FUD (fear, uncertainty, and doubt) is a strong motivator, especially when it has something to do with your personal financial situation.

FUD (fear, uncertainty, and doubt) is a strong motivator, especially when it has something to do with your personal financial situation.

As much as financial institutions strive to maintain the perception of safety and soundness, they often benefit from the concerns and resulting risk-averse behavior of their customers.

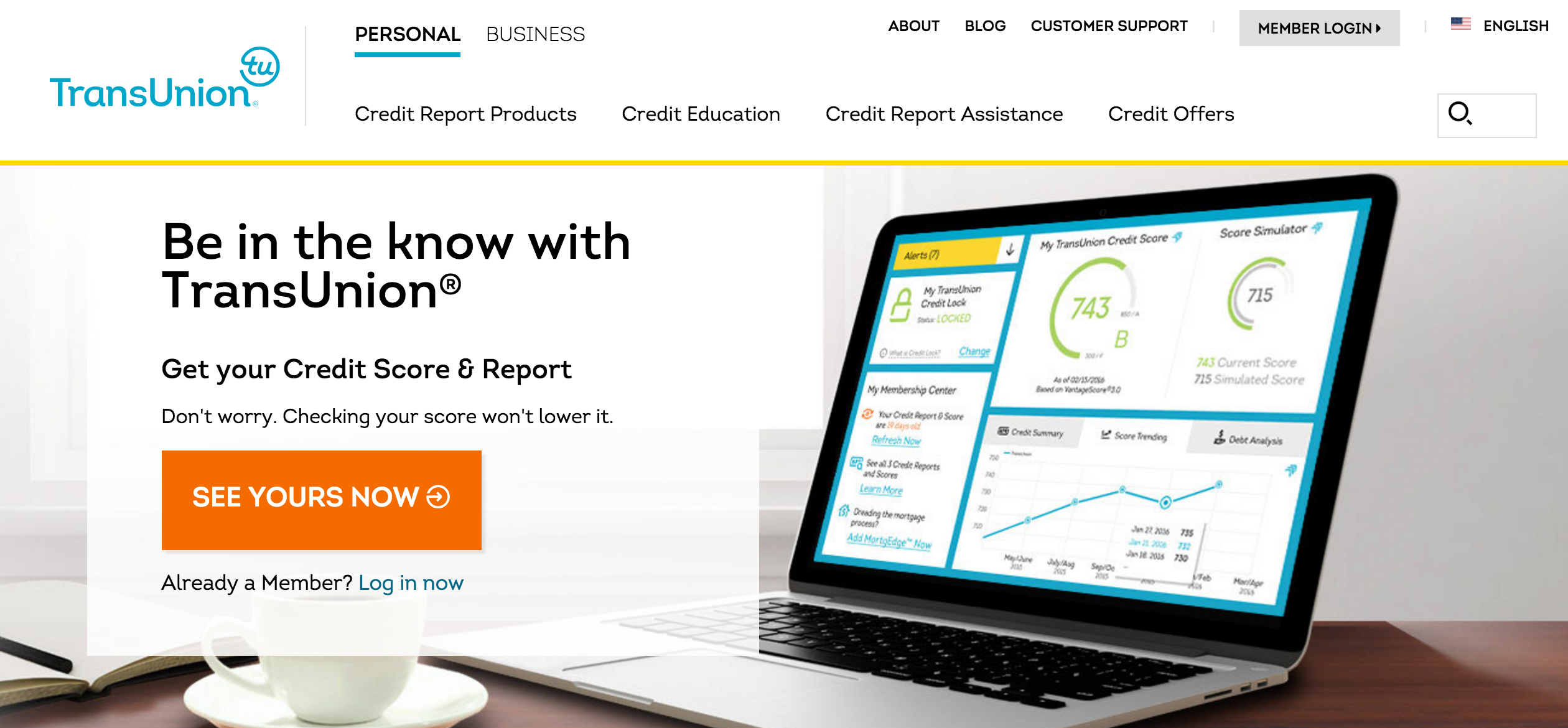

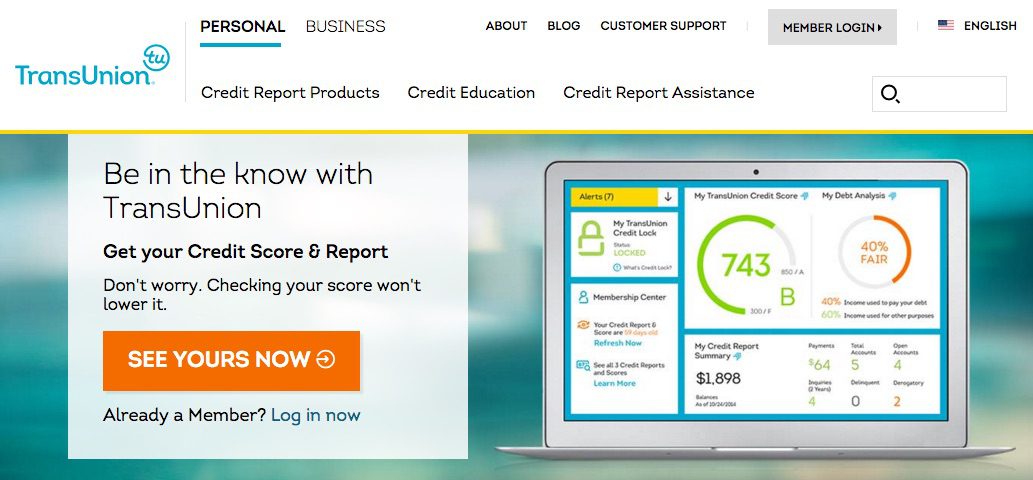

Case in point: credit reports and identity theft protection. Sure, it’s relatively simple to request a credit report every six months to make sure the credit bureaus have accurate info on file under your name. The problem with this approach: it takes time, you must pass rigorous authentication tests each time, you have to remember to do it proactively, and once you successfully access your report, you have to figure out what it all means.

One of the more confusing aspects of the credit report world is the various credit scores available. Each of the three major credit bureaus offer a proprietary score, but the most common one, used by 75% of mortgage originators, is from Fair Isaac, whose FICO score is almost a household word.

The new VantageScore is designed to simplify the confusing credit score landscape. Released today, it’s a joint effort from the three major credit bureaus, Experian, TransUnion, and Equifax, who worked together to create a single score incorporating information in all three databases. The new product will be marketed by a separate entity, VantageScore Solutions LLC, <vantagescore.com> a joint venture from the three companies (click on inset for a closer look).

The new VantageScore is designed to simplify the confusing credit score landscape. Released today, it’s a joint effort from the three major credit bureaus, Experian, TransUnion, and Equifax, who worked together to create a single score incorporating information in all three databases. The new product will be marketed by a separate entity, VantageScore Solutions LLC, <vantagescore.com> a joint venture from the three companies (click on inset for a closer look).

Rather than the 800-point scale in use today, the VantageScore will use a more common academic letter-grade scale as follows:

900-990 A

801-900 B

701-800 C

601-700 D

501-600 F

Analysis

While it should help bring more clarity to the credit score in the long term, the immediate effect is more confusion with a new name, additional marketing campaigns, and a new grading scale. This should be good for financial institutions that can use the raised awareness and heightened concerns to sell their own credit-monitoring services, which can be a solid source of monthly fee revenue.

We’ll be taking a close look at the market during the next six weeks as we research and author an update to our 2002 analysis of the credit report-monitoring opportunity (refer to Online Banking Report #83/84).

—JB