Ondot Systems has followed up its Best of Show winning demo from FinovateMiddleEast last month with news that the company is expanding to reach even more customers around the world. The company’s Mobile Card Services solution, a white-label product that gives cardholders control over their payment cards and provides issuers with opportunities to create personalized journeys for their customers, will soon be available to FIs and customers in Asia.

“The payment landscape is evolving rapidly in emerging markets like ASEAN. Banks can provide a holistic experience to consumers and deliver new products and services over legacy systems in a cost-effective and timely manner using new micro-service platforms,” said Ian Guy Gillard, CIO of Bangkok Bank. “Partners like Ondot enable banks to stay as innovation leaders while bringing in the best of fintech into banking, Gillard said. Bangkok Bank is the biggest commercial bank in Thailand, and is one of the largest banks in Southeast Asia.

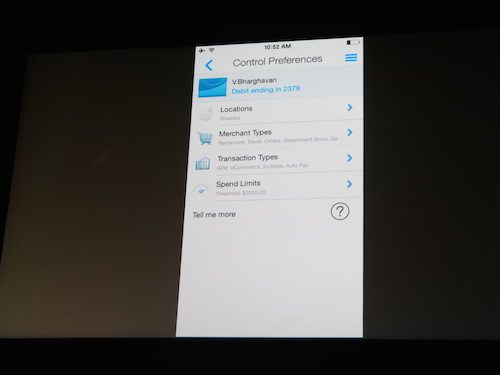

Millions of users at 3,000 banks and credit unions around the world rely on Ondot’s card controls technology to manage when, where, and how their cards are used. Banks typically have seen increased card usage by 23%, fraud costs reduced by 25%, and false declines lowered by 16% within a year of integrating Ondot’s technology. In addition to Card Control, Ondot’s consumer facing product line includes Card Connect, guided self-service for card management including transaction and fraud alerts and dispute initiation; Card Assist, which provides contextual advice and messaging based on location, preferences, and purchase history, and Fone Pay, which provides instant digital card issuance and provisioning cards into phone wallets.

Administrators get access to data insights from the platform including enhanced merchant and transaction information that leverages both crowdsourced data enrichment and user activity, as well as a consumer services platform to support rapid development and deployment of services on legacy systems.

“We use our own personal experiences and needs as cardholders to drive the product innovation,” EVP for Ondot Systems Rachna Ahlawat said. “I travel a lot – I want a solution that knows where I am so my card works around me, prompts me to customize my preferences, detects when I am back home, and helps me categorize transactions – a personal assistant that anticipates my actions and solves a need.”

Ahlawat also pointed out an example of the kind of circumstance that cardholders experience that Ondot’s technology helps them manage. “(If) if I get a transaction alert for a purchase I did not attempt, I want to initiate a dispute instantly. This action usually shuts off the card in the bank systems, but I don’t want to be left without a payment card to use till I reach home. With Ondot’s safe mode card controls, we can enable this capability – converting an unpleasant event into a positive experience for the cardholder by combining security and convenience.”

Founded in 2011 and headquartered in San Jose, California, Ondot Systems demonstrated its Card Control technology at the inaugural FinovateMiddleEast in February, winning Best of Show. The company followed this with an appearance the following month at FinovateEurope, where CEO and co-founder Vaduvur Bharghavan demonstrated how the technology leverages the smartphone to give cardholders a “remote control” over their credit and debit cards. Videos from both events will be available soon.

APPICS

APPICS Electronic IDentification

Electronic IDentification

Gary Singh, VP of Marketing

Gary Singh, VP of Marketing

Presenter

Presenter

Money Amigo is a social money interaction platform that solves the lack of simple and clustered services for the unbanked and underbanked.

Money Amigo is a social money interaction platform that solves the lack of simple and clustered services for the unbanked and underbanked. Outski’s

Outski’s

Whodini helps merchants engage customers using social media marketing, reaching loyal customers with targeted offers.

Whodini helps merchants engage customers using social media marketing, reaching loyal customers with targeted offers.