Saga, a startup creating blockchain-based currency for international exchange, has selected FIS to deploy its Integrity SaaS solution to manage the Saga treasury unit’s back office and its reserves, reports Henry Vilar of Fintech Futures (Finovate’s sister publication).

Saga is backed by reserves held in the most prominent national currencies, replicating the SDR (Special Drawing Rights) by the IMF and deposited in regulated banks in reputable jurisdictions.

The FIS Integrity SaaS solution will support Saga’s treasury unit in managing its reserves among its partner banks. The solution will also support Saga’s treasury requirements, including cash positioning and forecasting, foreign exchange, debt and investment management as well as accounting, compliance and reporting with full connectivity to the treasury ecosystem.

Saga worked with global business consulting leader Deloitte to assist in the selection process.

“FIS offers treasury technology solutions that help corporations and financial institutions modernize their treasury operations and thrive in a constantly evolving environment. We look forward to supporting Saga’s growth strategy globally,” said Steve Evans, head of corporate liquidity and bank treasury, FIS.

The company’s token, SGA, is expected to launch later this year and will rely on reserves hosted in commercial banks. It will be the first-ever cryptocurrency, governed by its shareholders, to introduce monetary tools modeled by economists and researchers from all over the world.

The cryptocurrency will apply banking-standard identification and know-your-client (KYC) and anti-money laundering (AML) procedures.

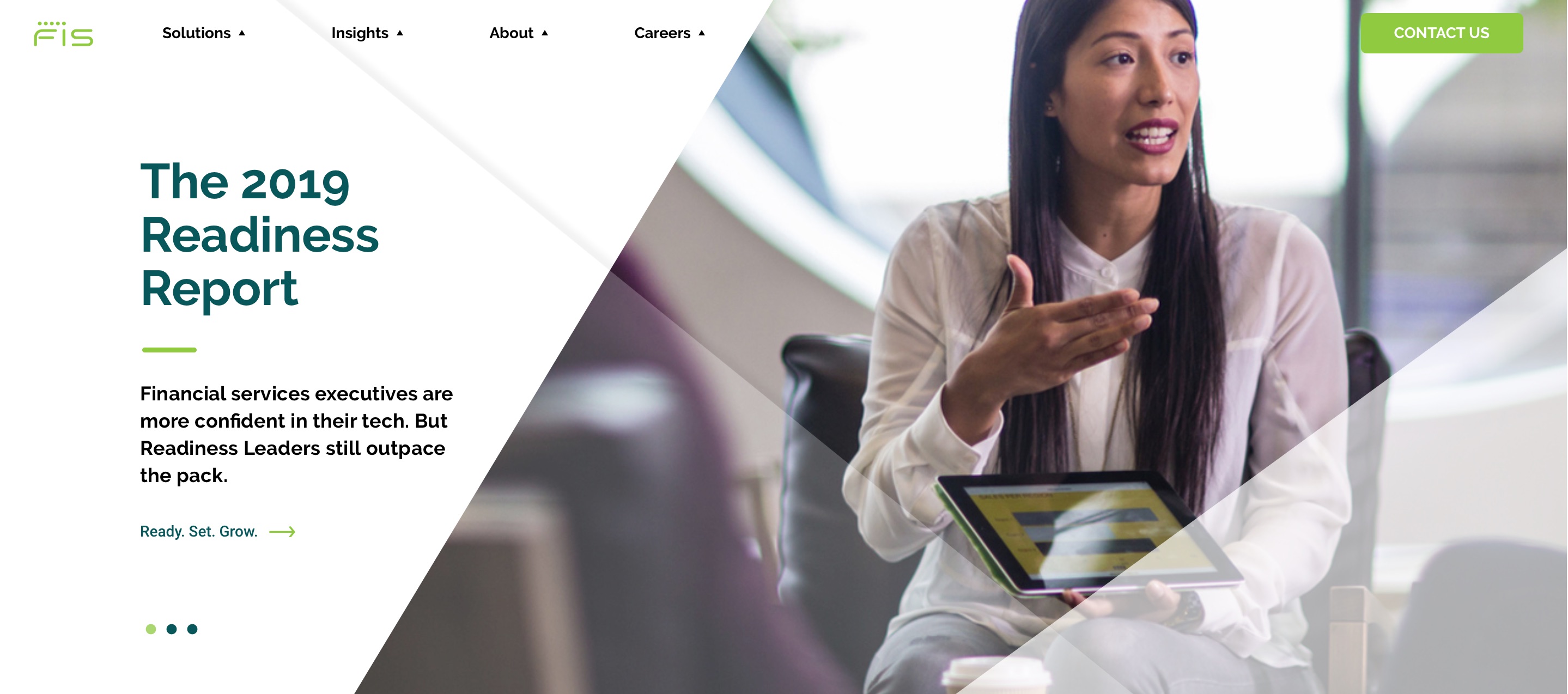

Founded in 1968 and headquartered in Jacksonville, Florida, FIS most recently demonstrated its Cardless Cash technology at FinovateFall 2016. This year, the company has been on a brisk, partnership-making pace, teaming up with Allegacy FCU in May, partnering with Visa in April, and collaborating with NationalLink in March. FIS announced that it would acquire Worldpay this spring in a $34 billion deal.