The Sneak Peek series looks at the innovators demoing live on stage at FinovateFall 2015. Be sure to pick up your tickets to our annual autumn conference, and we’ll see you in New York!

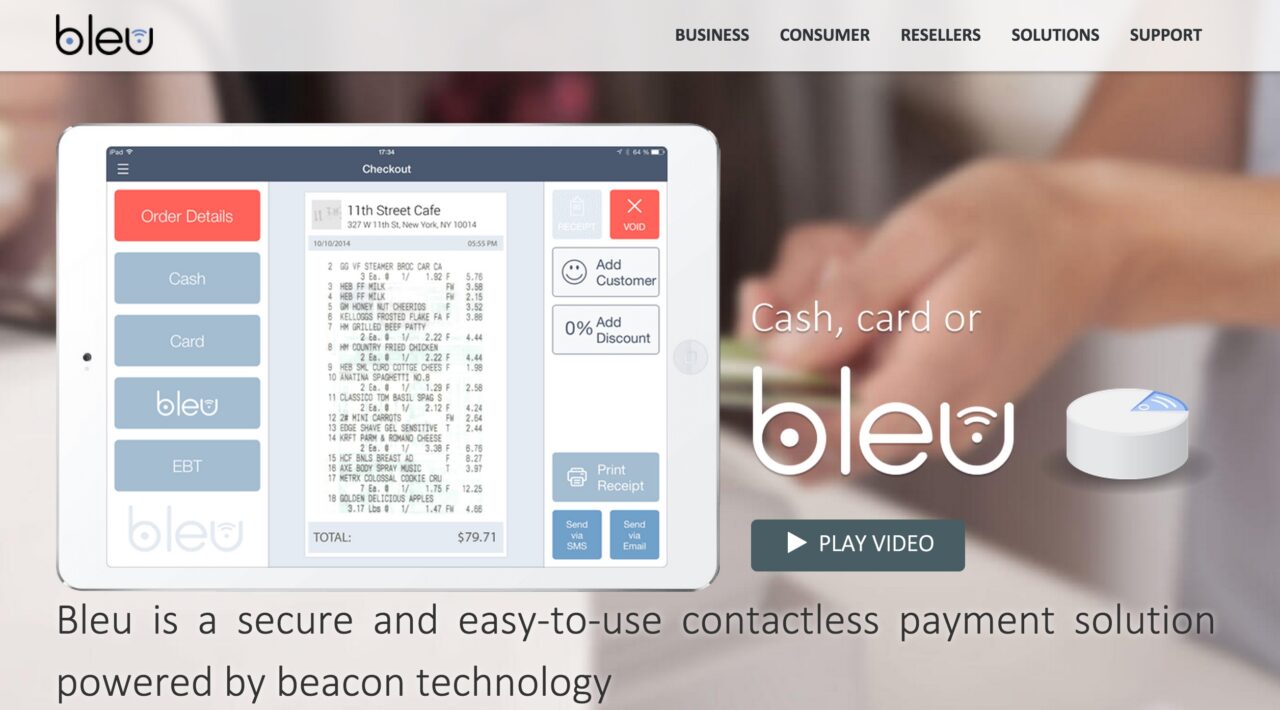

Bleu facilitates mobile transactions utilizing Bluetooth low-energy beacons. Bleu has developed a proprietary mobile point-of-sale and consumer application.

Bleu facilitates mobile transactions utilizing Bluetooth low-energy beacons. Bleu has developed a proprietary mobile point-of-sale and consumer application.

Features:

- Supports any payment type

- Can process a transaction up to 250 feet away from the terminal

- Uses Bluetooth low-energy beacons

Why it’s great

This first-time-ever revolutionary solution moves payment over Bluetooth supported on any iOS or android device.

Presenters

Presenters

Sesie Bonsi, President and CEO

Graduate of Pepperdine School of Law and founder of Bleu, Bonsi is dedicated to using his background and knowledge in the areas of mobile payment and infrastructure to transform financial technology.

LinkedIn

Brett Howell, Senior VP Business Development

Brett Howell, Senior VP Business Development

A graduate of Auburn University, Howell has more than 10 years’ experience in multiple business environments from a small-family business to a multinational corporation.

LinkedIn

Urban FT

Urban FT Presenters

Presenters Mark Kilpatrick, Chief Product and Brand Officer

Mark Kilpatrick, Chief Product and Brand Officer

D3 Banking

D3 Banking Presenters

Presenters Andy Holdt, Director, Sales Support

Andy Holdt, Director, Sales Support

IDmission

IDmission

AcceptEmail

AcceptEmail Presenters

Presenters Geerten Oelering, CTO

Geerten Oelering, CTO

Alfa-Bank

Alfa-Bank Presenters

Presenters