Naturally, we are always rooting for Finovate alums to make it big. And there are few fintech success stories bigger than 2008 alum, Credit Karma, which scored $175 million this week at a reported $3.5 billion valuation. That makes the credit-score provider the second most valuable alum (after Lending Club, currently trading at $6 billion).

Naturally, we are always rooting for Finovate alums to make it big. And there are few fintech success stories bigger than 2008 alum, Credit Karma, which scored $175 million this week at a reported $3.5 billion valuation. That makes the credit-score provider the second most valuable alum (after Lending Club, currently trading at $6 billion).

Three other alums received new investments this week: Currency Cloud ($18 million), Signifyd ($7 million) and Prairie Cloudware (undisclosed).

Total investment into the fintech sector this week were $245 million flowing to 15 firms. So far this year, fintech has attracted $7.9 billion.

Following are the deals announced from 19 June to 25 June in order of size:

Credit Karma

Credit reports and personal financial services

HQ: San Francisco, California

Latest round: $175 million (at $3.5 billion valuation)

Total raised: $368 million

Tags: PFM, credit scores, credit monitoring, Finovate alum

Source: Finovate

Currency Cloud

Cross-border payments

HQ: London, England, United Kingdom

Latest round: $18 million

Total raised: $35 million

Tags: Payments, fx, remittances, transfers, SMB, Finovate alum

Source: Finovate

PayRange

Mobile payments for vending machines

HQ: Portland, Oregon

Latest round: $12 million

Total raised: $15.2 million

Tags: Payments, acquiring, SMB, mobile, cards

Source: The Oregonian

Vogogo

Payments risk and compliance management

HQ: Palo Alto, California

Latest round: $12 million

Total raised: $21.5 million

Tags: Payments, risk, compliance, SMB, merchants, cards, acquiring

Source: FT Partners

Canopy Tax (formerly Beanstalk)

Tax and accounting-practice management

HQ: Salt Lake City, Utah

Latest round: $8 million

Total raised: $10 million

Tags: Tax, adviser platform, marketing, client services, accounting, SMB

Source: Crunchbase

Signifyd

Fraud detection

HQ:

Latest round: $7 million Series A

Total raised: $11 million

Tags: Security, fraud, payments, ecommerce, Finovate alum

Source: Finovate

Digital Contact

Data analytics with financial services focus

HQ: United Kingdom

Latest round: $3.8 million

Total raised: Unknown

Tags: Investing, analytics, BI, big data, information

Source: FT Partners

Creditmantri

Consumer credit scores and lead generation

HQ: Chennai, India

Latest round: $2.5 million Series A

Total raised: $2.5 million

Tags: Credit portal, credit scoring, lead generation, loans

Source: WhoGotFunded.com

PromisePay

Payments gateway for online marketplaces

HQ: St. Louis, Missouri

Latest round: $2 million

Total raised: $2.1 million

Tags: Payments, merchants, SMB, acquiring

Source: FT Partners

BankerBay

Online investment banking platform

HQ: Bangalore, India

Latest round: $2 million Seed

Total raised: $3 million

Tags: Investing, wealth management, networking

Source: Fortune Term Sheet (26 June)

StockSpot

Online investment manager

HQ: Sydney, Australia

Latest round: $1.25 million Series A

Total raised: Unknown

Tags: Investing, wealth management, stocks, trading, equities

Source: FT Partners

Givesurance

Insurance premium commissions donated to charitable causes

HQ: Woodland Hills, California

Latest round: $900,000 Seed

Total raised: $1 million

Tags: Insurance, charitable giving, philanthropy

Source: Crunchbase

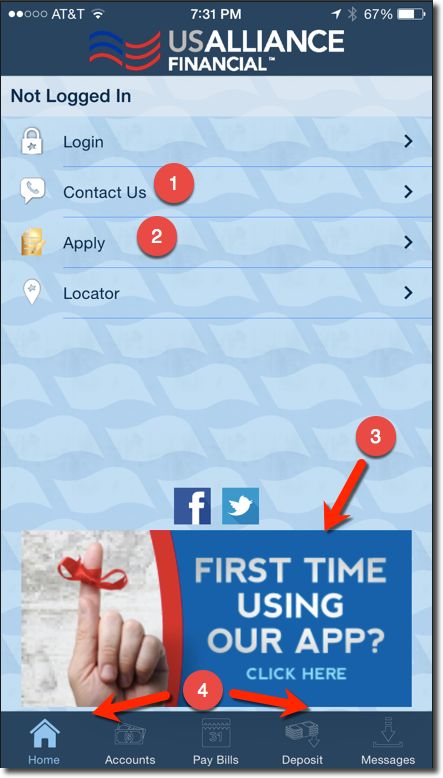

Prairie Cloudware

Digital payment solutions for financial institutions

HQ: Omaha, Nebraska

Latest round: Undisclosed

Total raised: $5 million

Tags: Payments, enterprise, Finovate alum

Source: Finovate

Pipelend

Puerto Rican marketplace lender

HQ: Puerto Rico

Latest round: Undisclosed

Total raised: Unknown

Tags: Lending, underwriting, consumer, loans, P2P, crowdfunding, investing

Source: Crunchbase

Coinplug

Bitcoin and blockchain technology

Latest round: $45,000 (award from JB Financial)

Total raised: $3.4 million

Tags: Payments, crypto-currency, bitcoin, authentication, security, virtual currency

Source: Coinbase