Finovate alums Malauzai Software and Geezeo have teamed up this week to bring Geezeo’s PFM tools to community financial institutions using Malauzai’s SmartApps technology solutions. Six Malauzai clients, including Indiana-based Fort Financial Credit Union, have signed contracts to deploy Malauzai’s solution with the new PFM offering.

The partnership enables financial institutions using Malauzai’s online banking platform to offer consumers and small businesses a view of their assets, bills, overall cash flow, goals and budgets. With such a comprehensive view into their customers’ financial lives, banks have an opportunity to cross-sell relevant products and services.

Central to the partnership is a passion to serve community financial institutions. Shawn Ward, CEO and co-founder of Geezeo, says, “We are really excited about this partnership with Malauzai because we share a commitment to provide innovative financial tools to credit unions and community banks.‚ÄĚ

Central to the partnership is a passion to serve community financial institutions. Shawn Ward, CEO and co-founder of Geezeo, says, “We are really excited about this partnership with Malauzai because we share a commitment to provide innovative financial tools to credit unions and community banks.‚ÄĚ

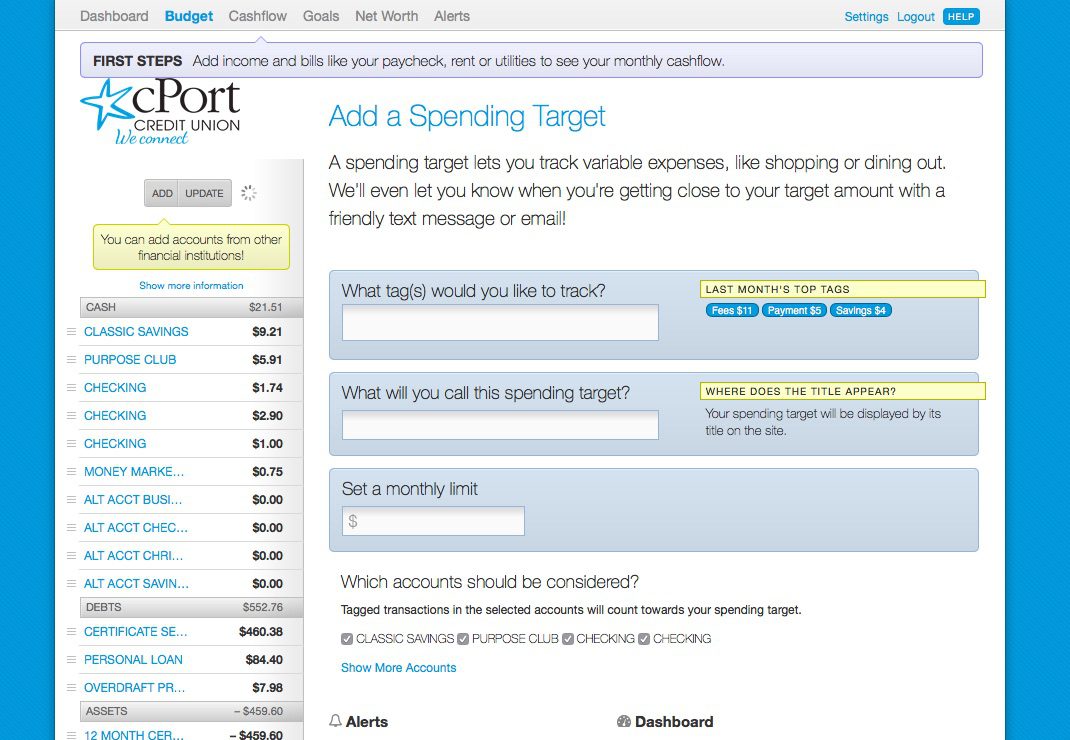

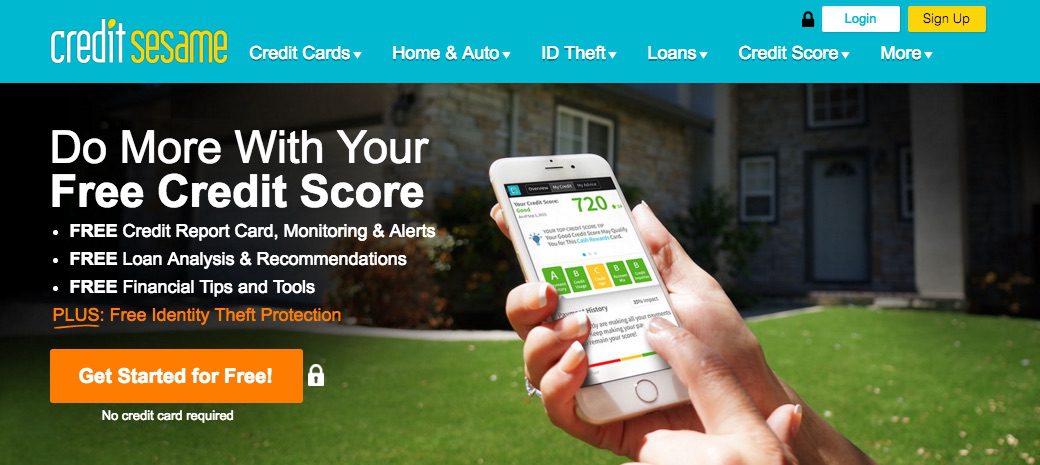

The integration will work on both web:

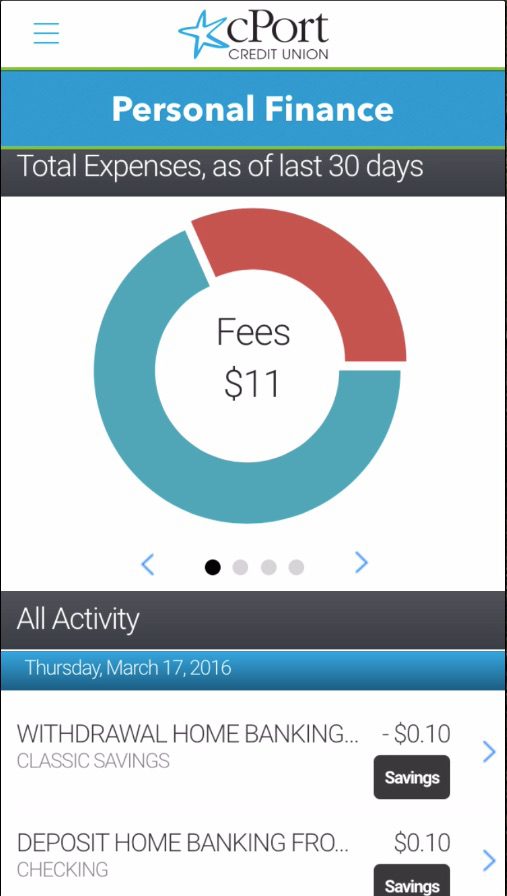

… and mobile:

Prior to today’s partnership, Malauzai’s apps were focused on the transactional aspect of money management. According to Rob Gaynor, chief product officer for the Austin-based company, the addition of financial management tools boosts the value of the two apps. He says the apps “allow banks and credit unions to better cement their roles as trusted financial partners to those they serve.‚ÄĚ

Malauzai, which launched in 2009, recently revamped its banking software. At FinovateSpring 2015, Malauzai launched its Virtual Banking Experience.

Geezeo was the first-ever company to demo at a Finovate conference (check out their retro video from 2007). The company last demoed at FinovateFall 2014 where it debuted TruBusiness business financial management software. Geezeo’s other recent partnerships include NYMBUS and Backbase.

Jerry Filipiak, CEO and Chairman of the Board

Jerry Filipiak, CEO and Chairman of the Board Diana Chin, Human Resources and Operations, New York City

Diana Chin, Human Resources and Operations, New York City

Presenter: CEO Chris Hopen, founder

Presenter: CEO Chris Hopen, founder

LendingRobot

LendingRobot