With the stock market rallying to new highs, the new robo fund from LendingRobot may have arrived just in time for people looking to diversify their portfolios with investments in the alternative lending market. LendingRobot Series makes it easy for peer lending investors to put money to work in different timeframes and risk exposures with returns ranging from 6.86% to more than 9%. The solution – part roboadvisory, part hedge fund – converts clients’ contributions into units which are invested across four leading lending marketplaces – Funding Circle, Lending Club, Lending Home, and Prosper. LendingRobot CEO Emmanuel Marot says that the new solution is designed to take advantage of the “excellent performance” of alternative lending investments and help investors avoid the problem of “fragmentation” that adds complexity to the process.

“That’s why we’ve created LendingRobot Series: to provide investors that understand the value of investing in alternative lending with the confidence that comes from intelligent automation, easy liquidity, and complete transparency,” Marot explained.

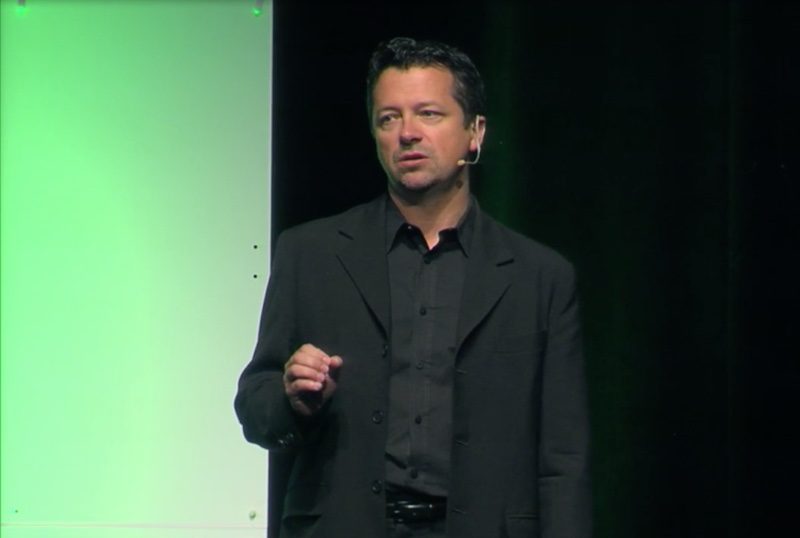

Pictured: LendingRobot CEO Emmanuel Marot demonstrating his platform’s dashboard at FinovateSpring 2016.

That “complete transparency” comes courtesy of LendingRobot’s decision to leverage blockchain technology to create a detailed, weekly ledger of the fund’s holdings. LendingRobot Series uses a hash code signature and notarization by Ethereum’s blockchain, to prevent data tampering, and assets are held in a bankruptcy protection vehicle with no liabilities other than its investors. The service charges a flat 1% a year management fee and caps fund expenses at 0.59% with no performance fees.. These compare favorably with the notorious “2% and 20%” demanded by most hedge funds.

LendingRobot supports four “Series” investors can choose from based on their investment preferences: short term aggressive and conservative, and long term aggressive and conservative. Average performance ranges from 6.86% for short-term conservative to 9.66% for long-term aggressive. Average maturity for short term series is 18 months. Long-term series maturities are 30-31 months.

Headquartered in Seattle, Washington, LendingRobot demonstrated its technology at FinovateSpring 2016, where it won Best of Show. The company has raised $3 million in funding, and includes Runa Capital and Club Italia Investimenti among its investors. TechCrunch profiled the company last summer, quoting Marot’s optimism toward the “insane growth in the peer lending market.” LendingRobot launched its P2P investment tracking mobile app – dubbed “Mint for P2P Lending Accounts” – last spring.

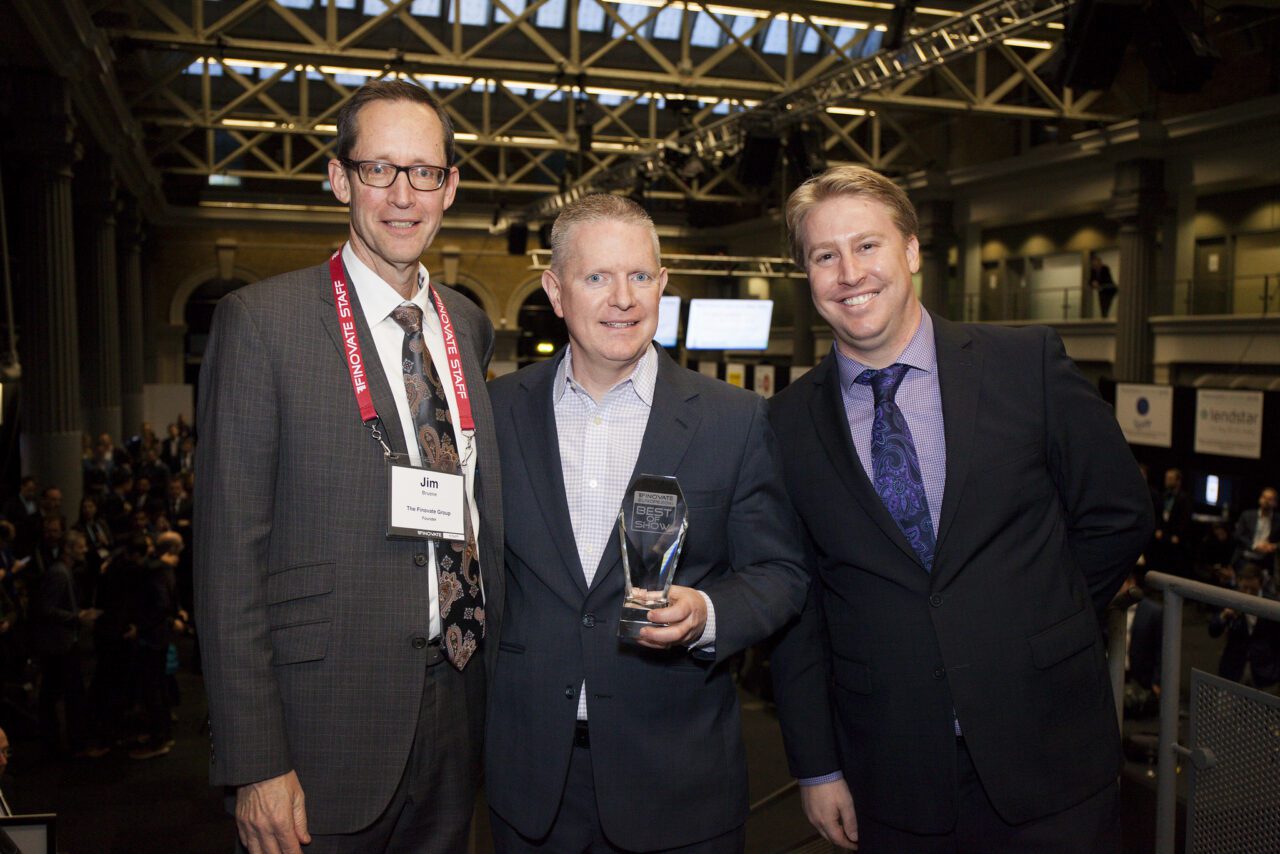

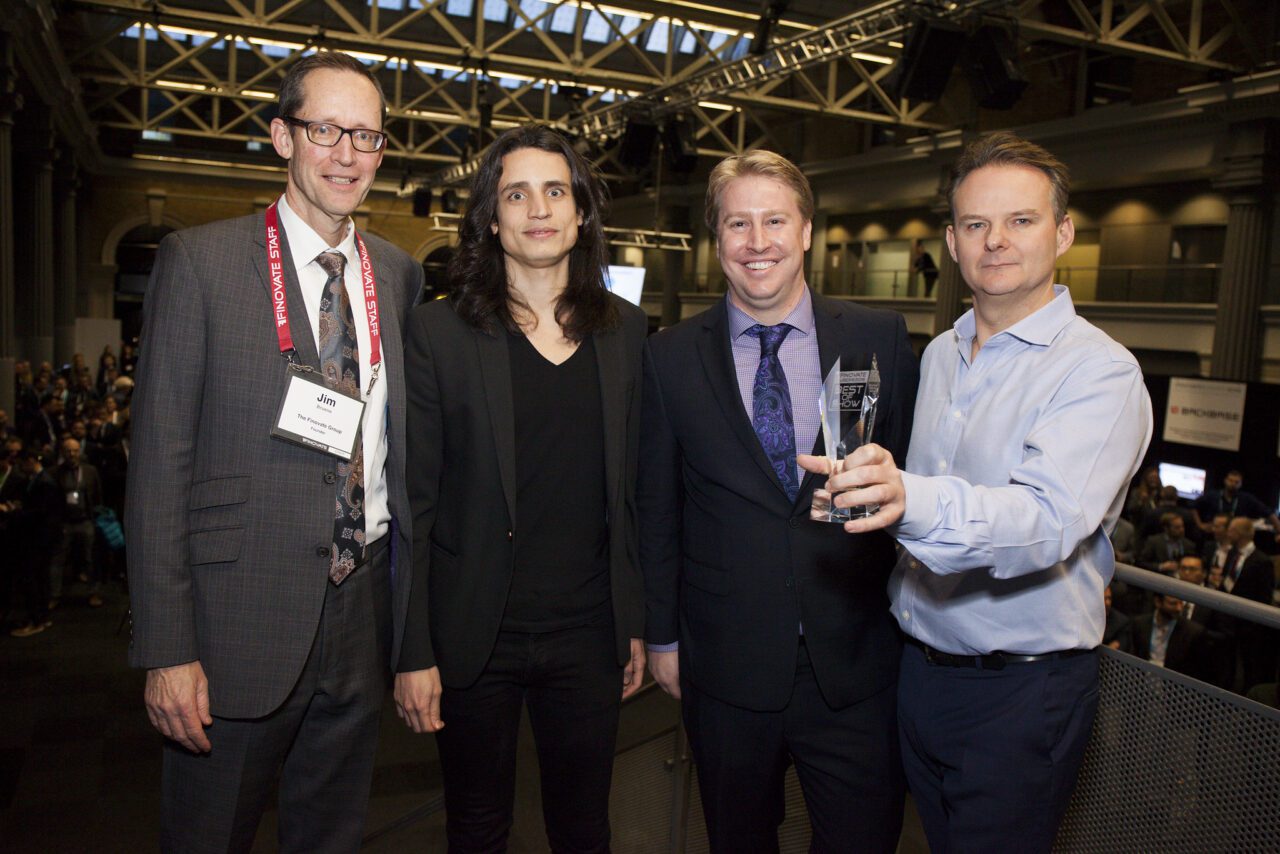

A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot.

A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot. Presenters

Presenters Szymon Mitoraj, Director of Internet and Mobile Banking Department, Head of Digital

Szymon Mitoraj, Director of Internet and Mobile Banking Department, Head of Digital

EyeVerify

EyeVerify IDScan Biometrics

IDScan Biometrics

Kristoff Zammit Ciantar, CEO

Kristoff Zammit Ciantar, CEO experience in all areas of IT, including as a developer, consultant, and trainer in many industries.

experience in all areas of IT, including as a developer, consultant, and trainer in many industries.