Blockchain solutions innovator Ripple announced plans to team up with remittance services company MoneyGram.

This announcement comes at a time when both Ripple and MoneyGram have been in the news headlines. Many outlets have reported on Ripple for the volatility of XRP, its digital currency (and for the rumored rise of its founder, Chris Larsen, as one of the richest persons in the world). And last week, an attempted purchase of MoneyGram by Chinese firm Ant Financial was blocked by the U.S. government.

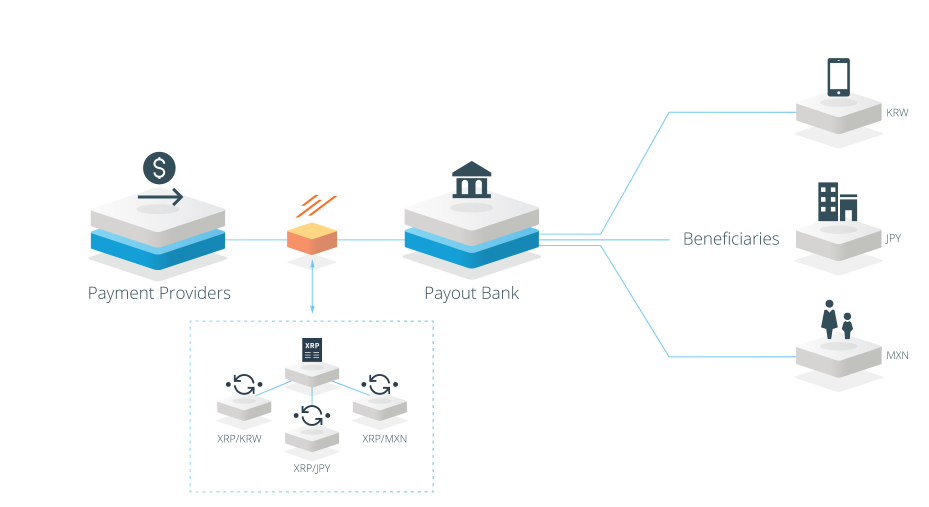

As a part of the partnership, MoneyGram will use XRP through Ripple’s xRapid, a service that aims to provide liquidity to financial institutions. Touting the practicality of leveraging XRP for remittances, Ripple noted that transactions can be made for fractions of a penny and in two-to-three seconds. This is favorable compared to Bitcoin’s fees of $30 per transactions and wait times of up to an hour.

Through agreement, the companies will also explore MoneyGram’s integration into Ripple’s xVia, an API for businesses, payment providers and banks to send payments across various networks using a standard interface.

MoneyGram’s current model requires the sender’s account to be pre-funded before they are able to send currency. Leveraging blockchain technology, MoneyGram can simplify cross-border transfers, making them more efficient. Ripple CEO Brad Garlinghouse said, “Money transfer companies are incredibly important because they help people get money to their friends and loved ones…. By using a digital asset like XRP that settles in three seconds or less, they can now move money as quickly as information.”

MoneyGram is the second largest money transfer company in the world, competing not only with traditional companies such as Western Union, but also with the likes of fintechs such as Azimo, TransferWise, and CurrencyCloud. Leveraging the blockchain for cross-border remittances and transactions is not new to fintech. At FinovateFall last year, we saw nanopay demo its cross-border payments platform that enables the banks to provide instant fund transfers, without intermediaries, at a 60% cost reduction. Similarly, in 2015 CoinJar showcased its platform that lets users buy, sell, send, receive, and spend digital and traditional forms of currency using the blockchain.

Ripple has offices in San Francisco, New York, London, Luxembourg, Mumbai, Singapore and Sydney, and counts more than 100 customers across the globe. At FinovateSpring 2013, company co-founder Chris Larsen debuted Ripple (originally known as OpenCoin). Last fall, Ripple teamed with AmEx and Santander to support blockchain-powered international B2B payments. And in December of last year, the company’s XRP currency reached a milestone, boasting availability on 50 exchanges worldwide.