Experience

the future

of fintech!

Latest from the Finovate Blog

Finovate spotlights banking and financial services innovations with exclusive short-form demos across all company stages and features insights from industry experts bringing emerging technologies into real-world context.

Throughout the last 15+ years, Finovate has taken place in California, New York, London, Berlin, Hong Kong, Singapore, Dubai and Cape Town.

50,000+

senior-level executive attendees

3,000+

industry expert speakers

3,000+

innovative fintech demos

50%+

attendees from banks and other FIs

Get Involved

For more information on a specific show, click on the show’s logo above.

Cutting-edge demos

7-minute demos of the most innovative tech in the market now, ready to plug in and give you the edge to compete. Short, punchy, and informative.

Insights from industry titans

Take the pulse of fintech and financial services with 100+ renowned industry experts.

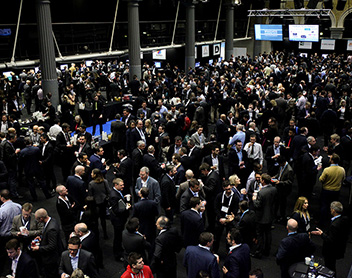

Meaningful connections

Your best route to a truly executive-level audience with 50% from banks, credit unions, and other financial institutions.

Networking measured in quantity and quality

Grow your network intelligently and effectively with our senior-level executive audience and AI tool. Match and meet with the people who can move your business forward.

Join our community!

Subscribe to our blog for the latest news from our alumni and information on upcoming shows!

What Finovate's community is saying . . .

Finovate is a well-run, extremely valuable event that I'd recommend to anyone in the industry.

Fintech’s X Factor…it seems like everyone who’s anyone wants to be seen at Finovate.

Even for us as a large company, this is a great venue for us to put a single product on display and share it with relevant stakeholders.

Great opportunity to survey innovation across the industry and meet people!

With inspiring speakers, informative panel discussions, fast paced demos & opportunity to grow a network of likeminded professionals all in the same event.