For the second week in a row, the number of deals reported, 38, was just one below the weekly record. In all, fintech companies worldwide raised $222 million the second week of June. Nine deals were for undisclosed sums and $500,000 was reported as debt, although two were convertible notes. There was an odd cluster of fundings around the $2 million mark with 10 of the 29 deals (with known amounts) landing between $1.8 and $2.5 million.

For the second week in a row, the number of deals reported, 38, was just one below the weekly record. In all, fintech companies worldwide raised $222 million the second week of June. Nine deals were for undisclosed sums and $500,000 was reported as debt, although two were convertible notes. There was an odd cluster of fundings around the $2 million mark with 10 of the 29 deals (with known amounts) landing between $1.8 and $2.5 million.

Five Finovate alums combined to raise nearly $100 million, 42% of the week’s total:

- Tradeshift received a $75 million Series D giving the trade platform a $500 million valuation

- CrowdFlower tapped Microsoft to lead a $10 million round to further its big data analytics

- Bento for Business landed $7 million for its digital business banking platform

- Buzz Points grabbed $1.8 million for its credit- and debit-card loyalty program

- Alpha Payments Cloud joined Wells Fargo’s latest accelerator class, receiving an equity infusion of $50,000 to $500,000

The total number of deals YTD stands at 627, nearly double last year’s 321. Total dollars raised YTD is now $16.4 billion, more than twice the $7.5 billion raised during the same period a year ago.

——-

Fintech deals by size from 4 June to 10 June 2016:

Tradeshift

Trading platform

Latest round: $75 million Series D

Total raised: $174 million

HQ: San Francisco, California

Tags: SMB, enterprise, trade finance, invoicing, billing, expense management, accounting, payables, Finovate alum

Source: Finovate

zipMoney Payments

Alt-lender and payments

Latest round: $20.6 million Post-IPO Equity

Total raised: $121.6 million Post-IPO, including $100 million Debt

HQ: Perth, Australia

Tags: Consumer, lending, credit, underwriting, payments, point-of-sale financing, POS

Source: Crunchbase

Jiff

Enerprise health benefits platform

Latest round: $17.7 million Series C

Total raised: $65.7 million

HQ: Palo Alto, California

Tags: Healthcare, insurance, employee benefits, HR

Source: FT Partners

nCino

Bank operating system

Latest round: $15.67 million

Total raised: $64.67 million

HQ: Wilmington, North Carolina

Tags: Institutions, CRM, loan origination, workflow, content management, analytics, BI

Source: Crunchbase

NexusCrowd

Real estate crowdfunding platform

Latest round: $15.5 million

Total raised: $15.5 million

HQ: Toronto, Ontario, Canada

Tags: Consumer, SMB, lending, peer-to-peer, P2P, credit, underwriting, investing

Source: Crunchbase

Ascend Consumer Finance

Alt-lender

Latest round: $11 million Series A

Total raised: $12.5 million

HQ: San Francisco, California

Tags: Consumer, lending, credit, underwriting, investing

Source: Crunchbase

CrowdFlower

Data analytics platform

Latest round: $10 million Series D

Total raised: $38 million

HQ: San Francisco, California

Tags: Insitutions, advisers, big data, machine learning, analytics, BI, Finovate alums

Source: Finovate

trueEX

Executation platform for interest rate swaps (IRS)

Latest round: $9.21 million

Total raised: $33.7 million

HQ: New York City

Tags: Institutions, trading, investing

Source: Crunchbase

Notarize

Electronic notary service

Latest round: $8 million Series A

Total raised: $10.4 million

HQ: Boston, Massachusetts

Tags: SMB, lending, legal, compliance

Source: Crunchbase

Bento for Business

Digital business banking platform

Latest round: $7 million Series A

Total raised: $9.5 million

HQ: San Francisco, California

Tags: SMB, small business, online banking, payments, debit cards, prepaid, expense control, Finovate alum

Source: Finovate

InvoiceFinance

Invoice financing

Latest round: $3.9 million Seed

Total raised: $3.9 million

HQ: ‘s-hertogenbosch, Netherlands

Tags: SMB, lending, alt-lender, commerical loans, trade finance, billing, invoicing, cash flow, working capital

Source: Crunchbase

FlexReceipts

Digital receipts

Latest round: $2.5 million

Total raised: $5 million

HQ: California

Tags: SMB, B2B2C, payments, personal financial management (PFM), spending, marketing

Source: Crunchbase

PaymentWorks

B2B payments platform

Latest round: $2.5 million Convertible Note

Total raised: $4.03 million

HQ: Cambridge, Massachusetts

Tags: SMB, payments, invoicing, billing, bill payment

Source: Crunchbase

Satago

Invoice financing

Latest round: $2.3 million

Total raised: $3.4 million

HQ: London, England, United Kingdom

Tags: SMB, lending, alt-lender, commerical loans, trade finance, billing, invoicing, cash flow

Source: Crunchbase

Muume

Mobile point-of-sale platform

Latest round: $2.3 million Series A

Total raised: $2.3 million

HQ: Cham, Switzerland

Tags: SMB, payments, mobile, mPOS, merchants, acquiring, credit/debit cards

Source: Crunchbase

Bunker Protect

Insurance marketplace for contract labor

Latest round: $2 million Seed

Total raised: $2 million

HQ: San Francisco, California

Tags: SMB, insurance, contract-related, 1099 workers

Investors: Hiscox, Route 66, American Family, Comcast

Source: Crunchbase

CreditVidya

Alt-credit score

Latest round: $2 million Series A

Total raised: $2 million

HQ: Mumbai, India

Tags: Institutions, lenders, credit reports, underwriting, credit

Source: Crunchbase

ePaylater

Consumer point-of-sale financing

Latest round: $2 million Seed

Total raised: $2 million

HQ: Mumbai, India

Tags: Consumer, lending, alt-lending, underwriting, credit

Source: Crunchbase

FollowIt

Real estate listings

Latest round: $2 million Seed

Total raised: $2 million

HQ: Woolloomooloo, Australia

Tags: Consumer, mortgage, home buying, discovery, lead generation

Source: Crunchbase

KrazyBee (Finovation Tech Solutions)

Alt-lender

Latest round: $2 million Seed

Total raised: $2 million

HQ: Bangalore, India

Tags: Consumer, lending, credit, underwriting, point-of-sale financing

Source: Crunchbase

Buzz Points (owned by Fisoc)

Debit and credit card rewards

Latest round: $1.86 million

Total raised: $1.86 million

HQ: Austin, Texas

Tags: B2B2C, institutions, payments, marketing, loyalty, marketing, Finovate alum

Source: Crunchbase

AppFront

Mobile point-of-sale apps

Latest round: $1.5 million Seed

Total raised: $1.5 million

HQ: Tel Aviv, Israel

Tags: B2B2C, SMB, payments, mobile, mPOS, merchants

Source: Crunchbase

GrowthDeck

Equity crowdfunding platform

Latest round: $1.45 million

Total raised: $1.45 million

HQ: London, England, United Kingdom

Tags: Consumer, SMB, equity, stock, peer-to-peer, P2P, investing

Source: Crunchbase

NettCash (owned by Mozido)

Mobile wallet & payments

Latest round: $1.3 million

Total raised: $1.3 million

HQ: Harare, Zimbabwe

Tags: Consumer, payments, mobile, merchants, acquiring, mPOS

Source: Crunchbase

Insly

Insurance management software

Latest round: $1.13 million Seed

Total raised: $1.16 million

HQ: London, England, United Kingdom

Tags: SMB, insurance agents, brokers, process management

Source: Crunchbase

Risk Focus

Risk management for capital markets

Latest round: $500,0000 Debt

Total raised: $500,000

HQ: New York City, New York

Tags: Institutions, compliance, risk mananagement, trading, investing

Source: Crunchbase

Besepa

Direct debit platform

Latest round: $340,000 Seed

Total raised: $630,000

HQ: Madrid, Spain

Tags: Consumer, SMB, funds transfer, payments, debit, billpay

Source: Crunchbase

Payfully

Receivables financing for AirBnB hosts

Latest round: $300,000 Convertible Note

Total raised: $300,000

HQ: Brooklyn, New York

Tags: Consumer, SMB, lending, alt-lending, invoice financing

Source: Crunchbase

PocketSuite

Payment and management tools for small businesses

Latest round: $120,000 Seed

Total raised: $395,000

HQ: San Francisco, California

Accelerator: Y Combinator

Tags: SMB, payments, billing, invoicing, accounting bookkeeping

Source: Crunchbase

Alpha Payments Cloud

Payments platform

Latest round: Undisclosed

Total raised: $12+ million

HQ: Singapore

Accelerator: Wells Fargo

Tags: Institutions, SMB, payments, hub, merchants, credit/debit cards, Finovate alum

Source: Finovate

BLender

P2P lending platform

Latest round: Undisclosed

Total raised: $5 million

HQ: Tel Aviv, Israel

Tags: Consumer, lending, peer-to-peer, P2P, credit, underwriting, investing

Source: Crunchbase

Capsilon

Document and data management for mortgage companies

Latest round: Undisclosed

Total raised: $21.4+ million

HQ: California

Tags: Institution, mortgage banking, brokers, process management

Source: FT Partners

Chamasoft

Bookkeeping tool for investment groups

Latest round: Undisclosed

Total raised: Unknown

HQ: Nairobi, Kenya

Tags: Consumer, lending, peer-to-peer, P2P, credit, underwriting, investing

Source: Crunchbase

Kwanji

FX comparison site

Latest round: Not disclosed

Total raised: $1.93 million

HQ: London, England, United Kingdom

Tags: SMB, foreign exchange, shopping, lead generation, price comparison, remittances

Source: Crunchbase

mergims

Mobile prepaid account

Latest round: Undisclosed

Total raised: $160,000

HQ: Kigali, Rwanda

Tags: Consumer, payments, underbanked, prepaid, mobile

Source: Crunchbase

Tokhelp

Fundraising software for charitable institutions

Latest round: Undisclosed Series C

Total raised: Unknown

HQ: Goiania, Brazil

Tags: Nonprofits, payments, merchants, acquiring, mobile

Source: FT Partners

VugaPay

Mobile payments

Latest round: Undisclosed

Total raised: $25,000+

HQ: Kigali, Rwanda

Tags: Consumer, payments, mobile, prepaid

Source: Crunchbase

Zuora

Billing solutions

Latest round: Undisclosed

Total raised: $242.5 million

HQ: Foster City, California

Tags: SMB, billing, invoicing, payments, accounts-receivables management, bookkeeping

Source: Crunchbase

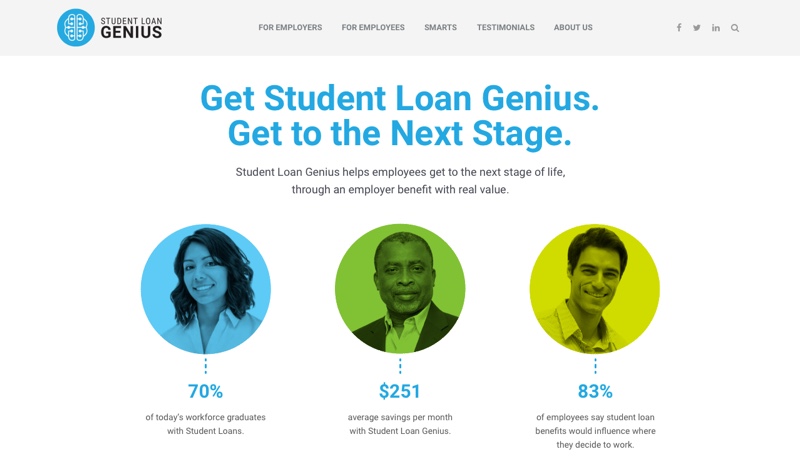

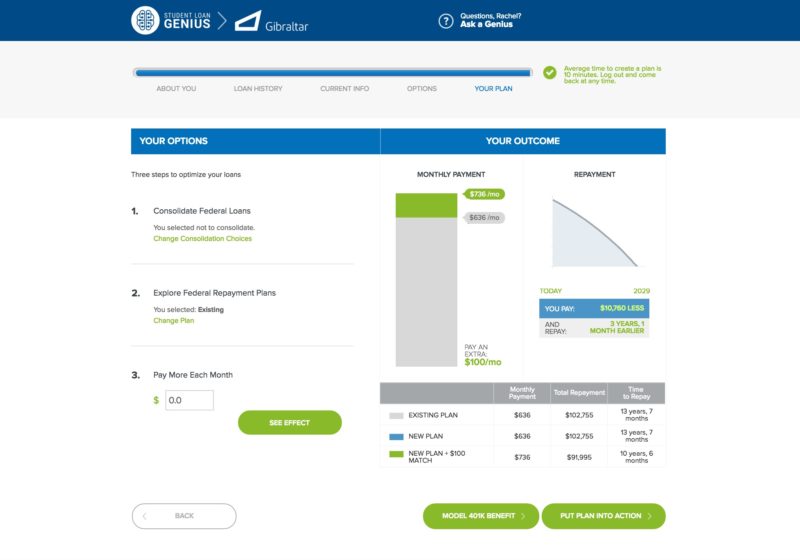

We spoke by phone with Student Loan Genius Director of Marketing and PR Jovan Hackley during FinovateSpring 2016 and followed up with a few questions by email.

We spoke by phone with Student Loan Genius Director of Marketing and PR Jovan Hackley during FinovateSpring 2016 and followed up with a few questions by email.

Richard Caetano, CEO, presented Stratumn’s blockchain-development platform at FinDEVr New York 2016.

Richard Caetano, CEO, presented Stratumn’s blockchain-development platform at FinDEVr New York 2016.