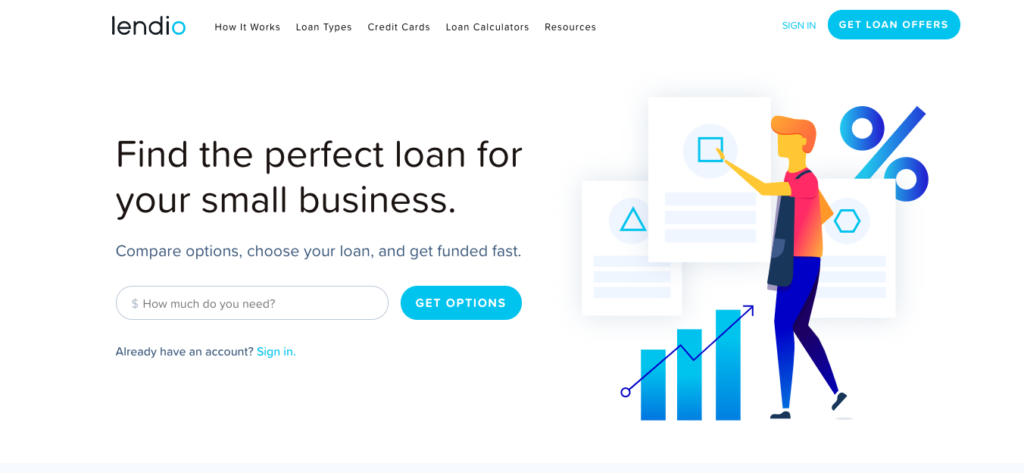

Online marketplace for small business loans Lendio landed $55 million in combined debt and equity funding today. The investment more than doubles the company’s previous funding, bringing its total to $108.5 million.

The equity portion of the Series E round was led by Mercato Partners’ Traverse Fund, which contributed $31 million, and included contributions from existing investors Napier Park Financial Partners, Comcast Ventures, Blumberg Capital, Stereo Capital, and Runa Capital. Signature Bank led the debt facility with $24 million.

Founded in 2011, Lendio serves as a matchmaker that connects small businesses seeking funding with its network of over 75 lenders. Since Lendio launched at FinovateSpring in 2011, the Utah-based company has funded more than 100,000 loans totaling $2 billion. Over the past two years, Lendio has seen an average year-over-year growth rate of 75%.

CEO Brock Blake called today’s investment a “significant milestone” for the company. “With these funds, we are strongly positioned to grow our existing platform as a trusted loan facilitator that supports both lenders and borrowers, while building out a range of new integrated lending services that get the right loans into the right hands at the right time.”

Lendio will use today’s investment to increase the scope and precision of its flagship loan marketplace; expand lender services functions, which provide lenders access to a white-labeled online loan application; and enhance its small business bookkeeping platform, Sunrise by Lendio. The company launched Sunrise last year after acquiring online bookkeeping startup Billy. The new service aims to help Lendio’s small business clients manage their cash flow and monitor their overall financial health.

“Lendio’s ability to combine data analytics with the human touch to connect small businesses quickly and precisely with ideal lending partners has made all the difference in its success,” said Ryan Sanders, senior investor at Mercato Partners Traverse Fund. “Lendio uniquely solves the problem of inefficient capital for small businesses by bridging lenders and borrowers. They are able to connect both sides and facilitate loans faster and more effectively between small business owners and lending institutions. Lendio’s impressive growth is a result of its technology-backed personalized service which has created a loyal and growing following in the industry.”