From your first IDE to your last coding day …

As our “Hail to the Chief” themed word-cloud shows, our upcoming developers conference FinDEVr Silicon Valley 2016 is dedicated to the women and men whose talents and insights drive not just the technologies we appreciate today, but also the solutions we dream about for tomorrow. (And, yes, tickets are still available!)

From serial entrepreneurs looking to power their next big thing with the brightest minds and best solutions, to startups eager to show new ways to solve old problems, FinDEVr is a unique opportunity to meet the teams behind the technology. Our two-track, 15-minute presentation format (slides allowed, code encouraged) combined with high-quality, end-of-day networking on both Tuesday and Wednesday is designed to maximize your exposure to the latest in SDKs, APIs, case studies and new integrations in the industry.

Brandon Dewitt, MX CTO, during his presentation, How You Build Something Is More Important Than What You’re Building

Join us 18/19 October for a two-day trip inside the laboratories where fintech’s future is being made. Find out how innovators are paving the way for safer, more efficient online transactions, better mobile app security, broader financial inclusion, and more. Tickets are on sale now. So visit our registration page today and save your spot. We’ll see you next week in Silicon Valley!

FinDEVr Silicon Valley 2016 is sponsored by The Bancorp.

FinDEVr Silicon Valley 2016 is partnered with Acuity Market Intelligence, BankersHub, BayPay Forum, BiometricUpdate.com, Bitcoin Magazine, Bitoinist.net, Breaking Banks, Byte Academy, California Bankers Association, Celent, The Cointelegraph, Colloquy, Emerging Payments Association, Empire Startups, FIDO Alliance, Fintech Finance, Global Platform, Hack Reactor, Harrington Starr, Juniper Research, Mercator Advisory Group, Next Money, Payment Week, Payments & Cards Network, SecuritySolutionsWatch.com, SIMAlliance, Swiss Finance + Technology Association, and Women Who Code.

Presenter

Presenter

Presenter

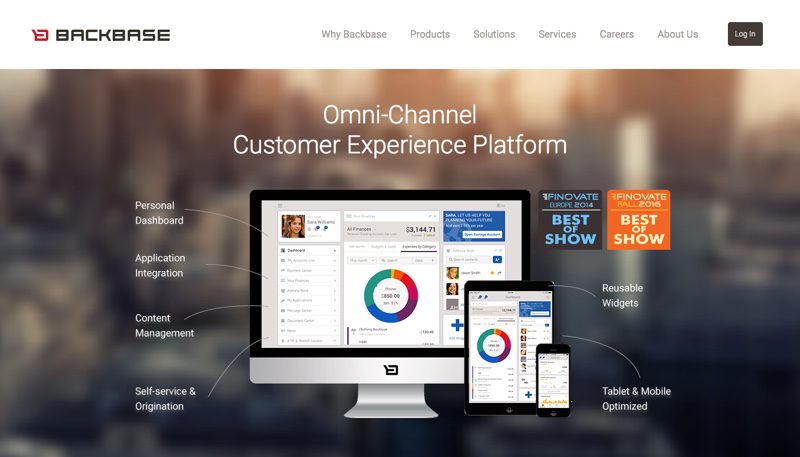

Presenter

Presenters

Presenters Wei Hao Goh, Head, Technical Account Manager

Wei Hao Goh, Head, Technical Account Manager