Financial development platform Hydrogen won the grand prize at the Luxembourg Fintech Awards last week. The awards, sponsored by KPMG Luxembourg and Luxembourg House of Financial Technology (LHoFT), were contested by nearly 200 applicants from 46 countries. As the Grand Prize winner, Hydrogen picked up €50,000 in prize money and will receive four months of hosting at Luxembourg’s co-working space, Technoport; 10 free consulting hours from KPMG; and a free membership to LHoFT, including six months of hosting at the LHoFT fintech hub.

“We are building the global financial platform of the Web 3.0 and Luxembourg is a natural place for us to offer our platform given their leading financial standing in Europe and globally,” Michael Kane, Hydrogen co-founder and CEO explained in an e-mail. “We are very excited to be honored with this prestigious award; it shows how tremendous our team is and how big the problem is we are solving.”

Hydrogen offers a suite of APIs that enable developers at financial services companies to build and deploy their financial apps anywhere globally. The firm provides the core infrastructure and connectors that companies require when building and managing fintech apps, including robo advisory and wealth management, savings, insurance, and PFM-based solutions. Hydrogen’s platform also gives developers the ability to leverage blockchain technology to better secure client information and to apply automated machine learning to cloud-based datasets.

Applicants to the awards were evaluated based on the quality of the idea behind the innovation, the technology/solution involved, business model, market potential, team, and more. Looking at the 15 semi-finalists who competed for the Grand Prize, Luxembourg House of Financial Technology CEO Nasir Zubairi said, “the diversity of the activity sectors represented as well as the geographical diversity demonstrate the international dimension of the Fintech awards and the indisputable appeal of Luxembourg as a FinTech hub.”

This year’s awards featured a strong showing by regtech firms, added Head of Advisory at KPMG Pascal Denis, which he attributed to Luxembourg’s “unique landscape of cross-border expertise.” Denis pointed out that artificial intelligence and blockchain-based technologies also made a strong showing. “We are able to attract the next generation of disrupters,” he said.

Also making it to the finals was fellow Finovate alum ThetaRay, a cybersecurity firm based in Israel. Lingua Custodia, a French translation company that specializes in financial documents won first runner up, with Swiss regtech firm, Apiax, picking up the second runner-up prize. BitValley was granted the Financial Inclusion Award for its work in leveraging blockchain technology to provide micro-insurance for farmers.

Founded in 2017 and headquartered in New York City, Hydrogen demonstrated how its technology can be leveraged to build sophisticated financial services platforms at FinovateEurope earlier this year. The company’s co-founders, Michael and Matthew Kane, showed how Hydrogen could build a savings platform, based in Europe, complete with UI/UX, onboarding simulations, back end connectivity, and business intelligence. The Kane brothers also demoed how the platform could be further enhanced by using blockchain technology for security and leveraging a proprietary AI to support an interactive digital assistant.

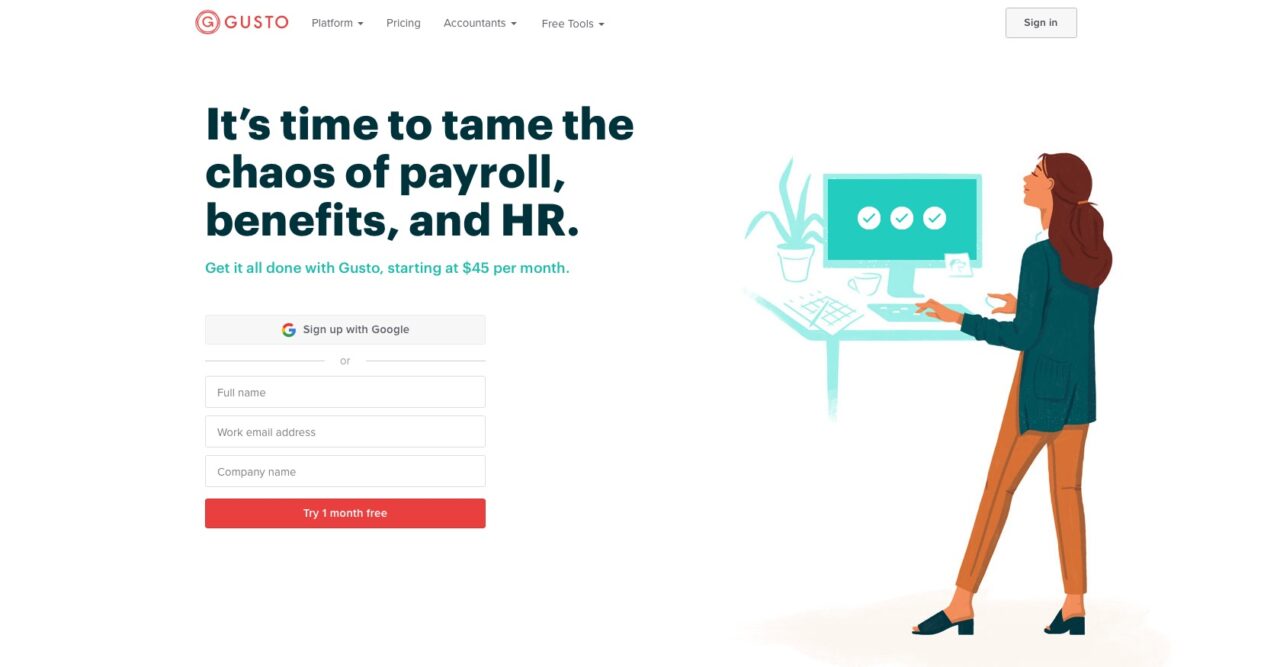

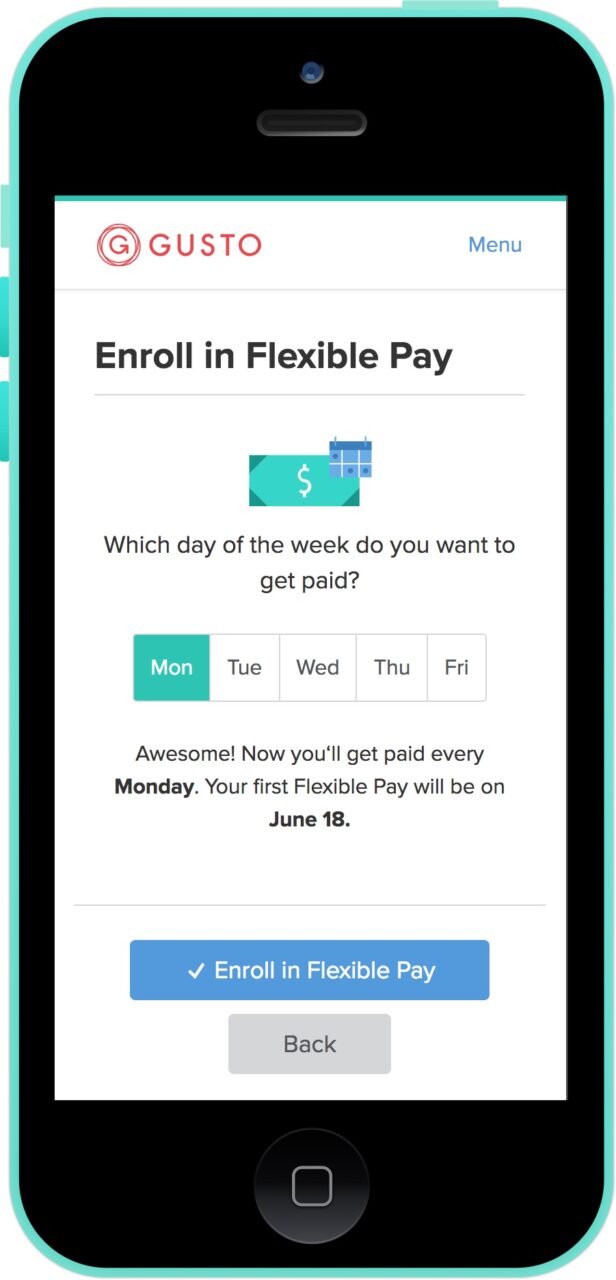

schedule. “The two-week pay schedule should no longer exist in today’s world.” Gusto co-founder and CEO Joshua Reeves said. “It’s a relic of calculating payroll taxes manually and was instituted in the U.S. almost 90 years ago. With modern technology, employees shouldn’t have to wait weeks to get paid.”

schedule. “The two-week pay schedule should no longer exist in today’s world.” Gusto co-founder and CEO Joshua Reeves said. “It’s a relic of calculating payroll taxes manually and was instituted in the U.S. almost 90 years ago. With modern technology, employees shouldn’t have to wait weeks to get paid.”