Leveraging the power of technology to make raising capital in the bond market easier and more efficient for large companies is the goal of Overbond, the Toronto-based startup launched in 2015. The firm’s technology enables companies to access both investor and dealer networks directly for the first time. CEO Vuk Magdelinic, co-founder, calls Overbond “a little bit like eBay meets Funding Circle.”

Even though bond-issuance is the “lifeline” of finance, Magdelinic notes that the processes and technology supporting this $2.6 trillion industry are far from state of the art. He said:

We talk with inside investors who tell us they are getting inundated with hundred-plus phone calls a week regarding new bond issues. Issuers have lost confidence [as to whether] they are getting the best price possible on their bonds. And regulators have caught on and said flat-out that the process isn’t competitive and transparent enough.

Overbond’s platform replaces a process that, in addition to being 50-years old, is manual, non-transparent, error-prone and costly for everybody involved.” By digitizing every step of the bond-origination process, Overbond provides all participants with transparent, digital price discovery, robust deal-execution workflow and “better relationships,” courtesy of the platform’s big data analytics, which scan and evaluate the universe of investors to make specific, predictive relationship-management recommendations.

At FinovateFall, Overbond debuted its proprietary digital price-discovery module. “It’s all about price discovery, ” Overbond co-founder and Head of Product Han Ryoo said while introducing the new feature live on stage. “We allow discreet channels for issuers, dealers and investors to express their interest,” he said, “and dealers are able to turn this interest immediately into orders.”

Company facts:

- Founded in 2015

- Headquartered in Toronto, Ontario, Canada

- Raised $7.5 million in funding

- Named one of KPMG’s Top 50 Emerging Global Stars in 2016, a Canadian Innovation Exchange Top 20 Company, and one of Paypal and Techvibes’ Fintech Five.

From left: Overbond co-founders CEO Vuk Magdelinic and Han Ryoo, head of product, demonstrated their bond-origination platform at FinovateFall 2016.

We briefly caught up with Vuk Magdelinic, CEO and co-founder of Overbond, at his booth during the networking session at FinovateFall 2016, and followed up via e-mail afterward. Here are his thoughts on the impact his company’s technology can make on the bond-origination process.

We briefly caught up with Vuk Magdelinic, CEO and co-founder of Overbond, at his booth during the networking session at FinovateFall 2016, and followed up via e-mail afterward. Here are his thoughts on the impact his company’s technology can make on the bond-origination process.

Finovate: What problem does your solution solve?

Vuk Magdelinic: The technology is aimed at making the primary bond-issuance process more digital, transparent, and secure. It reduces operational risk, market risk, and transaction costs for all involved parties.

Finovate: Who are your primary customers?

Magdelinic: Corporate and government fixed-income issuers, fixed-income dealers, and fixed-income investors.

Finovate: How does your technology solve the problem better?

Magdelinic: Overbond is the first fully integrated platform to connect corporate and government bond-market issuers, dealers, and fixed-income investors. It transforms a currently manual process into a digital process and simplifies all stages of bond origination through better relationship management, digital price discovery, and robust deal execution.

Key platform features include:

- digital primary bond issuance workflow

- digital supply-and-demand discovery

- internal/external communication and relationship-management tools

- advanced data analytics and charting

- educational resources, documentation management

- comprehensive issuer/investor/dealer directories

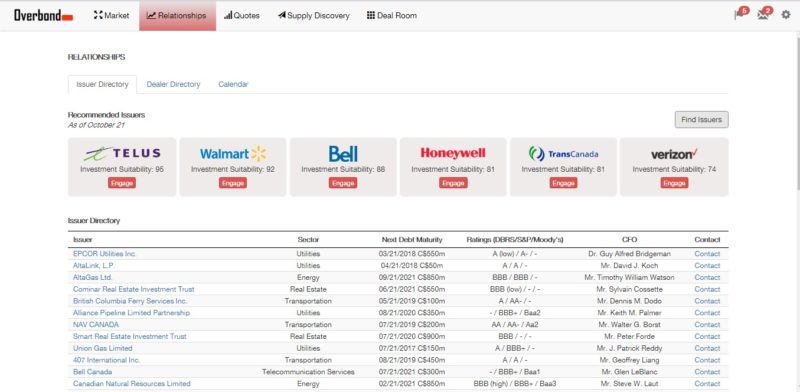

Pictured: Issuer Directory – The Overbond platform includes an issuer directory that allows you to directly contact issuers, dealers, and investors. It also includes a proprietary algorithm that provides users with “recommended” issuers, investors, or dealers to engage.

Finovate: Tell us about your favorite implementation of your platform.

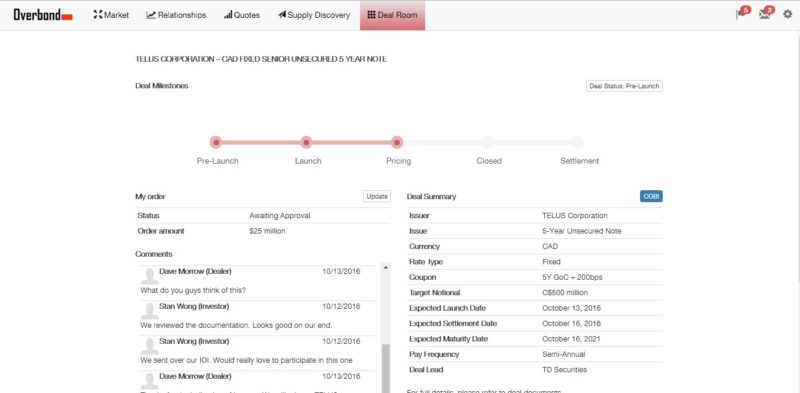

Magdelinic: Our favorite technology implementation so far is the price-discovery module. It is the first of its kind in the world, and is designed to enable optimal bond pricing and robust deal execution. The module addresses the long-standing issue of price discovery—aka soft sounding—being one of the most inefficient manual components of the bond-origination process.

Instead of countless phone calls and emails, our price-discovery module allows dealers, issuers, and investors to share real-time expressions of interest in a private and secure format. Parties involved can comment, fully customize, and gain insights into inquiries using our proprietary analytics engine. Ultimately, the module allows dealers, issuers, and investors to better gauge the market and gain confidence with respect to deal execution.

Pictured: Deal Room – The Overbond platform includes an end-to-end workflow for executing bond issuances. Here you can see a bond deal from an investor’s perspective; it includes milestones, your order status, dealer chat functionality, and a summary of the deal.

Finovate: What in your background gave you the confidence to tackle this challenge?

Magdelinic: We are both fintech leaders with extensive capital markets experience. I have more than a decade of experience in capital markets and technology. Prior to founding Overbond, I worked as a risk and regulatory consulting manager with PwC, and led large digital transformations for Deutsche Bank and BNY Mellon. I also spent time working in fixed-income, structured products origination with CIBC, where I met co-founder Han Ryoo.

Han Ryoo, head of product, has more than 8 years of fixed income and fintech experience from CIBC World Markets, TD Securities, BMO Capital Markets, Barclays Capital and Plooto. In particular, Han specialized in corporate bond origination leading $30+ billion in deals for over 40 multinational corporations. Han gained experience in fintech by working as director of operations at the business payments platform, Plooto. However, despite our experience, the most important factor contributing to our confidence in tackling this challenge, is that we believe in the power of technology for efficient capital markets.

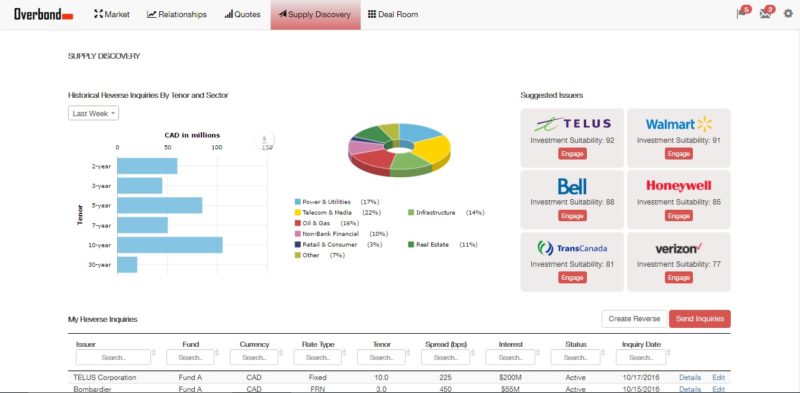

Pictured: Supply Discovery – Using Overbond’s supply-discovery feature, dealers and investors can see their historical reverse inquiry activity as well as recommended issuers to engage. Dealers and investors can then generate reverse inquiries, send them to issuers, and monitor them through the platform.

Finovate: What are some upcoming initiatives from your company that we can look forward to over the next few months?

Magdelinic: Over the next few months, we have a pipeline of initiatives that we are incredibly excited about! Here are a few things to look out for:

- Cobi Intelligence Analyst: Currently in beta format, Cobi is an “intelligence analyst” that uses big data and machine learning to study data and construct algorithms that allow it to make predictions. Cobi was designed to assist all fixed-income participants with their decision making related to the primary bond-issuance process.

- Overbond Chat: Overbond Chat allows all fixed-income market participants to build and enhance relationships by establishing private, secure, easily accessible, and ongoing channels of communication among issuers, investors, and dealers.

Finovate: Where do you see your company a year or two from now?

Magdelinic: We see ourselves as the company spearheading the transformation of bond-issuance processes from legacy systems into a fully digital investment banking approach. We plan to drive a more transparent, secure, and efficient process that generates significant value to all stakeholders involved. We see ourselves as a global fintech leader in the primary bond-issuance space, and we plan to empower issuers, investors, and dealers to make more effective decisions with respect to bond issues.