As Finovate goes increasingly global, so does our coverage of financial technology. Finovate Global: Fintech News from Around the World is our weekly look at fintech innovation in developing economies in Asia, Africa, the Middle East, Latin America, and Central and Eastern Europe.

Central and South Asia

- Pakistan joins Emirates Islamic QuickRemit online fund transfer service.

- The State Bank of Mauritius picks Miles Software’s Moneyware platform for wealth management and banking operations.

- DBS India joins SWIFT Global Payments Innovation (gpi) to bring better cash flow visibility via real-time cross border payment tracking for the firm’s corporate clients in India.

Latin America and the Caribbean

- Payments Journal highlights Boom Credit, a Miami, Florida-based fintech with a focus on the Mexican market.

- Pequenas Empresas & Grades Negocios interviews Creditas founder Sergio Furio. (In Portuguese).

- Central banks of Curacao and St. Maarten partner with blockchain company Bitt to investigate the creation of a digital currency.

Asia-Pacific

- Singapore’s Association of Banks makes its P2P funds transfer app, PayNow, available for business use.

- Singapore-based international money transfer startup InstaReM announces new Chief Technical Officer, Niles Pathak.

- CNBC reports that Ripple is looking to enter the Chinese cross-border payments market.

Sub-Saharan Africa

- Nigerian digital lending platform Mines picks up $13 million investment.

- Postbank Kenya launches mobile banking service, M-chama.

- United Nations Economic Commission for Africa (ECA) teams up with the International Financial Corporation and Ant Financial to support digital financial inclusion in Africa.

Central and Eastern Europe

- Sberbank sees a cashless payments boom in Russia.

- Crimea’s largest bank replaces Visa and Mastercard as part of transition to Russia’s MIR payment system.

- Forbes interviews Olga Feldmeier, CEO of Ukraine-based Smart Valor.

Middle East and Northern Africa

- Temenos to collaborate with the Venture Lab at The American University in Cairo.

- National Bank of Egypt chooses Fusion Treasury and Fusion Risk from Finastra in upgrade of its treasury and risk management operations.

- Agricultural Bank of Sudan goes live on ICS Banks Islamic from ICS Financial Systems.

- Attijariwafa Bank to deploy Path Solutions’ Sharia-compliant, iMAL core banking solution.

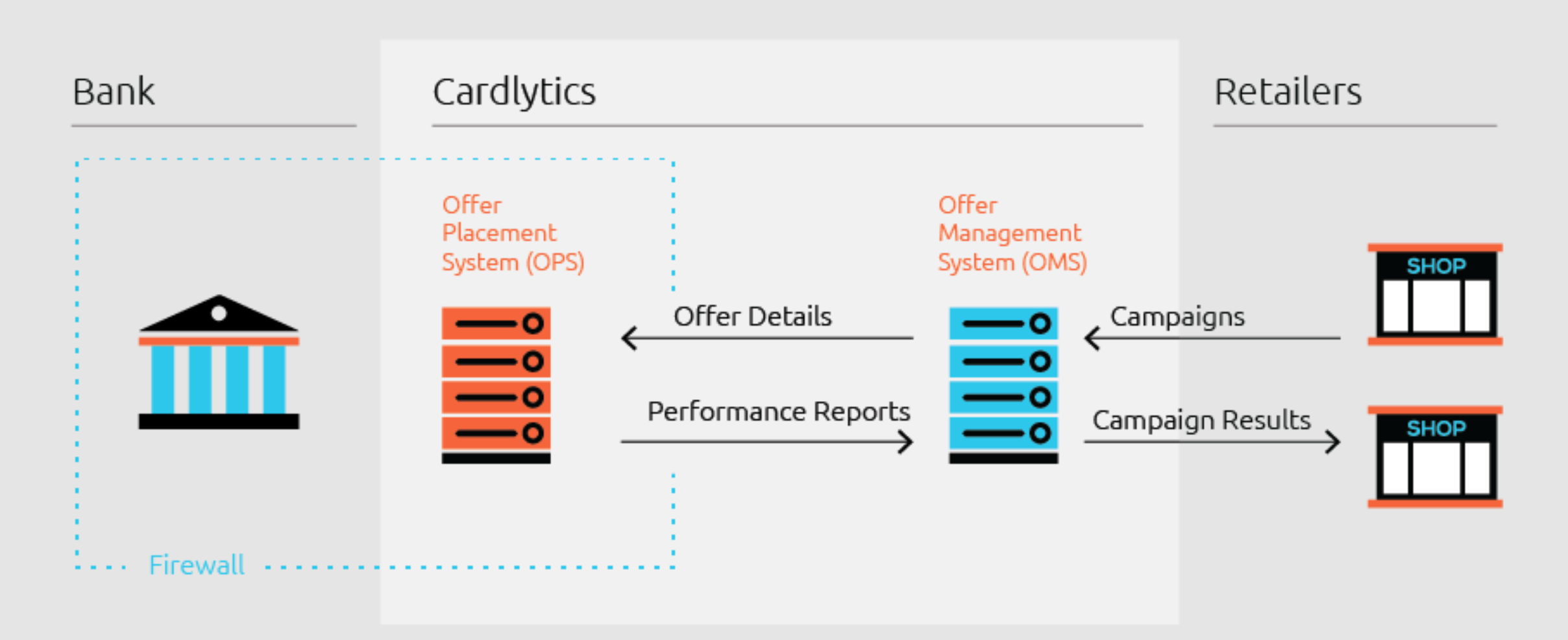

(above) Cardlytics’ Purchase Intelligence platform breaks down customers’ purchase data to offer banks insights.

(above) Cardlytics’ Purchase Intelligence platform breaks down customers’ purchase data to offer banks insights.

Presenters

Presenters

Presenters

Presenters Brie Tascione, CMO

Brie Tascione, CMO