As summer draws to a close, there may be a big acquisition on the horizon in the fraud and financial crime prevention space. Be sure to check in with Finovate’s Fintech Rundown all week long for the latest in fintech news.

Fraud and financial crime prevention

Is Visa looking to acquire fraud fighting platform Featurespace?

Financial wellness

Canadian fintech Koho launches Rent Reporting to help renters improve their credit.

Cryptocurrency / DeFi

Payments bank Banking Circle unveils Euro-pegged stablecoin.

Digital asset infrastructure provider Bitpanda partners with CoinMENA.

Digital banking

MyStateBank turns to Backbase for its new digital banking platform.

Surety Bank partners with Apiture for its digital banking platform.

Lyft teams with earned wage access company Payfare to launch new features for its Lyft Direct debit card and banking app.

Neobank Comun lands $21.5 million.

G2 Risk Solutions unveils solution to integrate merchant risk management.

Payments

Payments processor Adyen introduces new Chief Technology Officer Tom Adams.

Payroll and payments platform Thera raises $4 million in seed funding.

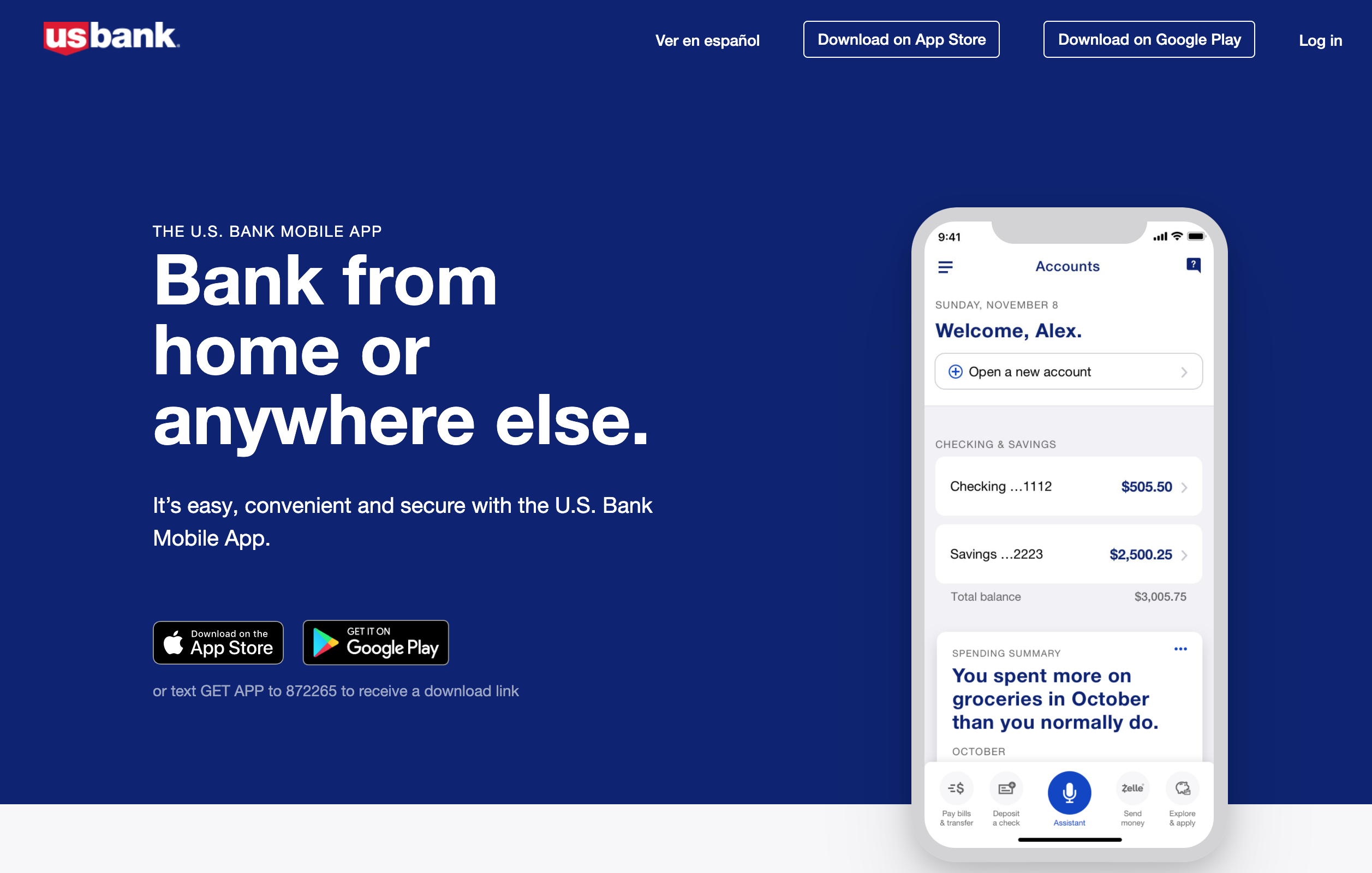

U.S. Bank acquires healthcare-based payments platform Salucro.

Vault expands payments capabilities of its accounts payable platform.

Viamericas partners with Paisamex to expand remittances to Mexico.

Identity verification

Verification platform Sumsub becomes the first identity verification provider to secure Global Digital Identity Certification (GDIC).

Socure introduces new Chief Revenue Officer Matt Thompson.

AuthenticID unveils enhanced Smart ReAuth for instant biometric reauthentication.

E-commerce

Real-time shopping platform Tilt secures $18 million in Series A funding.

Sephora selects Paze online checkout experience for its Beauty Insider loyalty members.

Lending

FICO unveils new enhancements to its platform to improve real-time decision-making.

Rogers Communications partners with Nova Credit, a cross-border credit bureau, to help newcomers to Canada build credit and finance a new smartphone.

Liberis and Sezzle partner to provide funding to small businesses across the United States.

Happy Money appoints Matt Potere as Chief Executive Officer.

Wealth management and investing

Digital investment platform Webull begins offering options trading to its customers.

Insurtech

Insurance brokerage software provider FullCircl inks multi-year agreement with international insurance intermediary group Howden.

Business finance solutions

Galileo enhances B2B expense management offering with Mastercard Smart Data.

Conotoxia launches multi-currency cards for businesses.

Communication

Glia launches ChannelLess AI-powered interactions for financial services.

Tory Passons, VP & Group Product Manager

Tory Passons, VP & Group Product Manager