Computer technology giant IBM launched in 1911 as Computer-Tabulating-Recording-Company (CTR) and was renamed International Business Machines (IBM) in 1924.

At FinovateSpring 2016, the company’s presenter Rob Stanich, global wealth management offering manager, began the demo saying, “We come to you from a tech startup based in New York… it’s called IBM; maybe you’ve heard of us.” He jokingly adds, “It took us only 100 years to get here.”

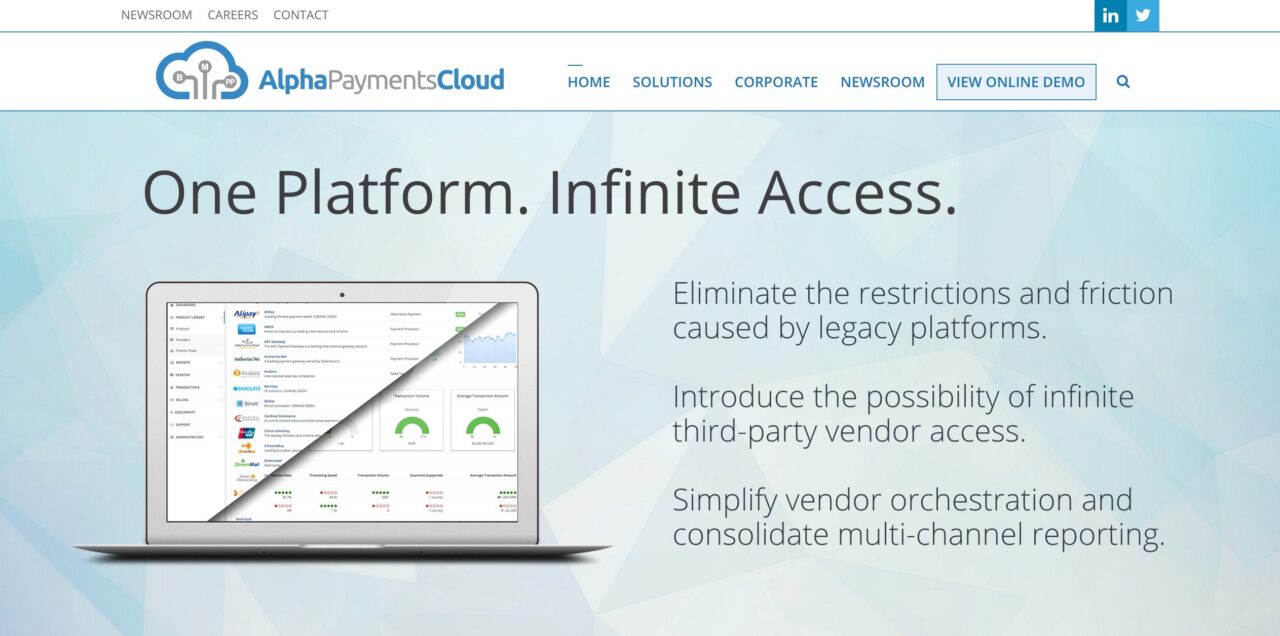

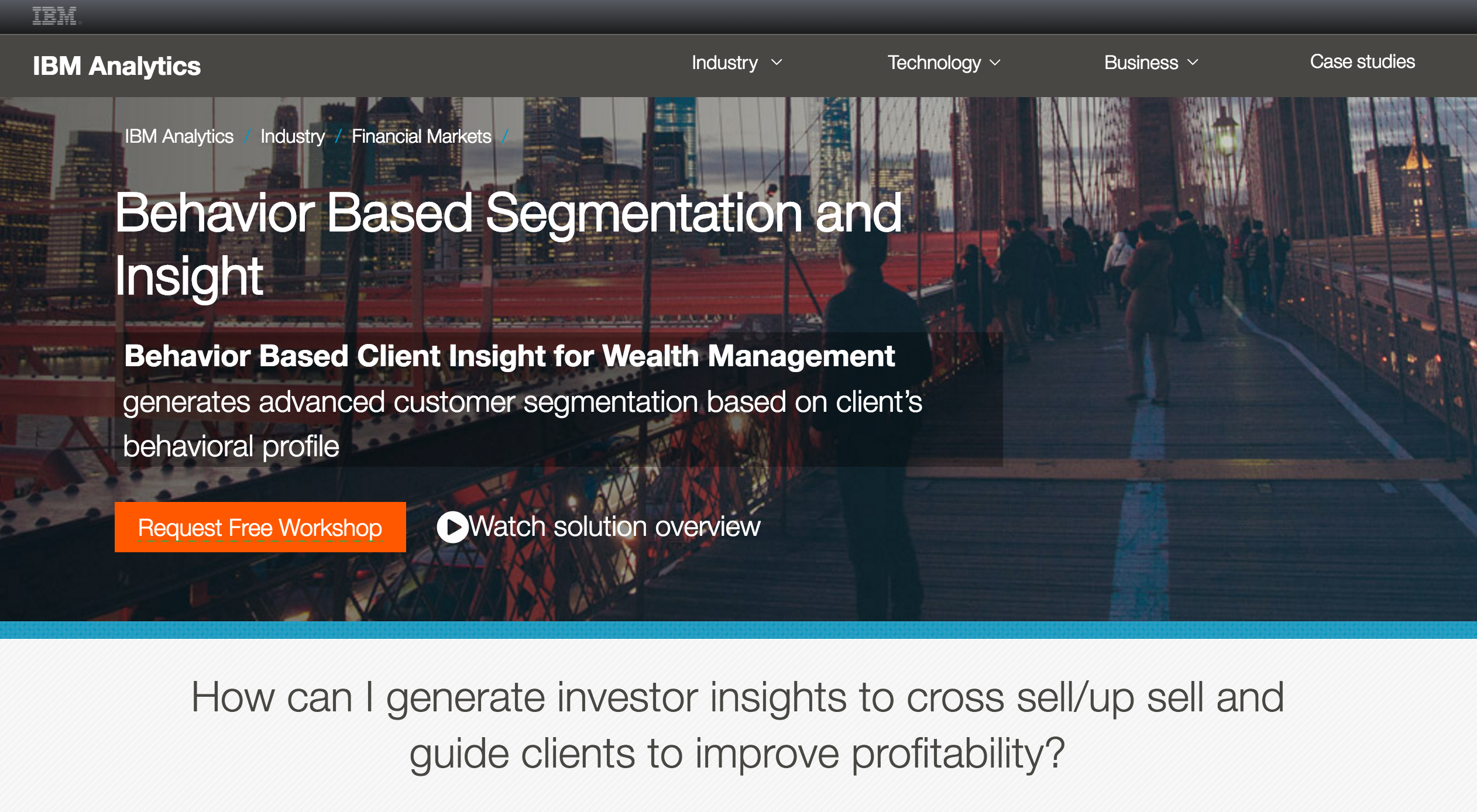

Stanich then explains that they’re doing something new within IBM called Client Insight for Wealth Management powered by IBM Watson, a solution to help advisers segment clients, predict life events and identify product and portfolio recommendations. While IBM has been working in the wealth management industry for some time, this is the company’s first API-based predictive analytics solution for the wealth-management industry.

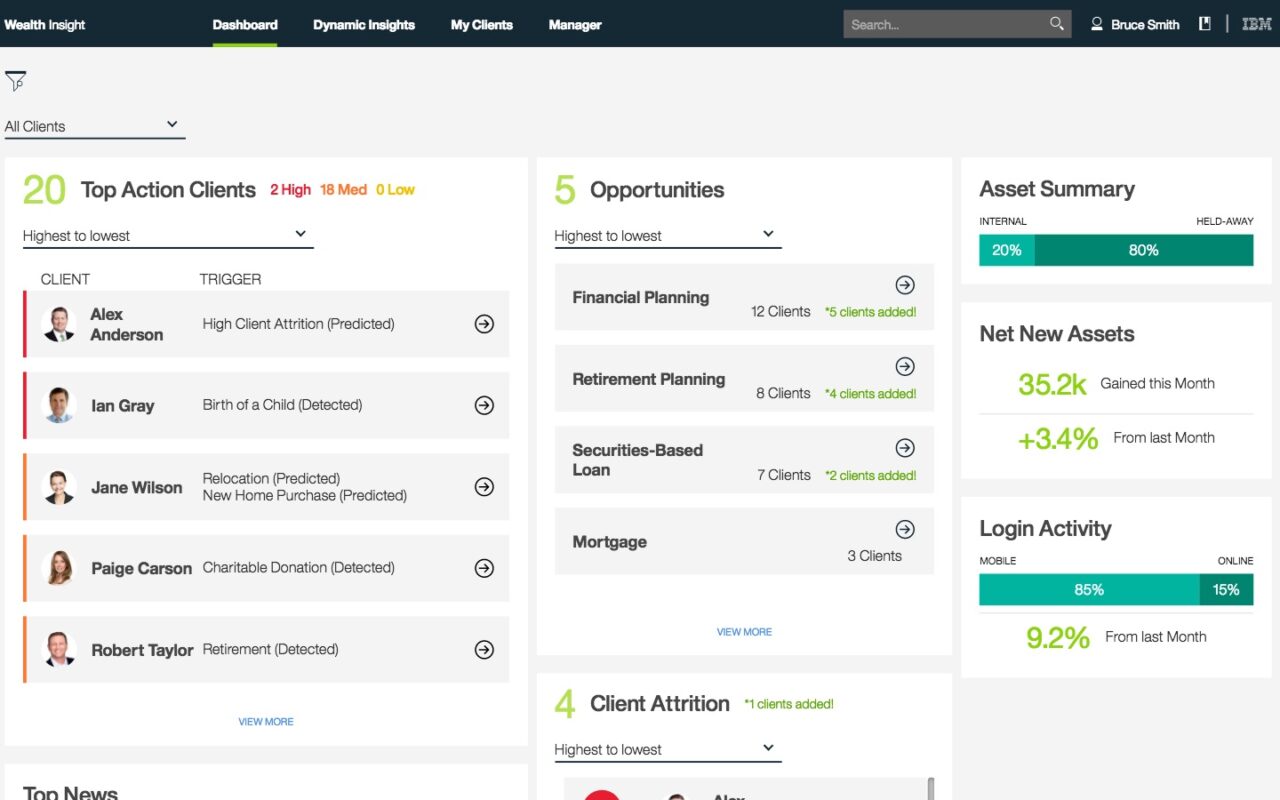

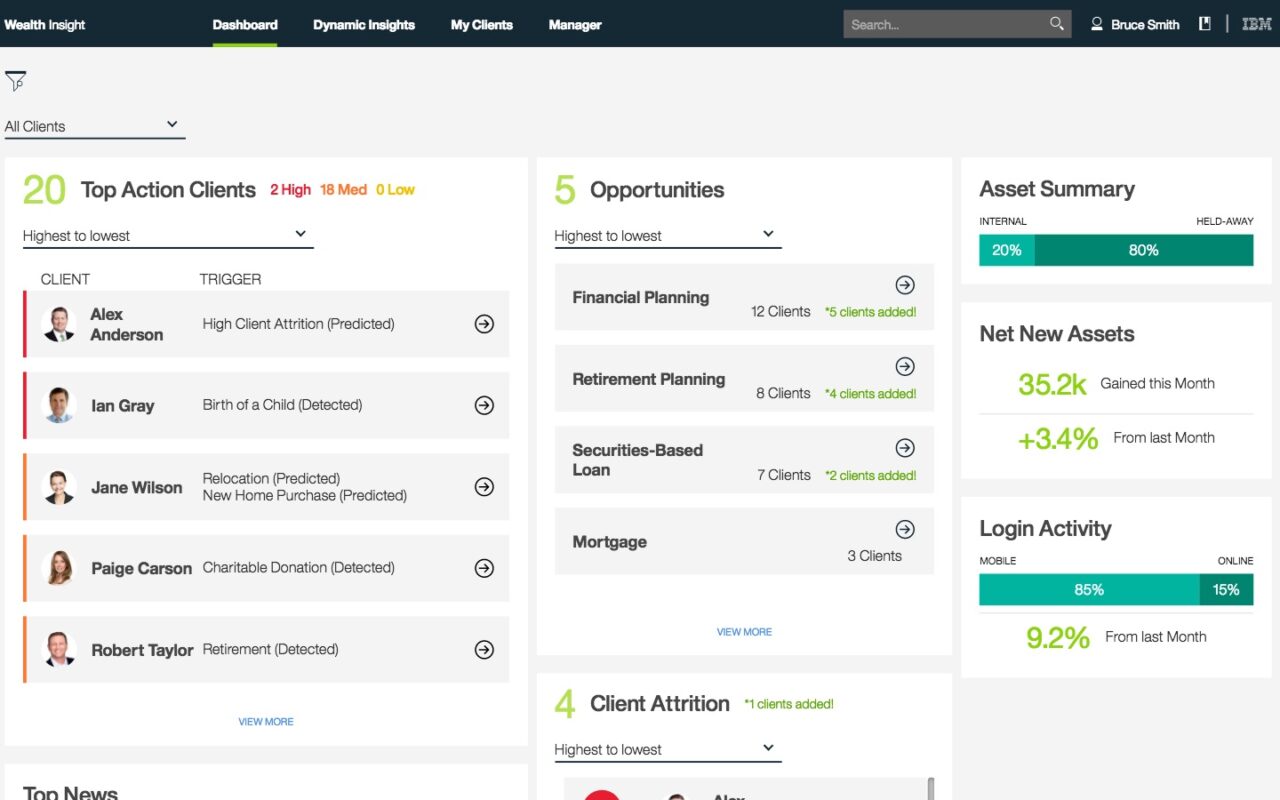

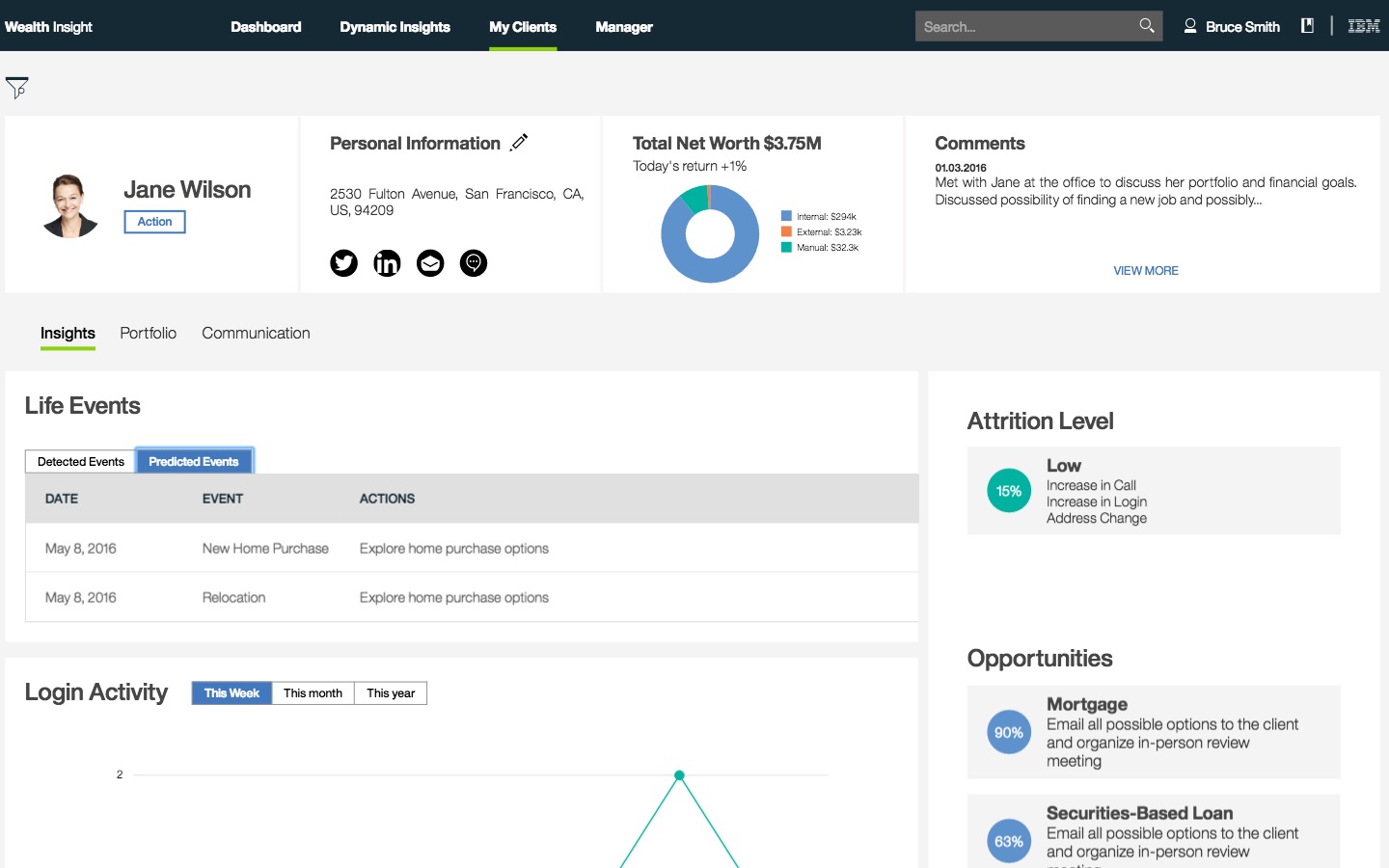

Financial adviser dashboard

Financial adviser dashboard

Company facts:

- Headquartered in Armonk, New York

- 300,000 employees

- 2015 revenue of $81.7 billion

Alex Baghdjian, senior offering associate, financial markets & wealth management, and Rob Stanich, global wealth management offering manager, presented at FinovateSpring 2016.

Alex Baghdjian, senior offering associate, financial markets & wealth management, and Rob Stanich, global wealth management offering manager, presented at FinovateSpring 2016.

We chatted with Rob Stanich, IBM global wealth management offering manager, about the new offering:

We chatted with Rob Stanich, IBM global wealth management offering manager, about the new offering:

Finovate: What problem does Client Insight for Wealth Management powered by IBM Watson solve?

Stanich: Client Insight for Wealth Management powered by IBM Watson is an industry-leading, cognitive- and predictive analytics-based solution for wealth management firms, fund providers, and self-directed investment firms of all sizes trying to gain or maintain a technology edge. Unlike any other platform in the industry, CIWM delivers data preparation with an established data schema, integrated, pre-built advanced analytical models, and APIs to deliver insights to any wealth management dashboard.

Our current offering has the some of the following capabilities:

- Segmenting and micro-segmenting by behavior to better understand client

- Predicting life and financial events to personalize offers, deliver alerts, and provide better service to drive loyalty

- Predicting client attrition to protect revenue and wallet share

- Understanding client-product propensities to better address client need’s and expand client relationships

- Tailoring news and alerts to streamline financial adviser prep before client meetings

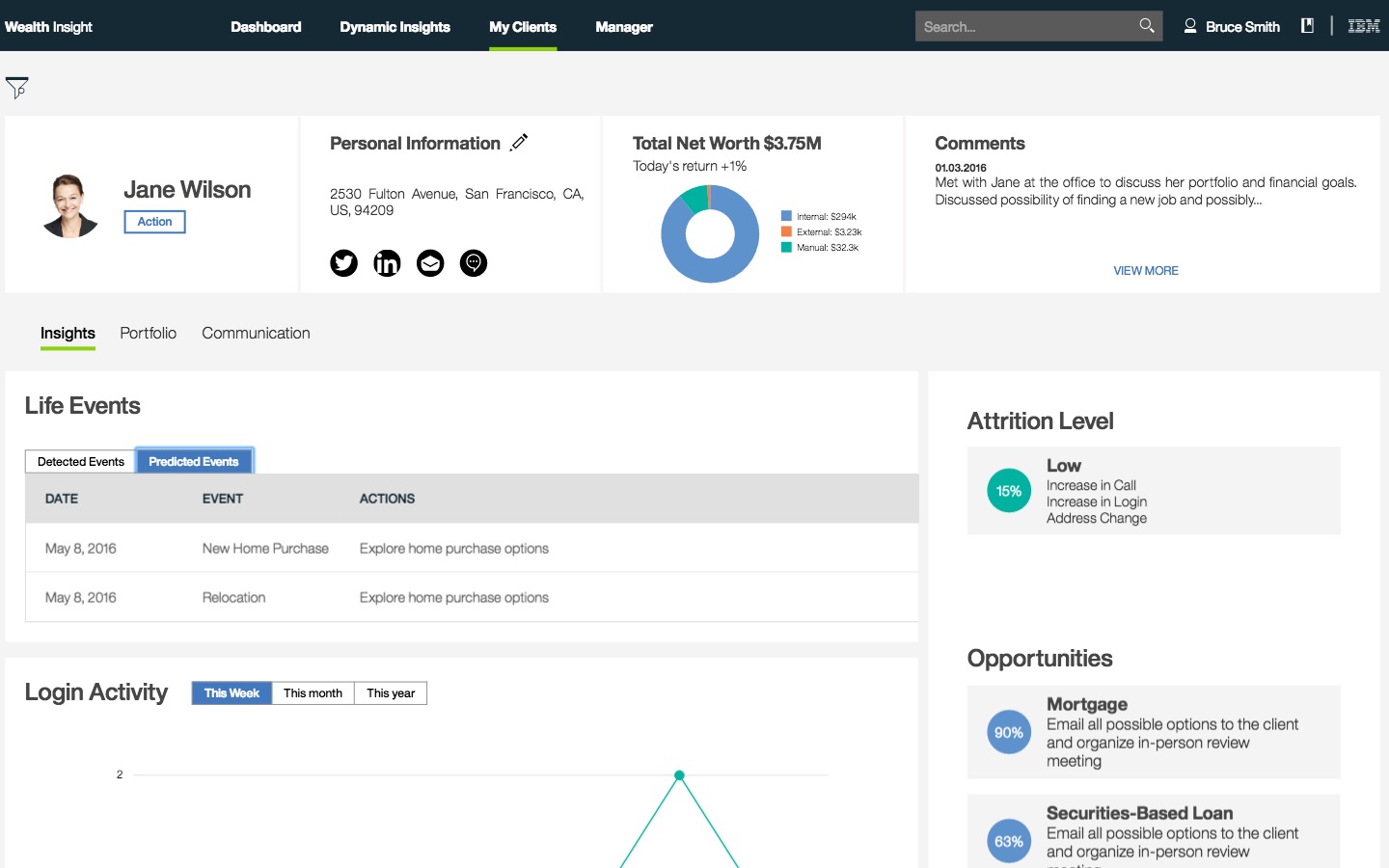

Client Profile screen

Client Profile screen

Finovate: Who are your primary customers?

Stanich: We currently service financial advisers and branch managers at large warehouses, self-directed brokerage firms, and mutual fund wholesalers. We are also going to be reaching the Registered Independent Adviser market through some soon-to-be announced partnerships.

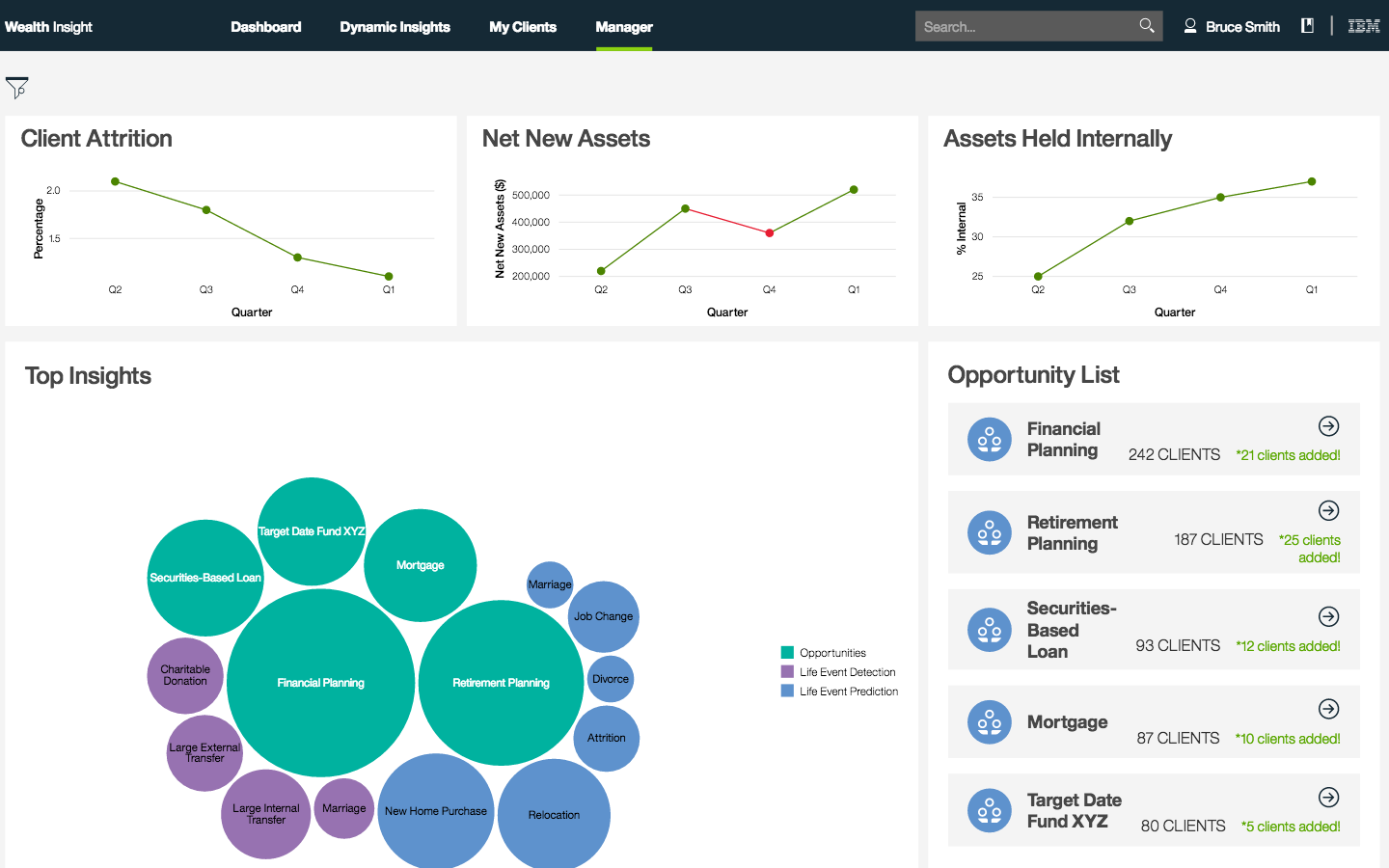

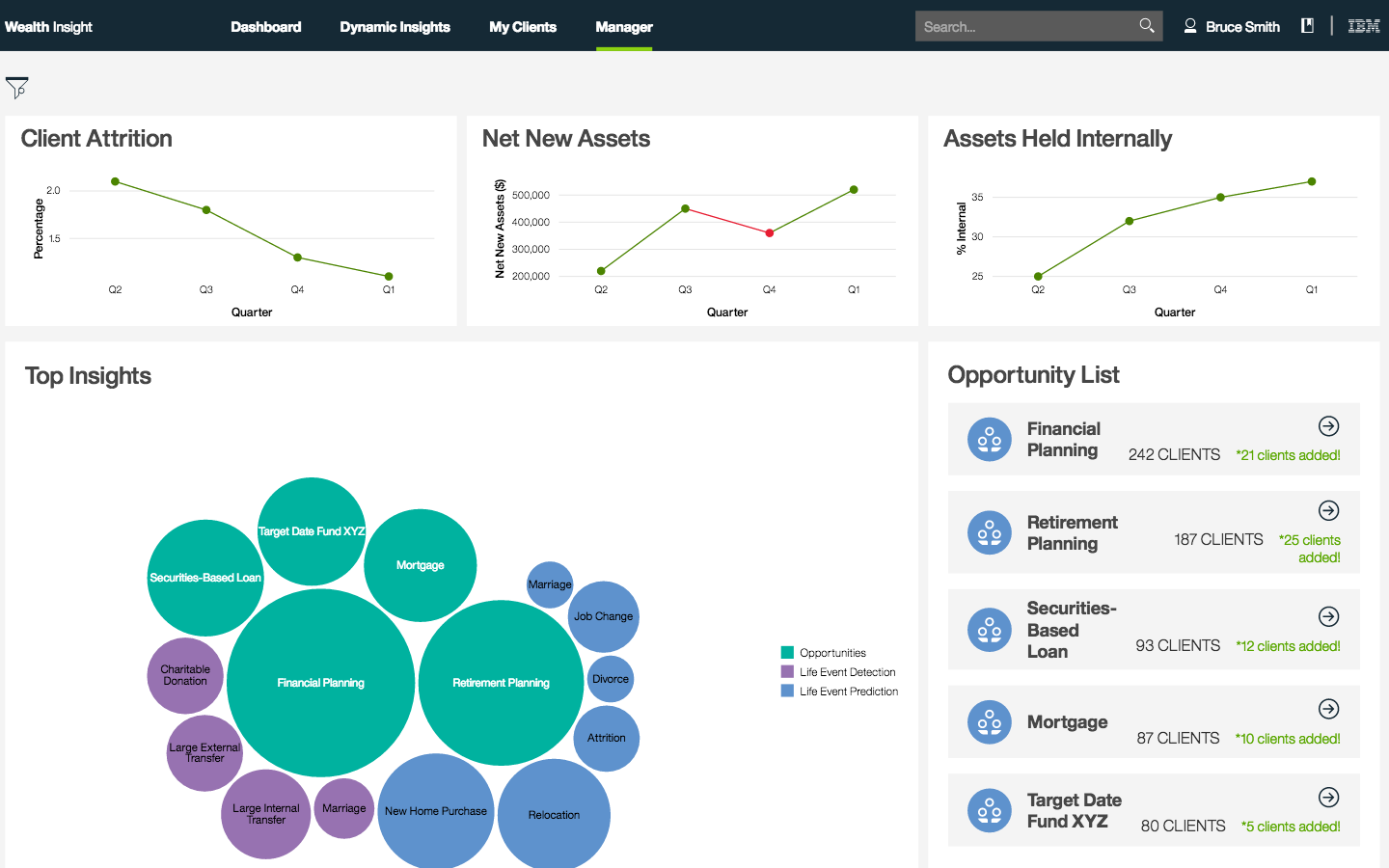

The Branch Manager dashboard

The Branch Manager dashboard

Finovate: How does Client Insight for Wealth Management powered by IBM Watson better solve the problem?

Stanich: We found that there really is this dearth of cognitive and analytics capabilities in wealth management. A lot of our clients want to get started, but have so many other issues affecting them—from new regulations to run the firm’s initiatives–that they haven’t been able to heavily invest in providing their financial advisers with advanced cognitive and analytics solutions. We’re here to solve that problem by providing a pre-built solution that can be stood up within a 12 week timeframe and immediately provide real capabilities and a real ROI.

And they’re not just buying the current capabilities of Client Insight for Wealth Management, but will benefit from IBM’s continuing investment in our roadmap, which will over time expand to cover such topics as prospecting, account aggregation, and adviser-succession planning. Not to mention that our solution will be applying some exciting new and advanced deep-learning techniques from IBM Research as well as integrations to other IBM application families within our Commerce and Watson divisions.

Finovate: Tell us about your favorite implementation of your solution.

Stanich: Our favorite implementations are the ones where we see the client planning to use the solution to assist financial advisers in fully servicing their client’s financial needs. For example, we find a lot of large banks who have clients’ mortgages and checking accounts wanting to also provide [their] financial planning through a financial adviser. If we can have a client’s needs better serviced all in one place–from financial planning, lending, to credit card needs–then it’s a deeper relationship between a client and firm and an overall better client experience.

Finovate: What in your background gave you the confidence to tackle this challenge?

Stanich: I’ve worked on Wall Street and in technology for 20 years now and have witnessed a lot of the major changes we now consider business-as-usual, from the rise of the self-directed brokerage firms in the 1990s to the current rise of the robo-advisers. Nonetheless, I’m a big believer that we’ll never lose financial advisers entirely. They’ll be more like the expert users of some of the same technology coming into the self-directed business today. We’ll augment these professionals to be “smarter” in the same way technology is revolutionizing medicine today, yet we still need doctors to exercise judgement. Change is always disruptive and causes a lot of hand-wringing, but I think we all see the transition happening around us already.

Finovate: What are some upcoming initiatives from Client Insight for Wealth Management powered by IBM Watson that we can look forward to over the next few months?

Stanich: We have some big partnerships that we’ll be announcing soon and some really great functionality on the docket to be released. We’ve already started getting feedback from clients, and the reaction has been overwhelmingly positive. Mainly, we’ll be focusing on the account-aggregation space, financial planning, and prospecting. Our solution is only going to keep getting better and better.

Finovate: Where do you see IBM’s Client Insight for Wealth Management a year or two from now?

Stanich: The vision for Client Insight for Wealth Management is to enable an adviser to service more clients with the same or better level of personalization as servicing their existing book of business, and improve the overall quality of that book. For self-directed firms, the vision is to deliver a more personalized level of service digitally, by arming them with some of the same advanced predictive and cognitive analytics becoming prevalent in other industries.

Finovate: What kind of metrics or facts about IBM’s Client Insight for Wealth Management can we share with our readers?

Stanich: It is the wealth management industry’s first pre-built, cognitive and analytics solution. We also have similar industry-specific offerings in banking, insurance, trade surveillance, and regulatory compliance.

Rob Stanich, global eealth management offering manager, and Alex Baghdjian, senior offering associate, financial markets & wealth management, presenting at FinovateSpring 2016:

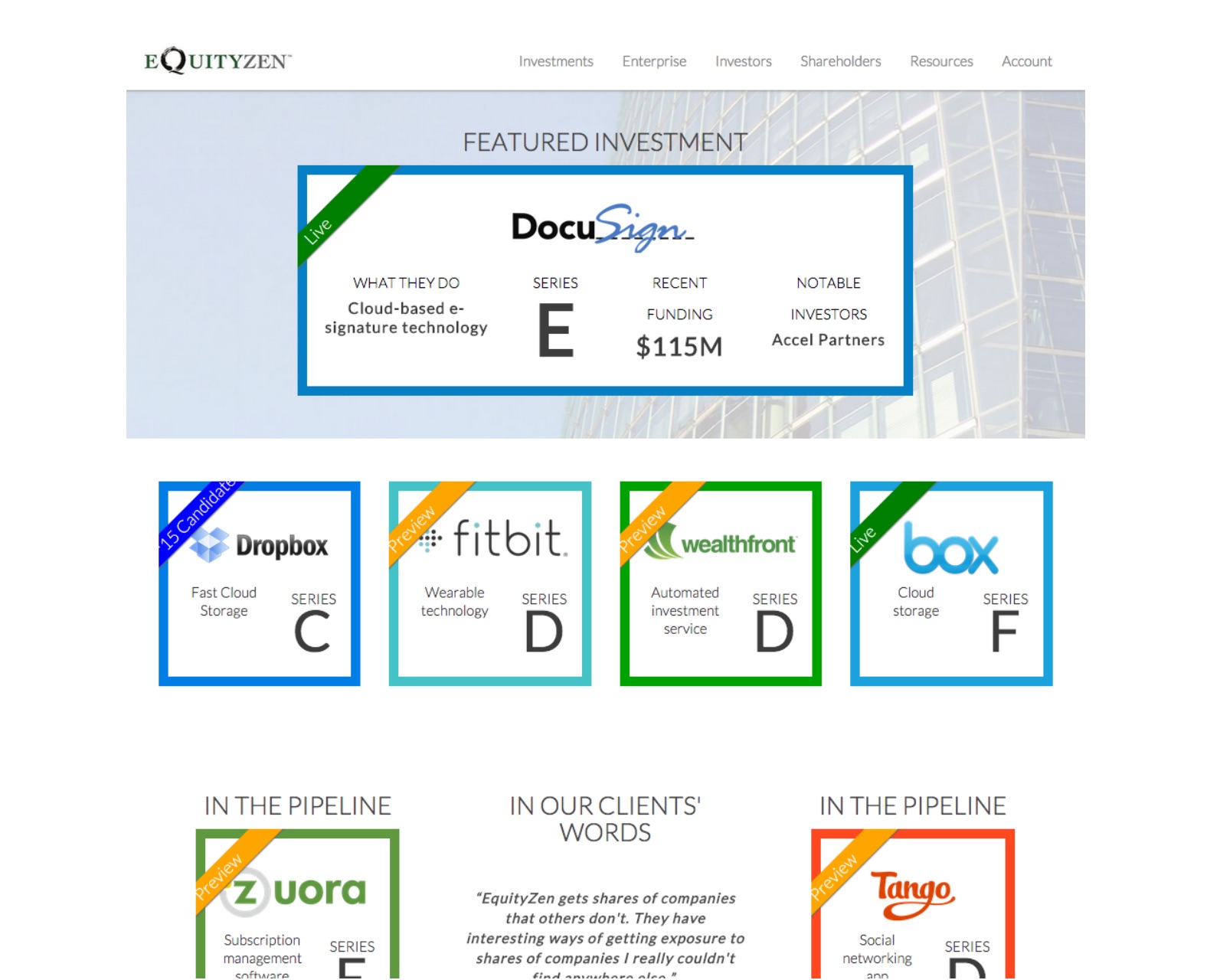

Before his presentation at FinovateSpring last month, we chatted with Atish Davda (pictured right), the company’s CEO, for further insight on EquityZen. Davda has been

Before his presentation at FinovateSpring last month, we chatted with Atish Davda (pictured right), the company’s CEO, for further insight on EquityZen. Davda has been

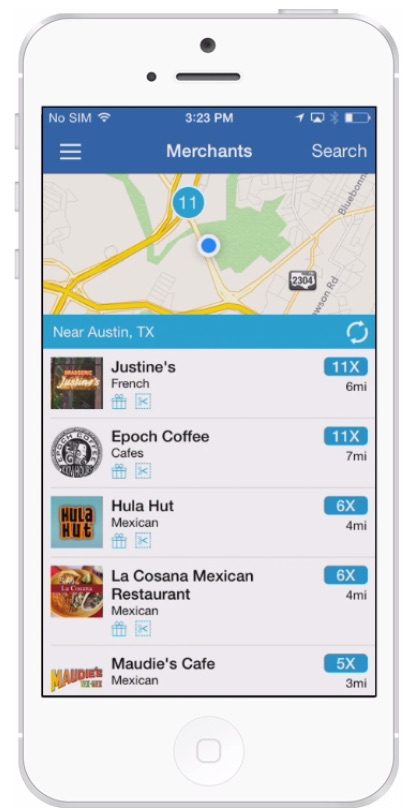

Community-focused rewards program

Community-focused rewards program

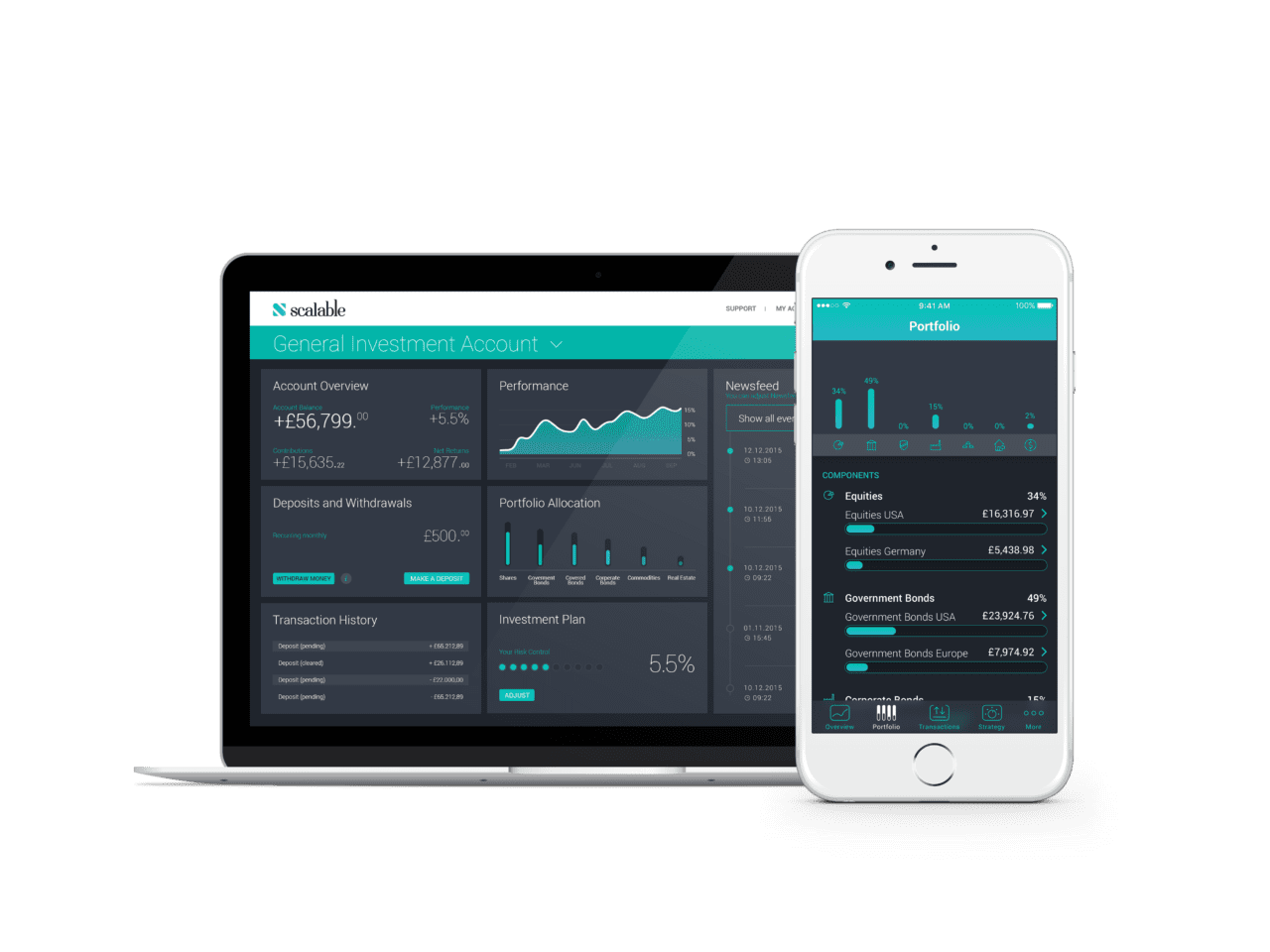

A group of select clients on the waiting list will be guided through Scalable Capital’s risk assessment module before their funds go live on the platform. The Germany-based company received approval from the FCA in February and will open up to the general U.K. public in early July.

A group of select clients on the waiting list will be guided through Scalable Capital’s risk assessment module before their funds go live on the platform. The Germany-based company received approval from the FCA in February and will open up to the general U.K. public in early July.

Financial adviser dashboard

Financial adviser dashboard Alex Baghdjian, senior offering associate, financial markets & wealth management, and Rob Stanich, global wealth management offering manager, presented at FinovateSpring 2016.

Alex Baghdjian, senior offering associate, financial markets & wealth management, and Rob Stanich, global wealth management offering manager, presented at FinovateSpring 2016. We chatted with Rob Stanich, IBM global wealth management offering manager, about the new offering:

We chatted with Rob Stanich, IBM global wealth management offering manager, about the new offering: Client Profile screen

Client Profile screen The Branch Manager dashboard

The Branch Manager dashboard

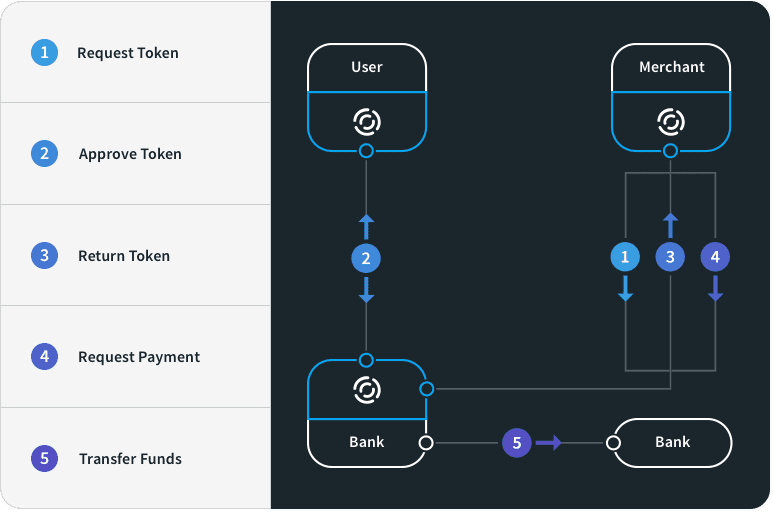

Token uses smart tokens, a digital representation of money, to secure the transaction flow and keep banks in control of the entire process. Here’s how it works:

Token uses smart tokens, a digital representation of money, to secure the transaction flow and keep banks in control of the entire process. Here’s how it works: