Funding to the fintech sector maintained pace this week with another quarter-billion ($234.3 million) added to the bank accounts of 17 startups worldwide. The biggest pure-equity round went to Finovate-alum CoverHound, an insurance portal gaining favor with the VC community.

Funding to the fintech sector maintained pace this week with another quarter-billion ($234.3 million) added to the bank accounts of 17 startups worldwide. The biggest pure-equity round went to Finovate-alum CoverHound, an insurance portal gaining favor with the VC community.

There were several interesting acquisitions including French bank Credit Mutual Arkea paying a reported $56 million for a majority stake (86%) in payment processor Leetchi, aka MangoPay. But the big news in the Finovate office was the acquisition of crowd-favorite BillGuard by one of our inaugural presenters, and double-unicorn, Prosper.

So far this year, fintech companies have raised $13.2 billion.

Here are the deals announced from 19 Sep to 25 Sep 2015, by size:

Harmoney

Consumer marketplace lender

HQ: Auckland, New Zealand

Latest round: $127 million (debt and equity)

Total raised: $135 million

Tags: Consumer, p2p, lending, credit, loans, investing

Source: P2P-Banking

CoverHound

Insurance portal

HQ: San Francisco, California

Latest round: $33.3 million; $100 million valuation

Total raised: $53 million

Tags: Consumer, insurance, lead gen, quotes, Finovate alum

Source: Finovate

DriverUp

Auto lending marketplace lender

HQ: Austin, Texas

Latest round: $20 million

Total raised: $70 million

Tags: Consumer, automobiles, auto loans, P2P lending, credit, investing

Source: Crunchbase

G-Banker

Gold trading platform

HQ: Bejing, China

Latest round: $16.8 million Series B

Total raised: $16.8+ million

Tags: Gold, investing, wealth management, trading, online-to-offline

Source: Crunchbase

Leetchi

Payment processor, aka MangoPay

HQ: France

Latest round: $11.1 million; $65 million valuation

Total raised: $56 million

Tags: Consumer, peer-to-peer payments, P2P, group payments, Credit Mutual Arkea (investor, majority owner)

Source: FT Partners, TechCrunch

Steller

Public infrastructure for money

HQ: San Francisco, California

Latest round: $7 million

Total raised: $10 million

Tags: Payments, blockchain, open source, developers, bitcoin, cryptocurrency, Stripe (investor), nonprofit

Source: FT Partners

PeerNova

Distributed financial platform

HQ: San Jose, California

Latest round: $6 million

Total raised: $19 million

Tags: Blockchain, bitcoin, cryptocurrency, enterprise

Source: WhoGotFunded

Ancoa

Risk management

HQ: London, England, United Kingdom

Latest round: $4.7 million Series A

Total raised: $6.3 million

Tags: Enterprise, security, regulations, compliance, fraud protection

Source: FT Partners

BestDealFinance

Financial services comparison portal

HQ: India

Latest round: $3 million Series A

Total raised: $3 million

Tags: Consumer, banking, loans, insurance, credit, lead gen

Source: Crunchbase

ModernAdvisor

Online investment advisory

HQ: Vancouver, British Columbia, Canada

Latest round: $2.2 million

Total raised: $2.2 million

Tags: Consumer, wealth management, investing, asset management

Source: Crunchbase

Novicap

Online invoice marketplace

HQ: London, England, United Kingdom

Latest round: $1.7 million

Total raised: $3.4 million

Tags: SMB, accounts receivables financing, factoring, trade finance

Source: Crunchbase

Ledge

Mobile P2P lending platform

HQ: Santa Monica, California

Latest round: $900,000 Seed

Total raised: $900,000

Tags: Consumer, loans, peer-to-peer, mobile

Source: Crunchbase

PaySur

Funds-transfer platform

HQ: Leon, Mexico

Latest round: $250,000

Total raised: $275,000

Tags: Consumer, payments, remittances, electronic transfers

Source: Crunchbase

Neotrade Analytics

Trading data provider

HQ: Bangalore, India

Latest round: $230,000

Total raised: $230,000

Tags: Trading, investing, enterprise, securities, data, analytics

Source: FT Partners

Crowdway (stealth website)

Financial markets analysis

HQ: Milan, Italy

Latest round: $170,000 Seed

Total raised: $170,000

Tags: Investing, information, trading, analytics, investors, wealth management

Source: Crunchbase

ConnectAbank

Financial services comparison portal

HQ: Mumbai, India

Latest round: Undisclosed

Total raised: Unknown

Tags: Consumer, banking, loans, insurance, credit, lead gen

Source: Crunchbase

Stockbit

Financial markets analysis

HQ: Jakarta, Indonesia

Latest round: Unknown

Total raised: Unknown

Tags: Investing, information, trading, analytics, investors, wealth management

Source: Crunchbase

StockRadar

Mobile stock trading information

HQ: Bejing, China

Latest round: Undisclosed

Total raised: Unknown

Tags: Consumer, trading, investing, stocks, analytics, Microsoft (investor)

Source: Crunchbase

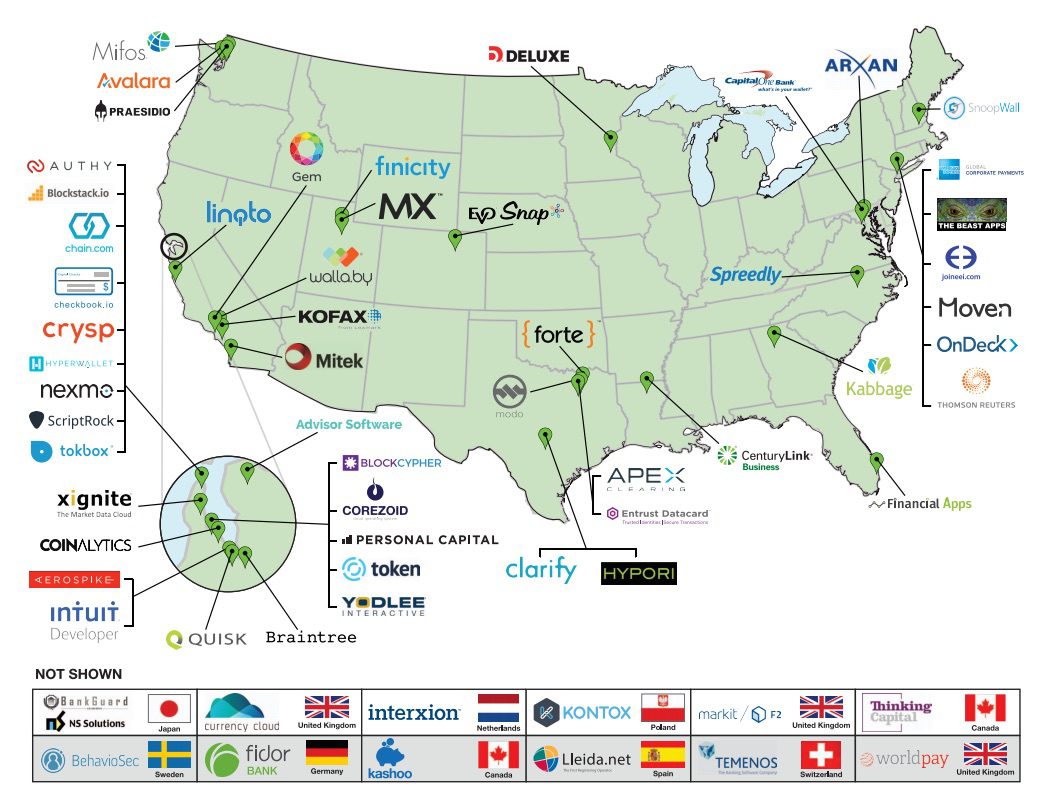

FinDEVr San Francisco 2015

FinDEVr San Francisco 2015