This post is part of our live coverage of FinovateFall 2015.

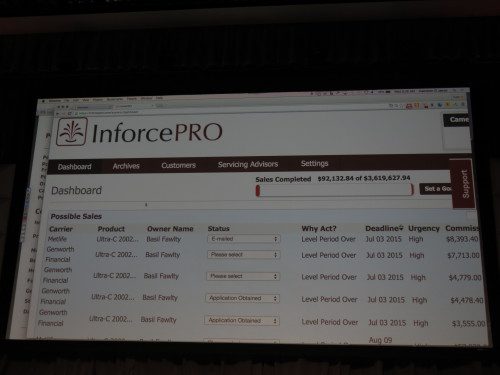

InforcePRO debuted its real-time policy review:

InforcePRO debuted its real-time policy review:

The real-time policy-review tool allows life insurance distributors to run policy reviews instantly. InforcePRO has legacy rate tables, contractual knowledge on legacy products, new quotes capability, and extensive analysis algorithms to identify sales and service opportunities on ANY policy sold in the last 30 years.

Presenters: Karan Kanodia, founder; Cameron Jacox, co-founder

Product Launch: August 2015

Metrics: $1 million raised, 22 employees, 1,000 registered users

Product distribution strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms

HQ: Austin, Texas

Founded: November 2013

Website: inforcepro.com

Twitter: @inforcepro

Hypori’s

Hypori’s Presenters

Presenters Joel Schopp, Senior Software Developer

Joel Schopp, Senior Software Developer

Presenters

Presenters Michael Grassotti, CTO

Michael Grassotti, CTO

HelloWallet

HelloWallet Presenters

Presenters Andrew Vincent, Senior Product Manager

Andrew Vincent, Senior Product Manager

Cameron Jacox, Co-founder

Cameron Jacox, Co-founder

Presenter

Presenter

Additiv

Additiv Presenter

Presenter

Presenter

Presenter