During a break in the action at FinovateEurope in February, I had the opportunity to sit down with MoneyHub CEO Toby Hughes and his team. MoneyHub was demoing later in the week, and we managed to catch up with him for a quick update.

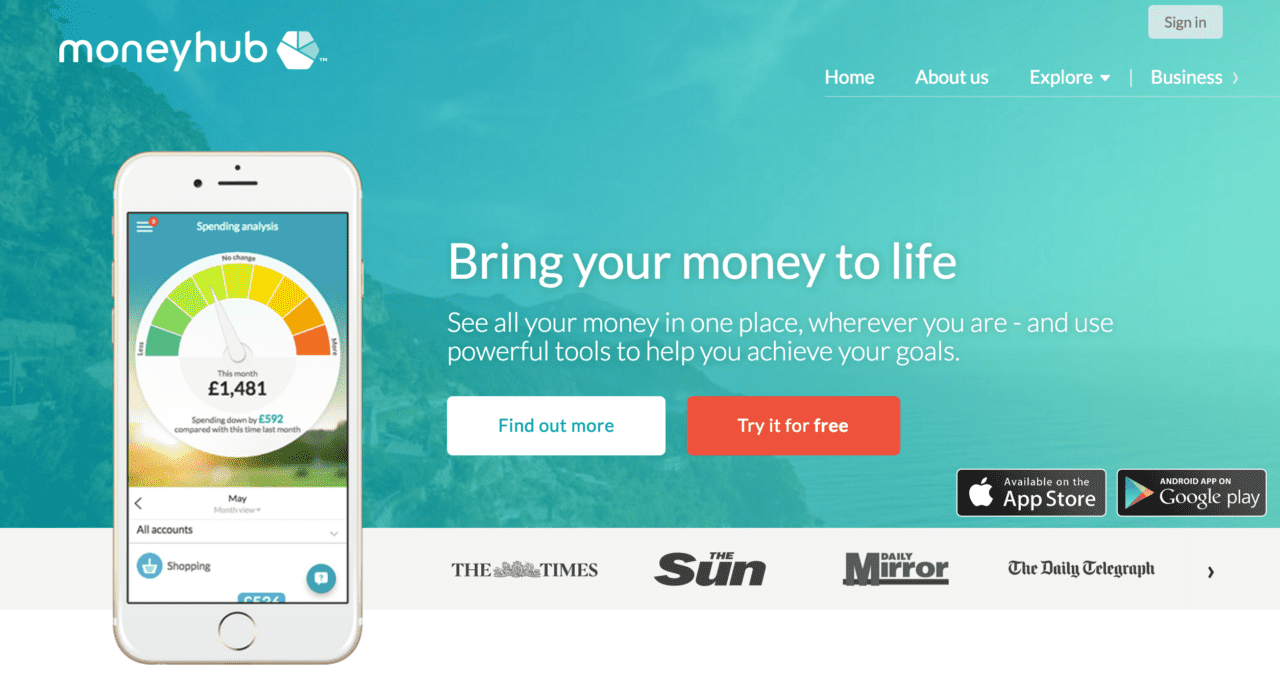

According to Hughes, the PFM technology MoneyHub would demonstrate at FinovateEurope 2015 in London had been live for 18 months. The platform helps users with both short- and long-term budgeting and financial planning, and was tracking £ 3 billion in assets.

“The project started four years ago,” Hughes said. “It took two-and-a-half years to get the first prototype up and running.” The result was a Best of Show win for a financial management platform that impressed Finovate audiences by its ability to help users find and best deploy future savings toward goals both short- and long-term.

MoneyHub CEO Toby Hughes and CTO Dave Tonge demonstrated the MoneyHub ecosystem at FinovateEurope 2015.

Founded in 2011 and headquartered in Bristol, United Kingdom, MoneyHub provides a free version of its service (via its YourWealth solution), as well as advanced versions for professional advisory firms, accountants, mortgage professionals, financial advisers, and larger financial organizations that want to use the technology with their own clients. As Hughes describes it, the goal is to put the customer “in the middle of their financial world and let it revolve around them.” He sees strength in not only in centralizing access to all financial data but also in providing financial professionals and their customers with tools to better see and understand the data itself. “Bring all the data into one place. Visualize it, manipulate it, and make choices,” Hughes says.

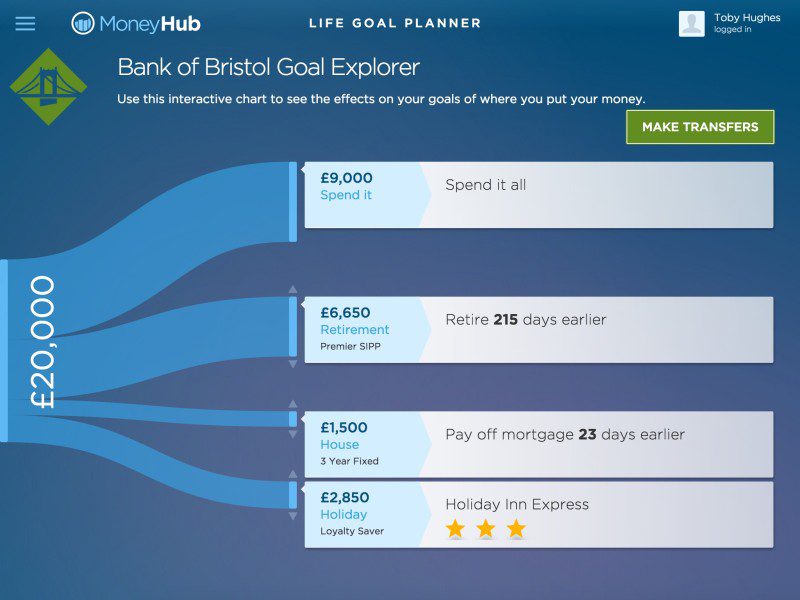

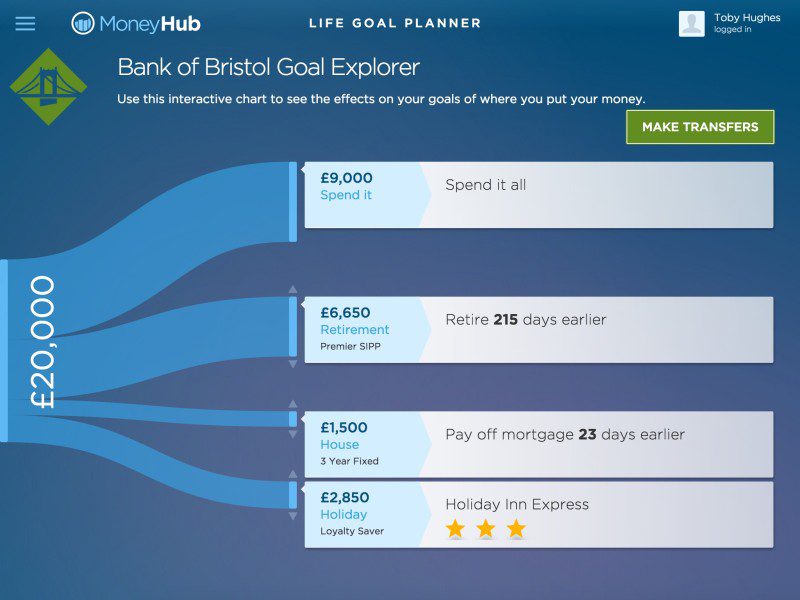

A year later, the company was back, this time introducing two new features—Choices and Insights—which help customers manage their finances around “non-financial” themes. Hughes also showed how product providers can use the technology to position their products in such a way as to be featured in part of the customer’s life plan.

The goal-planning module above is part of MoneyHub’s Choices feature. The module is a simplification of a feature called Scenarios which, with its complex financial modeling, was admittedly best reserved for advanced users and financial planners. With Choices, users are able to see graphically and in advance how spending decisions impact preset goals ranging from saving for a holiday to planning for an early retirement. The drag-and-drop interface makes it easy for users to view multiple financial scenarios quickly.

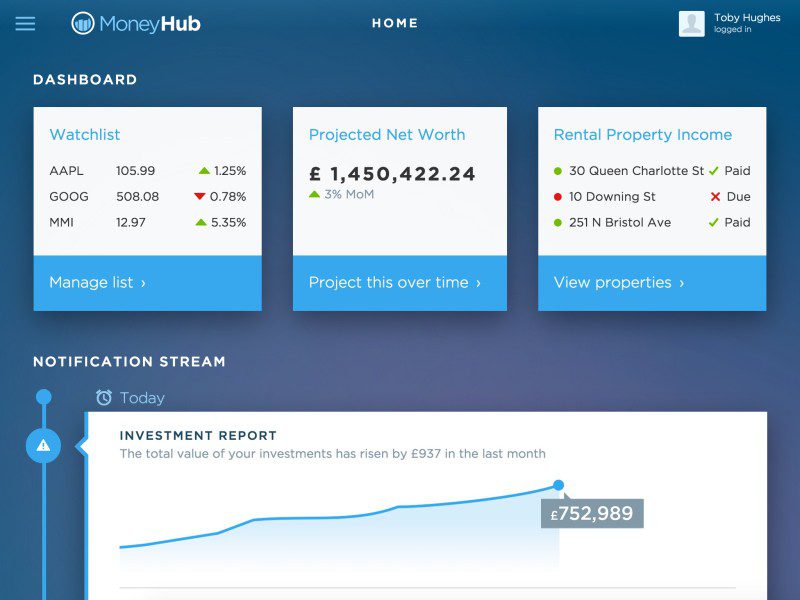

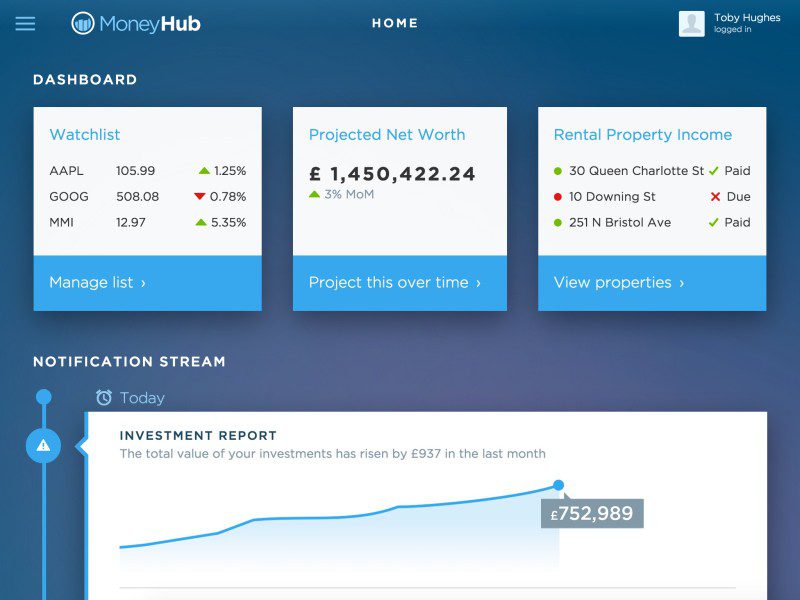

Insights (below) is another new feature on the platform. Insights is also accessible via the Dashboard and provides for interactive sharing between the customer and the financial professional he or she is working with. Insights also features an Interactive News Feed that is driven by the client’s finances and investments. Changes to stocks owned, the arrival of an expected mid-year bonus at work, additional income from rental property ownership, and so on, are all displayed on the client’s dashboard.

MoneyHub’s platform is designed to promote engagement: an interface that relies on simplification, visualization, and “non-financial” themes and goals that clients are comfortable with, and a seamless engagement mechanism through the Insights feature that ensures financial professionals are in tune with their clients’ dynamic financial world. “Our goal is to enable customers and organizations to work together more efficiently and effectively,” Hughes said. “And to enable individuals to answer the question, ‘Will I have enough?'”

Winning Best of Show (as YourWealth) in its first Finovate was big, but the news got even bigger when the company announced shortly afterward that it had been acquired while in the middle of its Series A round of funding. The acquirer, Momentum UK, was a division of MMI Holdings, a major financial services group based in South Africa.

The immediate result was “much more infrastructure and much more funding,” Hughes said. MoneyHub opened up a 120+ person facility in Bristol in February to help the company accommodate the changes. “We’ve gone from a startup-grade organization to an enterprise-based solution,” he explained, and said that the company was planning to “scale aggressively over the summer” in the U.K. market. This plus what Hughes called a “huge” new upgrade of the platform before the end of the year.

Currently the platform is available as a free service, a MoneyHub Premium service that pulls data from your linked accounts automatically for £9.99 a year, and MoneyHub Connect, the service for financial professionals to use with their clients.

Writing in Money Marketing, Ian McKenna included MoneyHub among those innovations that were “directly relevant to the way that consumers are likely to manage their money in the future.” And as far as MoneyHub is concerned, that future is already here.

Presenter

Presenter