Curated online platform for alternative investments Artivest announced a major new partnership today. The firm has been selected by institutional investment manager LaSalle to help it enter the retail market for privately-held value-added real estate investment programs via a closed end fund.

“We are delighted to find a compelling platform to seamlessly connect financial advisors and qualified high net worth investors to our flagship, U.S. value-add investment strategy,” Jason Kern, CEO of the Americas at LaSalle Investment Management, said.

One of the largest real estate investment managers in the world with $65 billion in assets under management, LaSalle will leverage Artivest’s Open Network to make its offerings available for investment by advisors and qualified purchasers. In an investment environment increasingly characterized by passive management and low-fee ETFs, LaSalle sees Artivest as a partner to help it meet investor demand for alternative solutions that can provide outperformance.

Artivest combines expert insights, extensive due diligence, and a streamlined investor experience to improve the process of finding, evaluating, and investing in leading private funds for advisors and fund managers. The solution reduces the complexity of private fund investing, helping clients save time and more readily identify opportunities that are most compatible with their investment goals.

“Our platform brings together data-driven insights, proprietary technology, and robust diligence expertise to deliver a simplified, efficient experience and remove the barriers that have traditionally stood in the way of advisors and investors seeking access to alternatives,” Artivest founder and CEO James Waldinger said.

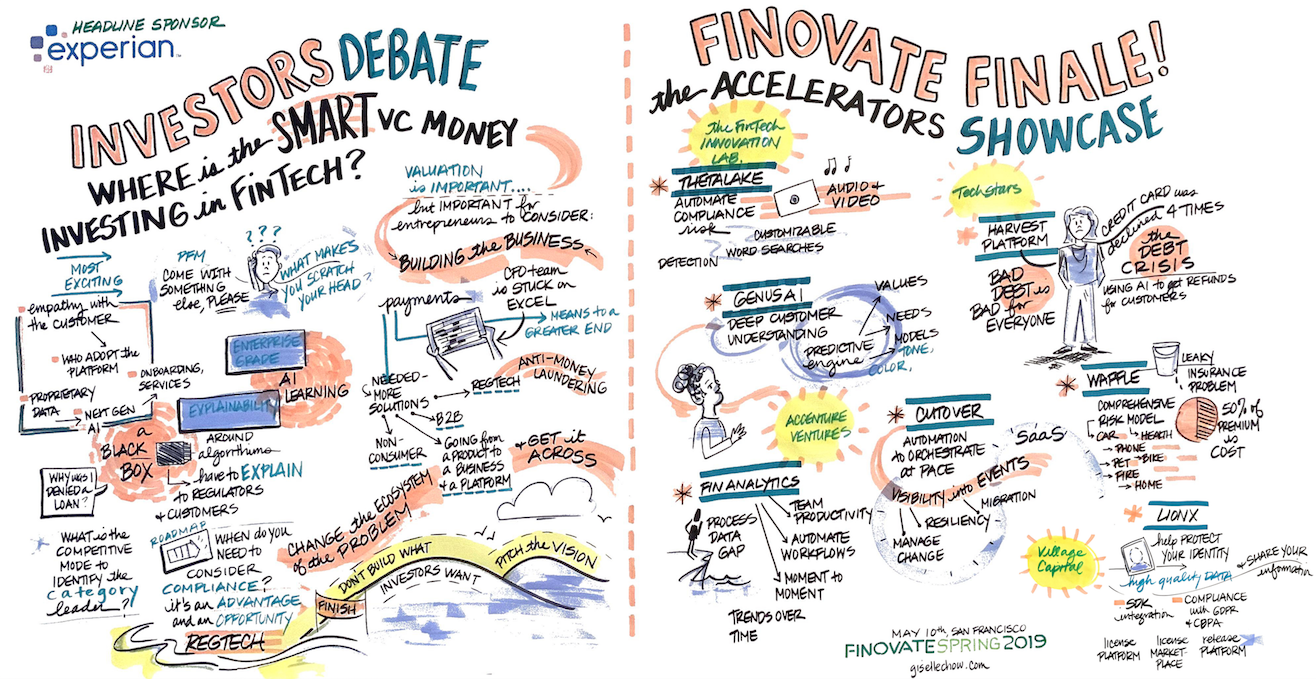

Artivest demonstrated its curated investment platform at FinovateSpring 2014. Headquartered in New York City and founded in 2012, the company completed a merger with alternative investment manager Altegris last summer that made the company one of the biggest independent alternative investment solution providers in the world.

Earlier this year, Artivest announced that was expanding its services to include both product structuring and fund distribution solutions for asset and wealth managers. Back in December, Chicago-based Northern Trust added private market capabilities to its ArcLine Alternatives platform for its wealth management customers courtesy of a partnership with Artivest.

With more than $17 million in funding, Artivest includes 500 Startups, RRE Ventures, Founders Fund, Kohlberg Kravis Roberts, and Signatures Capital among its investors.