On Finovate.com

- SWITCH Lands $400,000 Angel Investment.

On FinDEVr.com

- Check out today’s previews of upcoming FinDEVr New York presentations:

Around the web

- Customers can now host Actiance Vantage on Microsoft Azure

- Handpoint launches EMV Tip Adjustment feature for MPOS.

- Financial Times reports: Starling Bank strikes money transfer deal with TransferWise

- ShopKeep expands into online ordering and delivery with ChowBOT acquisition.

- Narrative Science launches Narratives for Business Intelligence API.

- Strands to power PFM for Kenya’s largest bank, Commercial Bank of Africa.

- Citi introduces new mobile passcode solution for its Treasury and Trade clients. See Citi at FinDEVr New York next week.

- BBVA to focus on identity, AI, and “fintech for companies” in ninth installment of its Open Talent innovation competition.

- Cachet Financial Solutions aims to raise more than $9 million in initial public offering this week.

- Following its platform limit announced in December, Zopa has set up a waiting list for new prospective investors.

- Capital One Financial Corporation appoints Amy Lenander as UK CEO.

- Putnam-Greene Financial Corporation to deploy core banking technology from Fiserv. Join Fiserv in New York next week for FinDEVr New York.

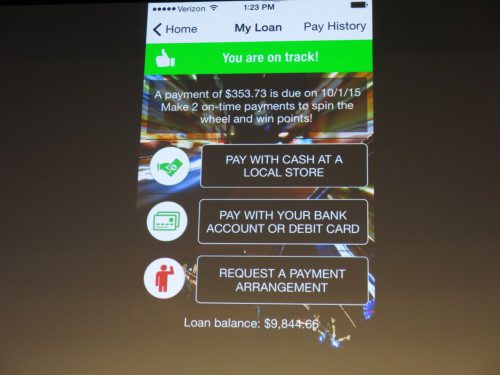

- PaySwag to power mobile loyalty and instant rewards to the underbanked for Sionic Mobile.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

Max Haynes, Founder and CEO

Max Haynes, Founder and CEO Mark Miller, Founder and Chief Technology Officer

Mark Miller, Founder and Chief Technology Officer