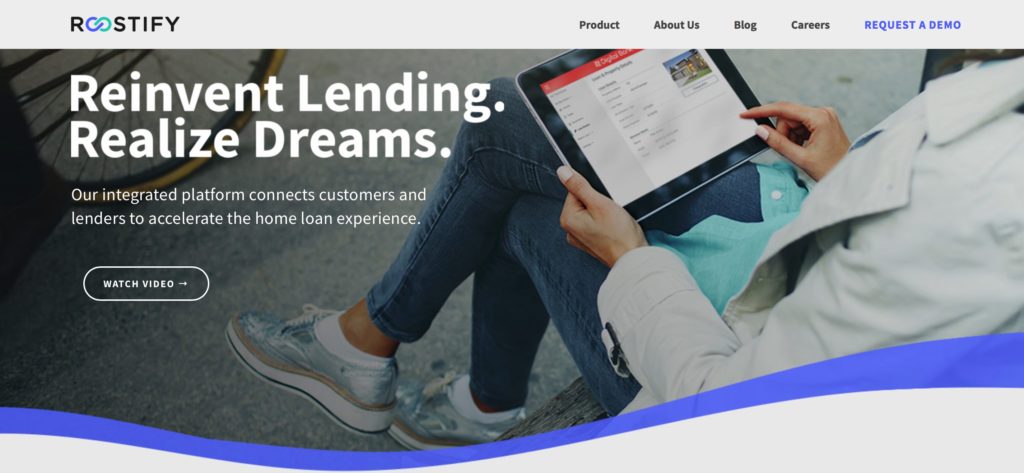

Faster loan processing and a better experience for mortgage borrowers is the goal of the new partnership between Finicity and SaaS loan origination technology solution provider LendingQB, which has integrated Finicity’s digital Verification of Assets (VoA) solution into its platform.

Demonstrated at Finovate two springs ago as part of Finicity’s growing inventory of credit decisioning solutions, Verification of Assets leverages consumer-permissioned transaction data to help lenders spot underwriting factors that can shave as many as six days off the typical mortgage origination timeline. The solution delivers reports in 30 seconds or less, and can be refreshed during the origination process.

“Digitizing the loan origination process is the key to the future of lending,” Finicity CEO Steve Smith said. “We’re proud to be one of the tech providers behind this movement and are glad to work with leading digital loan originators like LendingQB to help the industry evolve and improve the experiences for lenders and borrowers alike.”

Tim Nguyen, CEO of LendingQB’s parent company, MeridianLink, put the partnership in the context of the company’s determination to remain at technology’s cutting edge for the sake of all parties in the mortgage journey. “At LendingQB, we pride ourselves on our ability to seek out the best technology and partnerships to combine with our solution,” Nguyen said. “This creates a competitive advantage for lenders that delivers a more meaningful experience to the people that really matter: borrowers.”

Founded in 2011, LendingQB helps companies build digital mortgage solutions with its browser-based loan origination system and open API integrations to 300+ vendors and services. The company, which is headquartered in Costa Mesa, California, inked a deal with CoreLogic in June and, in April, was named to the HousingWire Tech100 for a second consecutive year.

In addition to Verification of Assets, Finicity also offers Verification of Income (VoI) as part of its suite of credit decisioning solutions. VoI provides confirmation on up to 24 months of historical income, and features confidence scores on income streams to help anticipate future income. Detailed information from both VoA and VoI is available via the company’s Finicity Reports.

Finicity most recently made fintech headlines when it announced its partnership with Pulte Mortgage this spring. Named one of the Best Fintechs to Work For by PaymentsSource at the beginning of the year, the Salt Lake City, Utah-based fintech has raised $79.9 million in funding and counts Experian Ventures and Bridge Bank among its investors.