Courtesy of Brussels-based fintech fund, E-Merge, Sezzle is $500,000 closer to its fundraising goal of $1.5 million.

Sezzle is a startup based in Minnesota whose initial solution, Sezzle Pay, leverages the ACH rails to provide faster, lower cost payments. With the customer’s bank account details, Sezzle Pay can initiate immediate payments at checkout. “That’s attractive because ACH is such a low-cost payment method,” Sezzle founder and CEO Charlie Youakim explained during his company’s Finovate debut this spring. “Our rate is 1.5% plus 15 cents, that’s half the cost of quoted credit and debit card processing.” He added: “That’s going to bend the ear of the merchant. That’s going to get Sezzle Pay in the checkout.”

Sezzle CEO Charlie Youakim demonstrated Sezzle Pay at FinovateSpring 2016 in San Jose.

And in order to better compete at the checkout, Sezzle offers 1% rewards for users that click through and pay with Sezzle Pay. This is novel in that while 60% of payments are made with debit cards, “you’d be hard pressed to find a debit card that can give you rewards,” Youakim said. The solution also appeals to millennials, according to Youakim, who noted that only 37% of millennials have a credit card. “The other 63% have no way of getting rewards,” he said.

Writing about the investment at the Sezzle blog, Youakin thanked investors and referenced a number of new hires to help further build the Sezzle platform, including Python, Django, and Swift developers Sukhneer Guron and Rishi Mukherjee, and a pair of “young Ivy Leaguers,” Sean Kilgarriff and Killian Brackey. “We’ve already put some of this capital to use,” he wrote. “I’m excited to see what this team can do now that we have the resources and support that we require to reach our goals.

Founded in January 2016 and headquartered in Minneapolis, Minnesota, Sezzle demonstrated its Sezzle Pay technology at FinovateSpring 2016. The company is a 2016 semifinalist in the Minnesota Cup, the largest statewide, new-venture competition in the U.S., and was profiled in SuperbCrew.com earlier this month.

Udi Solomon (VP, Product) demoes ThetaRay at FinovateFall 2015.

Udi Solomon (VP, Product) demoes ThetaRay at FinovateFall 2015.

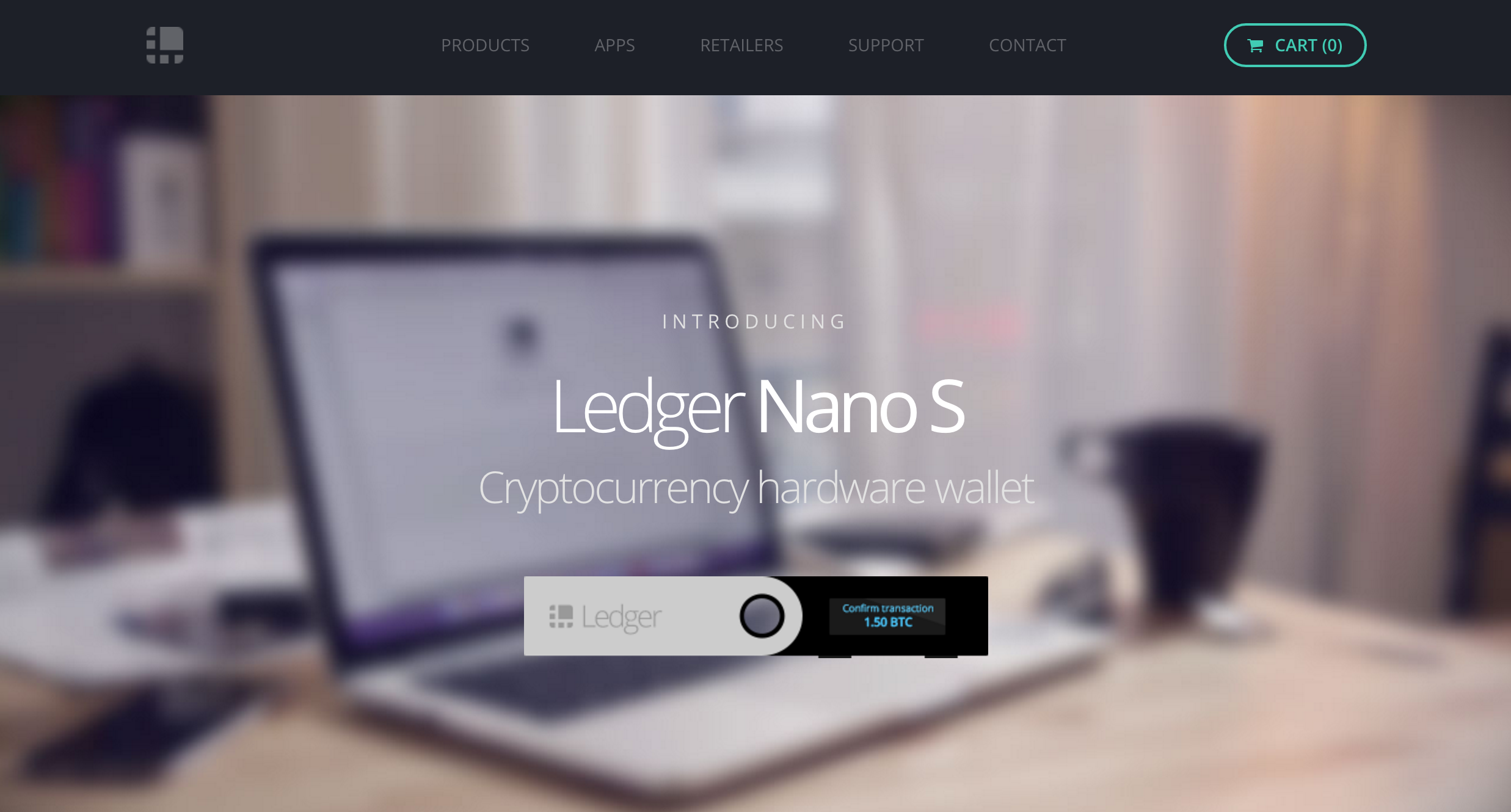

The built-in OLED display on the Nano S allows the user to double-check and confirm each transaction by tapping the buttons on the device. While the Nano S includes built-in apps for both Bitcoin and Ethereum, it also supports other blockchain-based currencies.

The built-in OLED display on the Nano S allows the user to double-check and confirm each transaction by tapping the buttons on the device. While the Nano S includes built-in apps for both Bitcoin and Ethereum, it also supports other blockchain-based currencies.

Online wealth-management platform

Online wealth-management platform