BBVA-owned Holvi announced this week it has teamed up with ridesharing company Uber. The two have joined forces in an effort to help Uber’s drivers manage their finances more efficiently.

Holvi has long been known for supporting workers in the gig economy, and has been referred to as the neobank for the self-employed. The company will enable Uber drivers in Helsinki to quickly open business and checking accounts. “We at Holvi want to support also this new form of entrepreneurship and make it easier for all entrepreneurs to manage their entrepreneurial responsibilities. In the future we will see more examples of platform economy and a decrease in traditional employment – we will develop Holvi to support these new forms of work,” said Antti-Jussi Suominen, Holvi CEO.

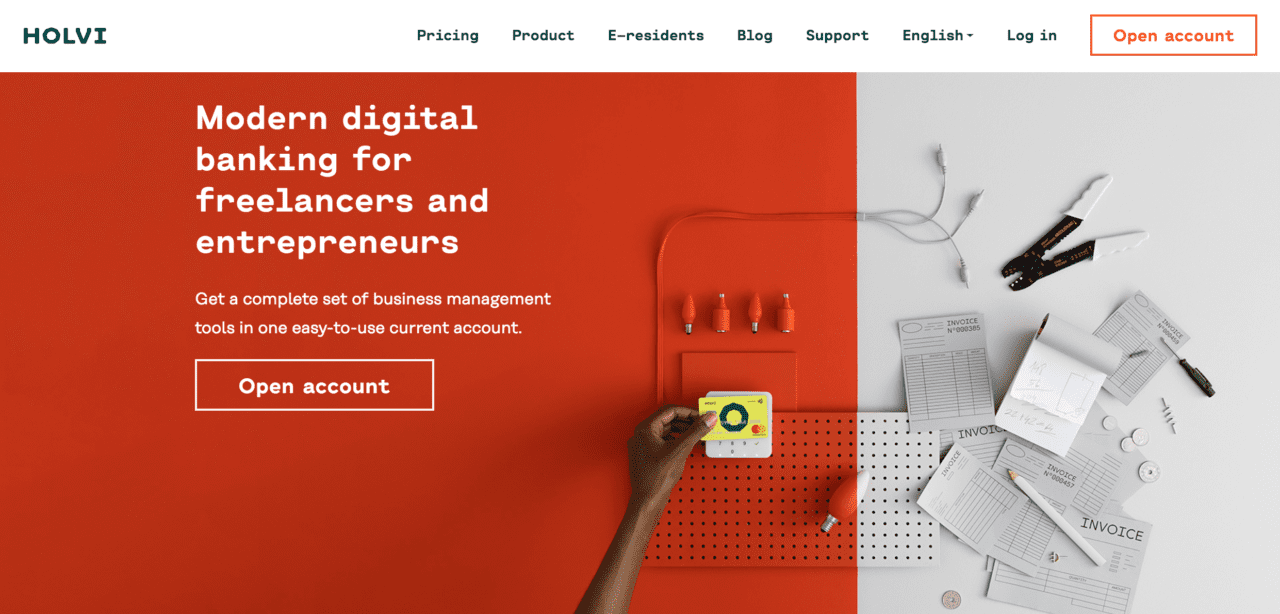

Drivers also have access to Holvi’s small business banking tools, such as bookkeeping, expense management, tax reporting, and automatic invoice management. Additionally, Holvi’s accounting services offer drivers access to its partner accountant network.

“Our collaboration with Holvi enables us to simplify entrepreneurs’ routine tasks so that our partner drivers can focus only on driving and serving their customers,” said Joel Järvinen, Uber’s country manager for Finland and Sweden.

Founded in 2011, one of Holvi’s co-founders, Kristoffer Lawson, demoed the company’s small business accounting tools at FinovateEurope 2013. In 2016, and with $4.9 million in funding, Holvi was acquired by BBVA for an undisclosed amount. Later that year, the company appointed Suominen as CEO.