It’s Open Banking Season in the U.K. And this makes this week’s launch of The ID Co.’s Open Banking API platform especially timely. The new solution enables business customers to use The ID Co.’s DirectID user verification technology to access open banking services with live connections to all major U.K. banks.

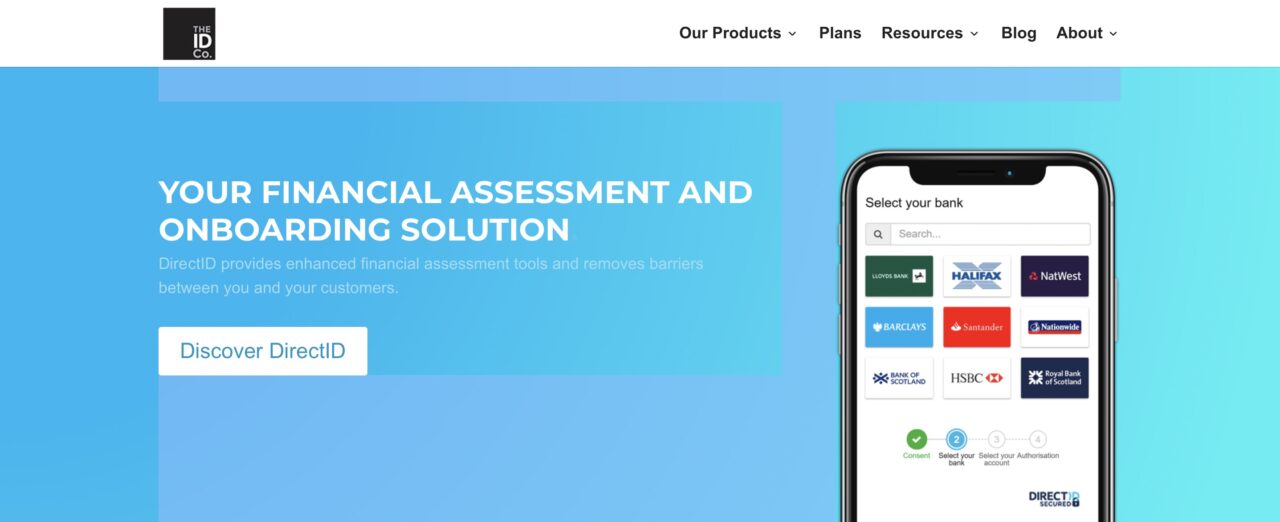

These connections provide access to institutions including Barclays, HSBC, Lloyds Group, Santander, The Royal Bank of Scotland, and Nationwide. Digital banks like Starling and Monzo are supported, as well.

“Open banking in the U.K. represents a huge opportunity for not only businesses but consumers to benefit from,” The ID Co. CEO and founder James Varga said. “We are passionate to enable our customers to take advantage of the Open Banking opportunity and help them unlock the true value of Open Banking. After all, it’s not just about the raw data – it’s what you do with it that counts.”

DirectID provides businesses with a plug and play, identity and bank data service that is designed to increase conversions, reduce risk, and save time and money. The solution features tools for income verification and underwriting, and verifies account information with instant access to digital bank statements. DirectID also includes a complete AML compliance and KYC verification process, and real-time assessments of credit risk exposure.

CTO for The ID Co. Scott Leckie called completion of the open banking integrations “an exciting step” and added that support for additional U.K. banks – as well as support for new Open Banking V2 data blocks and new products and services leveraging bank data – are forthcoming in the next few months.

DirectID is currently live with leading lenders, FIs, and fintechs in the U.K., the U.S., Canada, Australia, and the Netherlands. As miicard, the company demonstrated its identity-as-a-service technology at FinovateFall 2013. Last month, The ID Co. was granted FCA Authorization as Open Banking AISP in the U.K. market, and announced at the time that “key Open Banking customers and platform enhancements” would be added to the platform soon.

An inaugural member of the fintech accelerator, SixThirty, the Edinburgh, Scotland-based firm has raised more than $9 million in funding. The ID Co.’s customers include OakNorth Bank, Navient, and fellow Finovate alum Prosper.