Update: August 29, 2017

According to a press release issued this morning, Urban FT reports that its bid to acquire Digiliti Money has fallen through after Digitili rejected the offer. This occurred after Digitili proposed alternate terms to the contract, which Urban FT and its lawyers considered “unreasonable and unacceptable under the circumstances.” The rejected bid valued Digitili Money at $10.5 million on a net equity basis.

Kasey Kaplan, Urban FT president said, “We will leave our offer on the table for acceptance by Digiliti until close of business on August 31.” He added, “Placing Digiliti into bankruptcy, if that’s what the Board is considering,” continued Kaplan, “would be a great loss to all of those stakeholders and would truly disrupt so many organizations that rely on Digiliti’s services every day.”

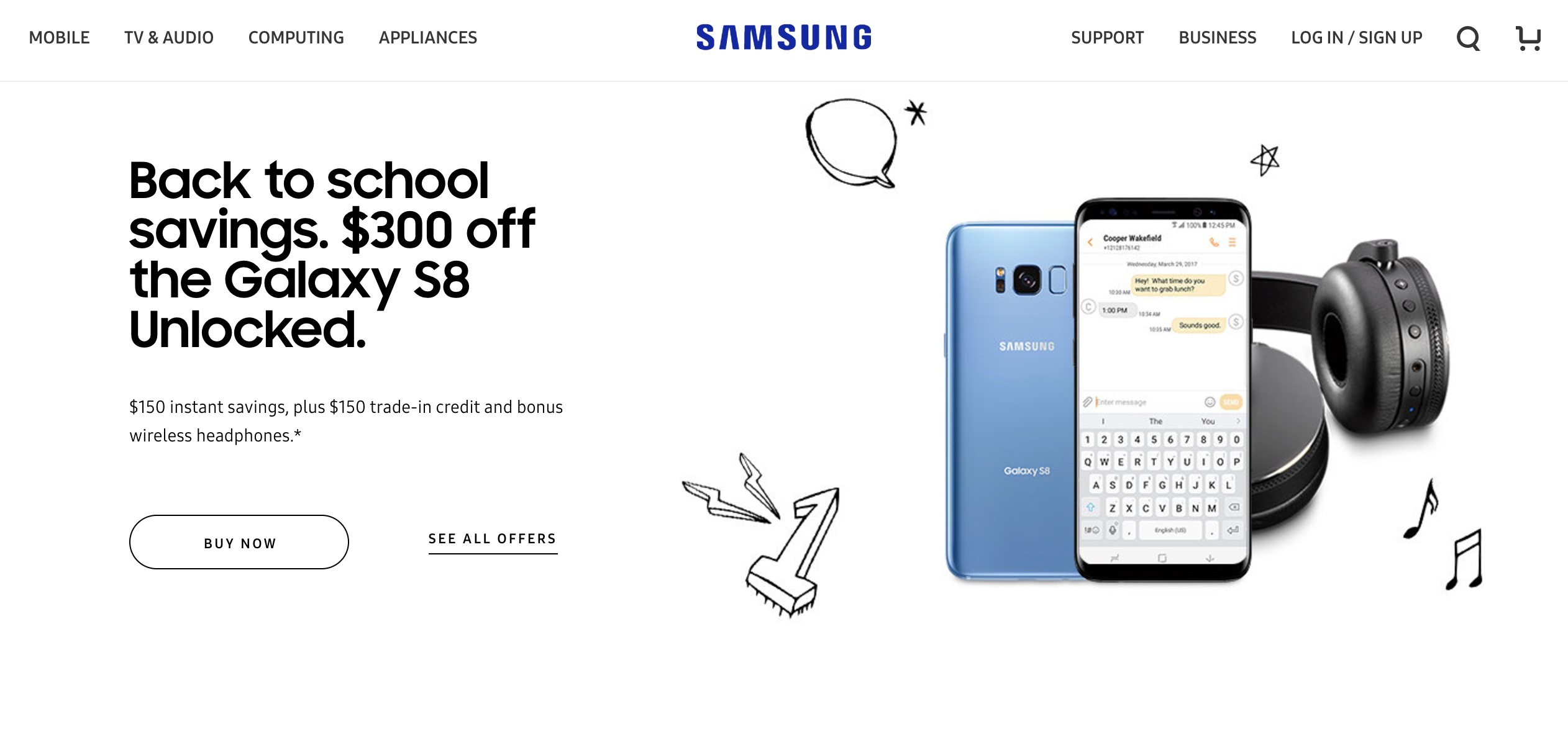

Digital banking platform Urban FT is eyeing its second acquisition this summer. The New York-based company has made an all-cash offer of an undisclosed amount to buy Digiliti Money, which rebranded from Cachet Financial Solutions earlier this year.

It is no secret in the fintech community that Digiliti Money has undergone financial difficulty as of late. The company, which is publicly traded on the NASDAQ with a market cap of $2.2 million, saw its CEO resign earlier this month. Digiliti appointed interim CEO Bryan Meier, who said that the company is “reducing [its] cash burn to improve [its] bottom line performance, which [it is] demonstrating with the implementation of [its] recent cost-cutting initiatives intended to reduce [its] annual operating expenses by nearly $3 million.” In a statement on August 14, Digiliti made it clear that it is “actively reviewing strategic options to restructure the company, including the potential sale of the company or potentially filing for Chapter 11 bankruptcy.”

Despite Digiliti’s struggles, Urban FT believes the acquisition will be beneficial on both sides. Urban FT maintains it can help Digiliti reduce operating costs attributed to data expenditures and offer more value to the company’s client base with its robust mobile features. To Urban FT’s benefit, Digiliti has an appealing roster of client and strategic relationships. “We are looking to grow organically by expanding our base of users on our existing platform, which we think is exceptional, but we also want to grow acquisitively,” says Urban FT CEO Richard Steggall.

The move to buy Digiliti Money comes after Urban FT acquired mobile banking technology provider iParse in July and Wipit in 2015. Urban FT COO Glen Fossella said the company is able to move quickly toward the acquisition “because of the support of the Urban FT board of directors and investors, and because [it has] a clearly defined acquisition strategy that focuses on businesses with strong client relationships, recurring revenues and technologies that deliver an additional competitive advantage to our core products and services.” He adds, “we hope Digiliti Money will match our speed and commitment to completing this transaction.”

At FinovateFall 2016, Urban FT debuted the Workshop, a real-time, mobile app management platform that enables banks to quickly configure, brand, and launch mobile banking apps without coding. The company was founded in 2013 and has 40 employees.

Digiliti Money demoed its Select Mobile Money prepaid suite at FinovateFall 2014 in New York. The company was founded in 2010 and went public July 18, 2014. It is headquartered in Minneapolis, Minnesota.

![Urban FT Bids to Acquire Digiliti Money [UPDATE: Bid Rejected]](https://finovate.com/wp-content/uploads/2017/08/Screen-Shot-2017-08-16-at-8.46.47-AM.png)