This article was first published on FinTech Futures on 22 March 2017.

Throughout the year we will be profiling women in FinTech, not simply to celebrate their success but also to hear what has worked for them during the course of their careers. This week, Samina Rizwan, Enterprise Architect, Habib Bank Ltd tells us about her path into FinTech and how she has become a distinguished leader within the industry, making a positive impact in the financial services industry. In 2016, Samina was shortlisted for the Woman In Technology (W.I.T) Award with Banking Technology.

How did you start your career?

I started my career 1995, as a Computer Systems Engineer working for a PCB manufacturing company in San Jose. Being a professional engineer, I was excited about the challenges I used to face each day when I routed and designed multi-layered circuit boards in those days where technology was in its midway especially in a country like mine. Yet it was far from sight as to when that type of technology would become common and a career path for engineers in Pakistan. I then switched to the software technology soon after realizing these facts and proceeded with software development further growing into the project management regime and remained as a vendor for another eight years.

I joined the financial industry after 10 years of my career where I started working as customer rather than a vendor and that really change the way I thought about technology, as I was the end user of it. Being a banking technology person, the need of satisfying the bank’s customers became a pressing need of the day. I was engaged in the IT Portfolio Management at the bank working with internal and external customer and also turned the technology back end to offer more innovative financial products.

“I always believe in ‘change for good’.”

What sparked your interest in FinTech?

The Fintech Rise. As the financial world is shrinking and becoming more personal to customers based on their requirements, lifestyle trends, socio-economical changes around the globe has limited the financial institutions to cover the demand and supply cycle of all the customers at an equal and consistent level. Hence the rise of FinTechs gaining momentum and disrupting the financial industry by their financial inclusion in everyone’s life.

What was your lightbulb moment?

In developing countries like mine, the FinTechs have played a vital role along with other service providers like TELCO companies that are providing simple means of payment services to the unbanked masses.

This disruption created a phenomenal change in the financial institution including my previous and current organization to startup banking for the unbanked. This has not only brought in competition to the local market, but is also now becoming popular in the international markets. The African region is offering similar financial products to their customers using technology.

“Women have proven to be an important and critical part of the technology.”

What inspires you?

After having said all about FinTechs, financial institutions, we all remain human at the end of the day and being a human gives us the leverage to bring change on a faster pace, thus driving the technology owners to bring corresponding changes in their technology stacks. I always believe in “change for good” and so I follow the FinTech models to bring changes in the financial institutions while crafting business and IT strategies, bringing in new technologies to the bank, creating room for innovation and new ideas like digital banking.

“Women are far stronger than they think and can carry on another mile to reach the pinnacle of their professional lives and pick themselves up and move on…”

Why is the #WomenInFinTech movement important?

The other half of the world has always been a part of almost every industry, technology included. We, as females have been consistently assisting, creating, developing, researching, innovating, working by all means in all areas of science, technology and engineering at superior levels rather than mediocre levels. The current C-levels in most technology giants currently are “females” and I am really proud to be a woman too. Women, being patient in nature and having the great capability of multi-tasking, have proven to be an important and critical part of the technology.

What piece of advice would you give women starting their careers in FinTech?

I still consider that many women are still far away from being a mid-level and leading positions, and the main reason for such exclusion might be due to mid-career exits from their professional life and entering into domestic lives. It is also due to upbringing of children most of the time in our part of the world. But I would suggest that they are far stronger than they think and can carry on another mile to reach the pinnacle of their professional lives and pick themselves up and move on…

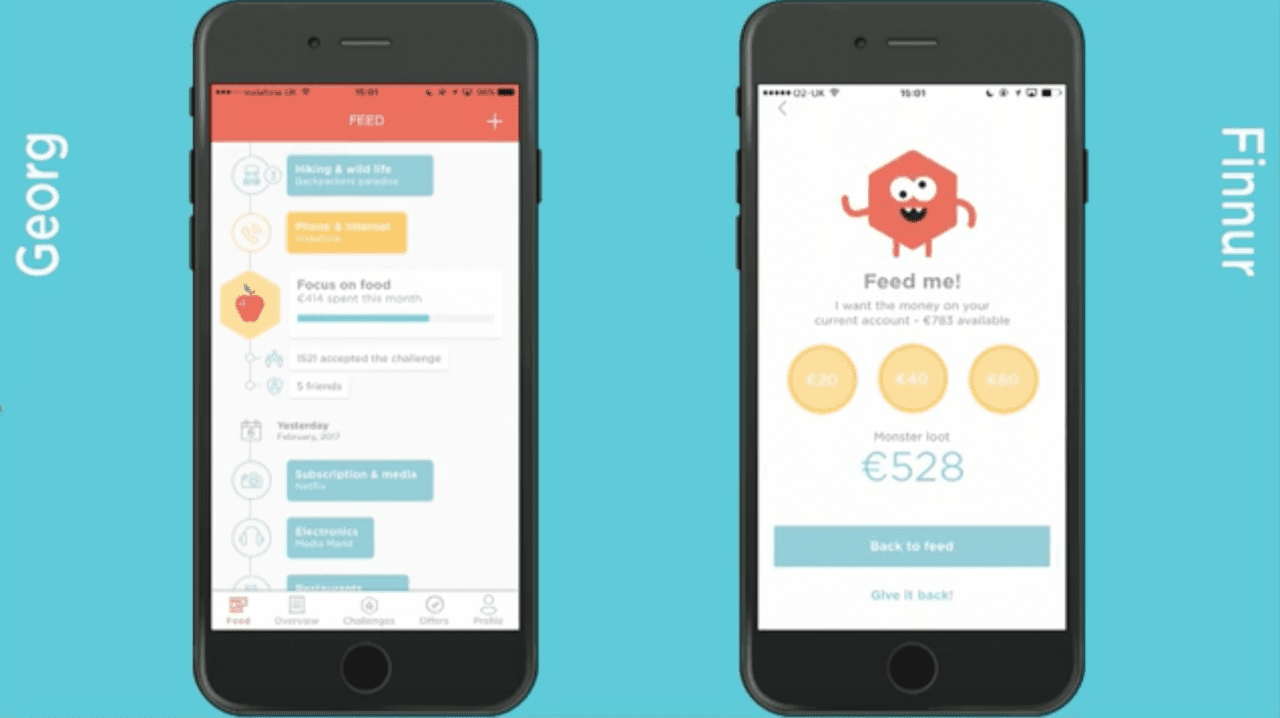

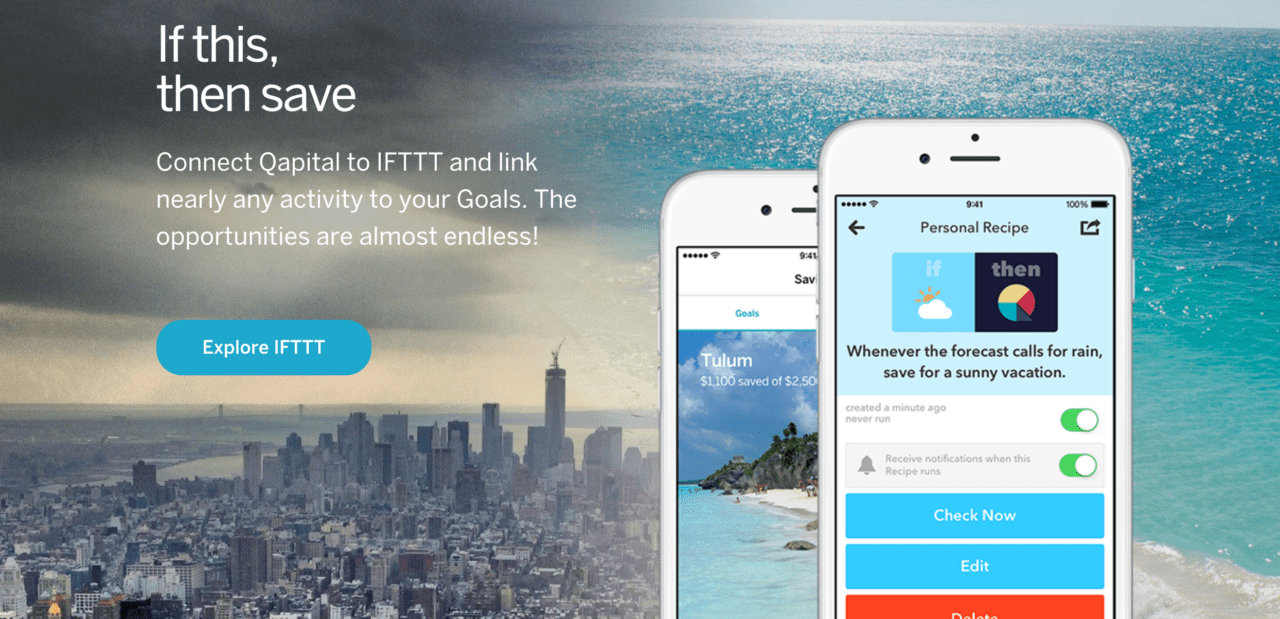

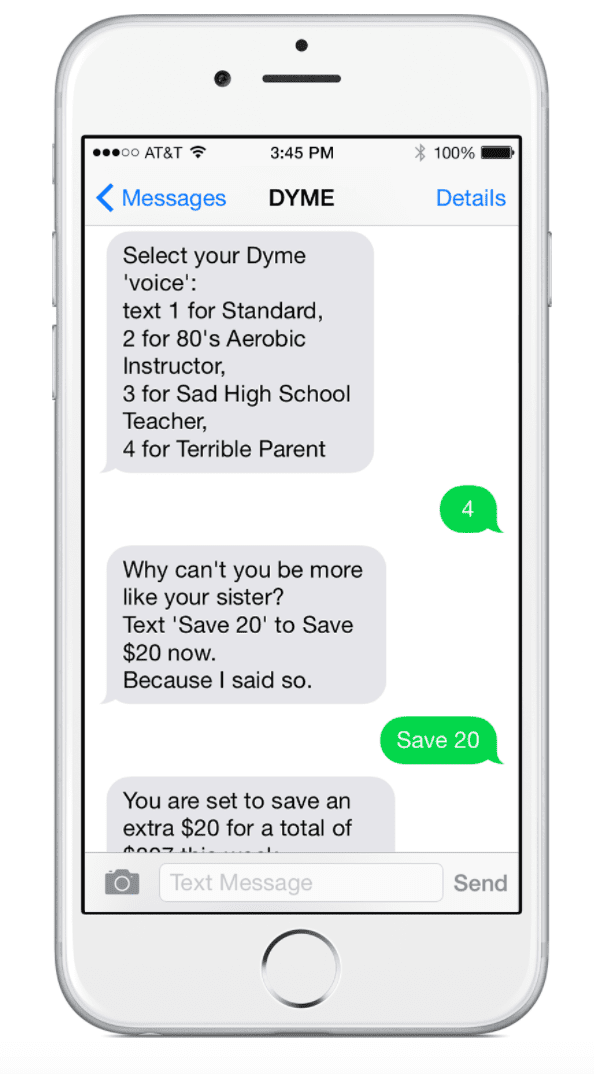

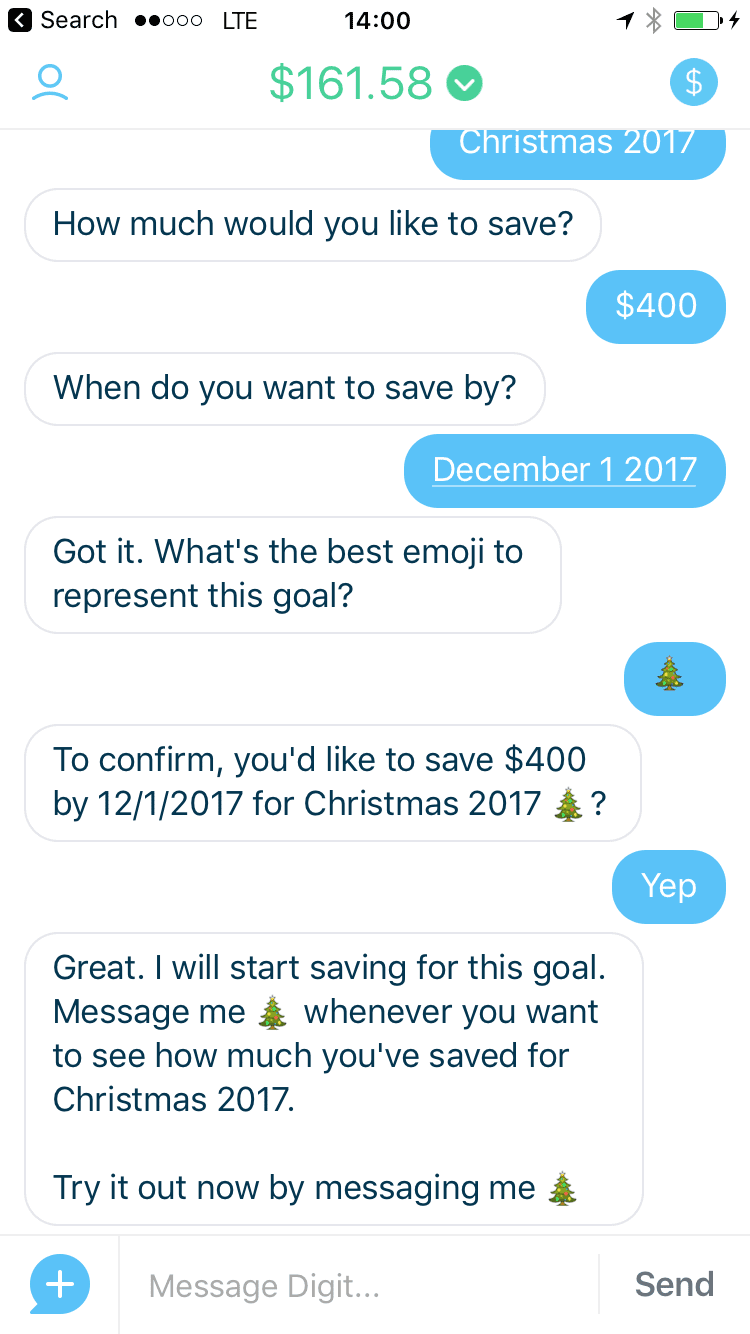

approach to determine the best dollar amount and frequency to save on behalf of the user, based on their historical spend. They use a chat-based interface for client communication and account management. Two examples in this space are Dyme, which takes a strict B2B approach, and Digit, which offers a B2C app.

approach to determine the best dollar amount and frequency to save on behalf of the user, based on their historical spend. They use a chat-based interface for client communication and account management. Two examples in this space are Dyme, which takes a strict B2B approach, and Digit, which offers a B2C app. a smartphone to take advantage of it. All they need to do it set up an account with their primary debit card and text the commands. Want to set aside an extra $10? Text, “save $10.” Want to withdraw your entire balance to pay your taxes? Text, “withdraw $1,700 for taxes.” To encourage interaction, Digit texts users their savings balance and checking account balance on a regular basis.Last month, the company expanded its platform

a smartphone to take advantage of it. All they need to do it set up an account with their primary debit card and text the commands. Want to set aside an extra $10? Text, “save $10.” Want to withdraw your entire balance to pay your taxes? Text, “withdraw $1,700 for taxes.” To encourage interaction, Digit texts users their savings balance and checking account balance on a regular basis.Last month, the company expanded its platform