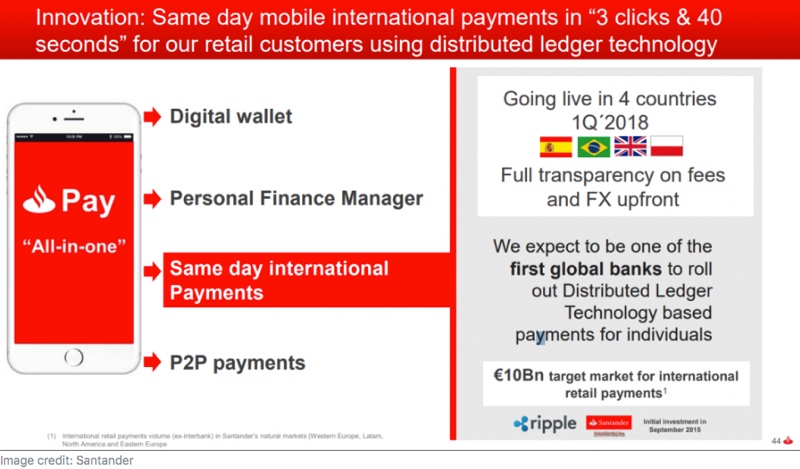

Banco Santander announced that the mobile app it plans to launch in the first quarter of this year will feature instant payments powered by technology from Ripple. The new service will enable customers to make same-day, cross-border payments. P2P payments, a digital wallet, and PFM functionality will also be part of the app

Using its own internal staff, the Spanish bank has piloted the technology for the past 18 months. The testing involved Apple Pay transactions between £10 and £10,000 and relied on Touch ID to ensure secure logins. Santander said it believes it will be “one of the first global banks to roll out distributed ledger technology based payments for individuals” and expects to initially launch the app in four countries simultaneously (believed to be Spain, Brazil, the U.K., and Poland, see below).

News of the new solution was sleuthed in part by analysts participating in Banco Santander’s 2017 earnings presentation which featured the below slide previewing the firm’s plans for same day mobile international payments in “3 clicks & 40 seconds.”

“The need for finance has evolved from providing a Pound in your pocket or card in your purse, where you pay at a till, to being seamlessly integrated into a new, always on, connected lifestyle,” said a representative of Banco Santander in Coinspeaker last week. “At Santander we work hard to ensure our banking is simple, personal and fair and believe new Blockchain technology will play a transformational role in the way we achieve our goals and better serve our customers, adding value by creating more choice and convenience.”

This news comes just a few months after Santander U.K. announced that it will partner with American Express to use Ripple’s technology for cross-border, B2B payments. Interviewed earlier this year, Head of Technology Innovation at Santander UK, Ed Metzger, praised Ripple’s advantages over SWIFT. “We chose Ripple because of its speed, transparency, and certainty … these three characteristics provide relief to the pain points of international payments.”

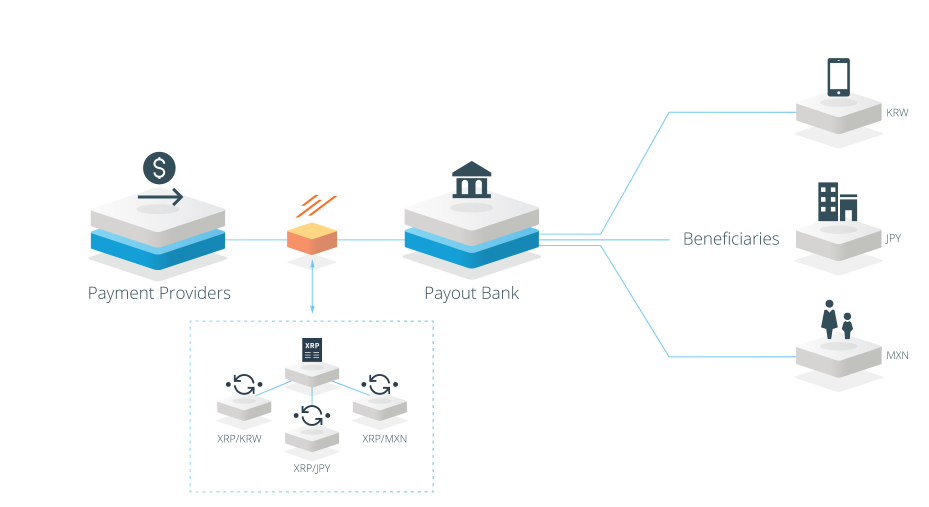

Making its Finovate debut as OpenCoin at FinovateSpring 2013, Ripple is based in San Francisco, California and was founded in 2012 by Chris Larsen. Last month, the company launched a trial with MoneyGram that will include leveraging XRP for remittances and the potential integration of Ripple’s xVia, an API that facilitates sending payments across multiple networks using a standard interface.

Ripple introduced its Infrastructure Innovation Initiative in December, an effort to help central banks, regulators, and market infrastructures test and pilot blockchain-based solutions. In October, the company launched a new accelerator program and incentives to encourage banks to become more involved in blockchain technology.

With more than $93 million in funding, Ripple includes Santander Innoventures, SBI Investment, Core Innovation Capital, and IDG Capital Partners among its investors. Brad Garlinghouse was appointed CEO of the company in the fall of 2016.