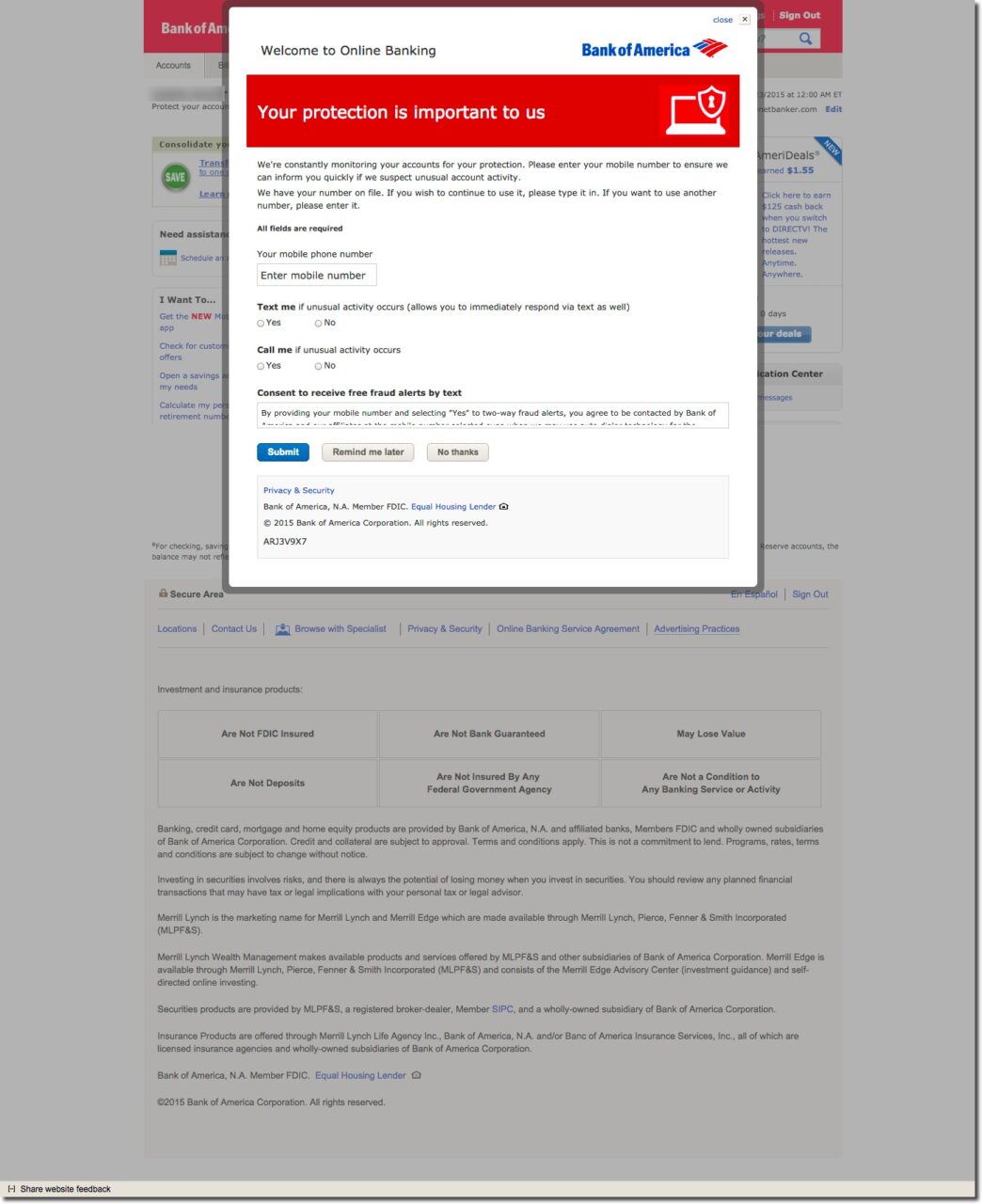

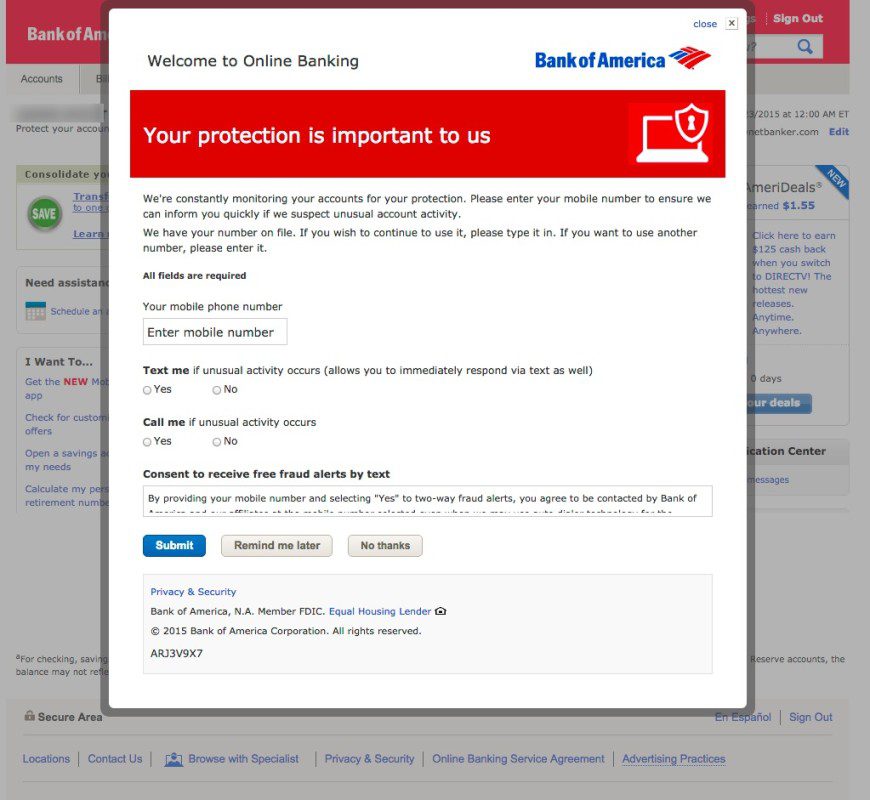

2. Remove the login

You cannot engage mobile users multiple times per day with a standard username/password system. Thankfully, logging in via fingerprint is becoming a handset standard. Bank of America said last week it was about to adopt TouchID on iOS, so the log-in problem should eventually be going away. And for non-biometric handsets and/or users, a 4-digit PIN entry is a pretty good workaround.

3. Stream the transactions

Users should not have to do any work to see each new transaction in reverse chronological order. It should be just like an email system showing new transactions at the top. Unread ones should be super-easy to identify by staying boldface until viewed. For extra credit, adopt the gmail standard, identifying Priority transactions at the top of the stream.

4. Gamify the spend

Once you’ve laid the groundwork with #1, #2 and #3, it’s time to do the tough part of making tracking fun, or at least interesting enough to hook users. I look to Fitbit and Starbucks for inspiration. I probably look at my Fitbit app 7 to 10 times per day to see how I’m doing against my weekly goals; in comparison, I probably open a mobile banking app about 1 or 2 times per month. Why does Fitbit get 20x the engagement? Because it’s a POSITIVE experience. Every time I open it up I’m literally steps closer to my goal. That’s positive reinforcement. In comparison, every time I look at my banking app, I’m one more step removed from my goal of spending less. That’s a negative.

Banking is never going to be as fulfilling as step tracking, but it doesn’t have to be a downer at every login. FIs need to provide positive reinforcement instead of negative. Moven does as good a job as any along these lines by showing a red/yellow/green color-code rating on each expenditure to help users instantly understand what they are doing. And there are lots of ways to begin quantifying spending once users stop being afraid to log in for fear of always getting bad news.

5. Reward the save

Once users start seeing tracking as a positive experience, positive behaviors can be rewarded. Starbucks does a great job getting me to change my behavior by delivering custom offers and rewards to the mobile app. Before the mobile app, and more importantly, mobile ordering, I was a once-or-twice per-month customer. Now, it’s my seventh day in a row inside a store in order to win “14 bonus” stars (value about $7 if I use them to score a sandwich).

Until interest rates get back to something that you can actually measure, financial institutions need to overhaul their rewards programs to provide incentives for beginning savers. I realize how challenging that is based on the near-zero margins currently in the deposit and debit-card business. But there are ways to do this, such as providing retailer discounts when savings goals are reached. See SmartyPig/Social Money (post) or Finovate demo.

—–

*Just kidding, Finovate employees do not invest in or advise fintech startups (outside the Finovate event-coaching process).

**By “fun,” we are not saying money management will compete with television or Facebook. The aim is to make banking useful on a daily basis, perhaps the equivalent of checking the weather forecast.

Blockstack.io

Blockstack.io Peter Shiau, CEO and co-founder

Peter Shiau, CEO and co-founder Lior Saar, CPO and co-founder

Lior Saar, CPO and co-founder

Darren Collins, Global Director, Financial Services and Insurance

Darren Collins, Global Director, Financial Services and Insurance

Joao Lima Pinto, Director

Joao Lima Pinto, Director Silvia Barbosa, Market Manager

Silvia Barbosa, Market Manager

Max Haynes, Founder and CEO

Max Haynes, Founder and CEO Mark Miller, Founder and Chief Technology Officer

Mark Miller, Founder and Chief Technology Officer

Eugene Joseph, CEO

Eugene Joseph, CEO

Kabbage

Kabbage Prosper

Prosper Cardlytics

Cardlytics