As 2020 begins, there may be no hotter fintech theme, both globally and in Europe, than the rise of the challenger bank. As we reported recently, the race for digital banking licenses in Singapore, for example, has resulted in an increasingly-crowded field of at least two applicants for each available license. In Europe, investment in challenger banks has made steady year-over-year gains since 2014, reflecting not only the strength in interest in the sector, but also the confidence that digital banks are likely to be a major component of the European financial landscape of the 21st century.

How has venture capital’s surging interest in challenger banks shaped the industry and does the flood of funding VCs are providing tell us anything about the future success of challenger banks in Europe?

From the €0.1 billion in VC investment in 2014 to the estimated €2.4 billion in VC investment in 2019, European challenger banks have been among the top recipients of regional venture capital in recent years – with sums comparable to that invested in payments companies. What is especially impressive about the growth in VC funding for challenger banks is the relatively smooth trend in positive funding growth over the year, with each year bringing in more investment dollars than the last.

In this way, investment dollars are following the customers. Research by AT Kearney indicates that European challenger banks have added more than 15 million customers since 2011, and that the industry will have as many as 85 million customers by 2023.

Quantifying the number of challenger banks in Europe overall is … challenging. In part, this is because there can be disagreement between which traditional banks with digital offerings can be considered truly challengers alongside fully, digital-only neobanks. Fintech Futures, Finovate’s sister publication, is developing its own database of challenger banks by nation; there are an estimated 80+ challenger banks in the U.K. alone.

These firms include a number of companies that have demonstrated their platforms on the Finovate stage – such as Revolut (U.K.), Klarna (Sweden), and Twisto (Czech Republic). And virtually every European country is represented by a significant (and often expanding) challenger bank – from N26 in Germany to bunq in the Netherlands, and from Bnext in Spain to Fire in Ireland. In addition to generous funding, these companies have been able to grow and scale thanks in large part to regulatory changes like PSD2 and the open banking movement that encourage data sharing and collaboration with incumbent financial institutions.

Challenger banks are also taking advantage of customer dissatisfaction with traditional banks; Koyo founder and CEO Thomas Olszewski noted that 2017 the biggest bank in the U.K. has an NPS (Net Promotional Score) of -24, with Germany’s biggest banks earning NPS scores of -8 and -22. NPS is a way to measure customer satisfaction via the likelihood of the customer recommending the company or service to another customer.

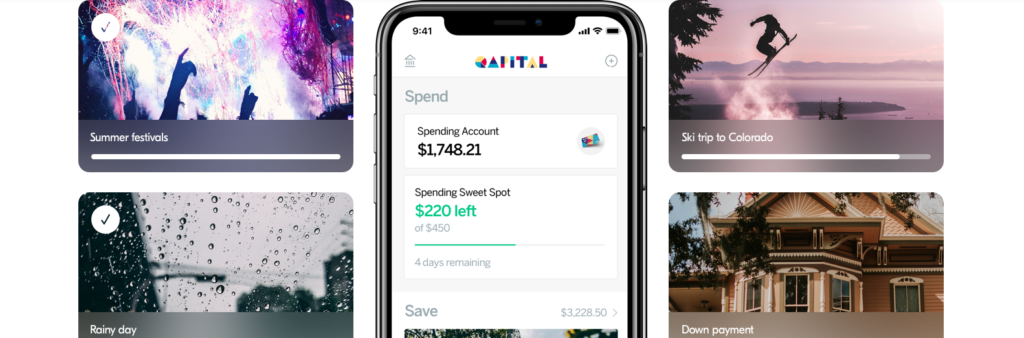

And, importantly, challenger banks are more likely to take advantage of the newest technologies for onboarding, and security, as well as provide the kind of digital customer experience (i.e., more mobile, more personalized; more social) that they have become accustomed to outside the world of finance.

Marcin Mazurek, founder of Inteliace Research, observed earlier this year that the eight bigger European neobanks – Revolut, N26, TransferWise, Monzo, Starling, Curve, and Tandem – had almost 27 million customers by the end of last year. “In fact, their number of clients has increased exponentially as the figure doubled every year since 2016,” he wrote. Mazurek credits the wave of VC funding to allow the strongest players in neobanking to get even stronger, suggesting that “investors are competing for the ‘privilege’ to fund top startups and not the other way around.”

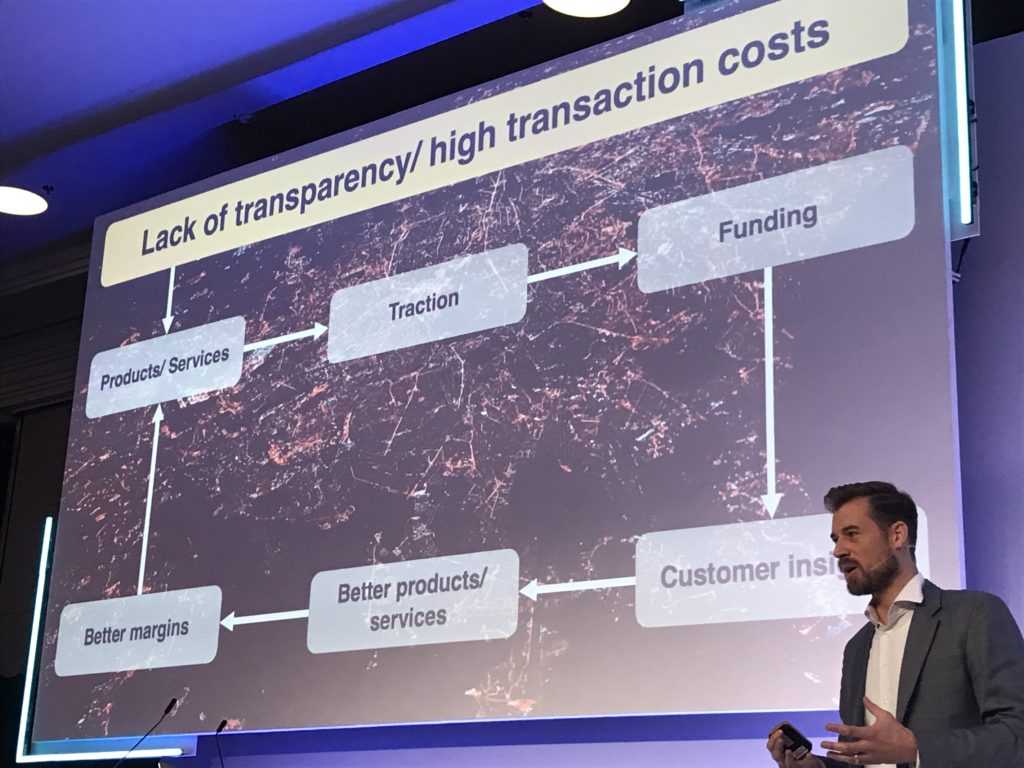

Mazurek also highlights a few warning signs for the sector, noting that VC investment driven valuations of challenger banks to potentially extreme levels. He does the math to reveal the fact that the seven biggest neobanks in Europe have implied valuation-to-funding multiples of 4.8x. This leads him to caution that there is a significant “disconnect” between challenger banks, their lofty valuations, and the relatively modest revenue per customer the major challenger banks are achieving (Mazurek estimates that challenger banks made between $3 and $38 in revenues per customer in 2018 and 2019).

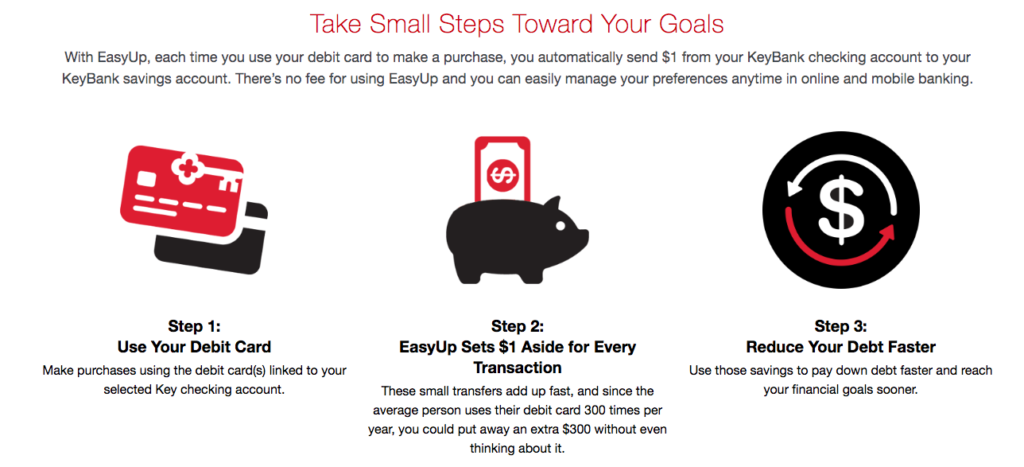

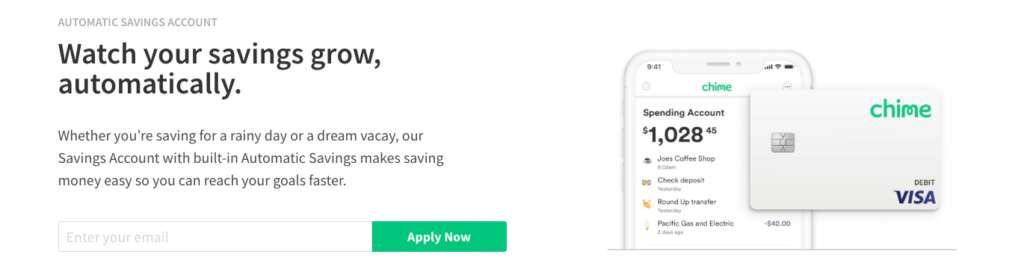

The way out for these challengers, according to Mazurek, is continued growth of the customer base. Investors, he said, are counting on future, “multi-million customer bases” to help close the valuation/revenue gap for neobanks. Another option is that these institutions will be successful in upselling their customers from the free and low-cost services and products they currently enjoy to more premium offerings. This may be all the more vital as fintechs explore “banking-as-a-service” offerings that will allow them to encroach on some of the territory newly-disrupted by challenger banks.

Indeed, the view increasingly seems to be that venture capital has played a major role in putting challenger banks on the map. They have provided them with the capital they need to develop new products and scale their businesses (an especially worthwhile option in Europe where a banking license from one EU central bank can enable a challenger bank to operate through Europe).

But at this point challenger banks may have reached a crossroads. At this point, the wisdom and mentorship venture capital provides may prove more worthwhile than their euros in determining which firms will grow and thrive.