Founded in 2009 and headquartered in Wilmington, Delaware, Global Debt Registry has developed technology and processes that help both individuals and financial institutions track the chain of title for charged-off consumer debts. This is key in making sure that debts are accurately connected with both debtors and debt owners, bringing transparency and efficiency to an arguably under-regulated space.

“Global Debt Registry believes there is a better way to manage charged off accounts,” said Global Debt Registry CEO Mark Parsells in response to emailed questions. “We enable large enterprises to securely store and grant access to data and documents on charged off accounts to facilitate better collection outcomes, whether place with collection agencies or sold.”

Read the rest of our conversation with Mark Parsells below.

Finovate: Global Debt Registry’s primary market is charged off debt. How big is this market and what are its growth prospects going forward?

Mark Parsells: There is over 100 billion dollars of charged off debt created every year. That number isn’t tapering, but steadily growing.

Historically, the market was dominated by credit card debt, which remains a major issue. But now medical debt and student loans are presenting new issues for the industry and consumers. As highlighted by the Consumer Financial Protection Bureau (CFPB) in late December, there are over 43 million Americans that have delinquent medical debt on their credit reports. This lack of understanding and transparency will continue to create issues when attempting to manage debt for the debt owner, collectors, and for consumers.

The market is ripe for digital transformation and we have a tried and tested solution to address these issues.

Finovate: The New York Times published a fascinating expose on what they called “the dark, lucrative world of consumer debt collection.” What do you think is the key takeaway from that story?

Parsells: Jake Halpern, the author of Bad Paper: Chasing Debt from Wall Street to the Underworld, highlighted many of the issues that result from the lack of digital governance. The open sharing offline of consumer data has inevitably led to abuses. One major highlight for us was the fact the author suggested a central repository of debt information, or a global debt registry, is necessary to bring the debt collection space out of the shadows.

Finovate: What do financial institutions do right now to establish debt ownership? How difficult is the process.

Parsells: Currently there is a fragile, inefficient model known as the “daisy chain” process. Debt information is passed around to debt buyers, agencies and legal collectors, which is insecure, inefficient and frequently without real hard information in support of the claim.

As debt information is passed around, the integrity of the information is lost. Debt collectors and agencies don’t have access to the right information, as original contracts and account statements rarely flow during this change in debt ownership.

When contacted by a debt collector, consumers will typically first attempt to contact the original creditor. But those lines of service are usually cut off, as now the debt owner is a separate entity, with no records to offer clarity to individuals. As a very underinvested area for banks, there is no centrally common digital infrastructure across the industry to support the management of charged off accounts and tracking of debt ownership and placement, leading to an inefficient and high-risk process for financial institutions.

Finovate: Who in the financial services industry is most in need of the kind of services Global Debt Registry provides? Who do you target?

Parsells: Global Debt Registry addresses the needs of large creditors, debt buyers, and collection agencies that support and service the $3.4 trillion consumer debt market in the United States, including credit cards, auto loans, home equity, student loans, and consumer finance/retail loans.

We provide data integrity services for the nation’s top banks and debt owners to track and communicate information about debt. Our solution helps large and small creditors looking for a better way to manage debt and ensure fair treatment of consumers.

Global Debt Registry also provides transparency and resources to risk and compliance officers, as they seek to manage the overall risk factors of the mounting debt space. Compliance officers like the solution, but so do those business leaders responsible for the P&L and customer experience.

Finovate: How difficult to navigate are regulatory and compliance issues in this industry? Do regulations make it harder to get the transparency people want?

Parsells: Debt collection rules were mainly drafted 30 years ago, prior to much technology and the invention of the debt market. Historically, this industry has been very under-regulated, and only during the last year or two has there been an increase in attention around these issues.

The formation of the Consumer Financial Protection Bureau has created a clear focus on creating more transparency for consumers, ensuring strong data integrity and regulations that more clearly set guidelines for fraud and inefficient debt tracking. The FTC and OCC have also added direction, along with State Attorneys General such as New York, taking actions against debt buyers for consumer abuses. Our digital solution addresses these regulatory concerns.

Fino

vate: What is the technological challenge of making all this data and information accessible? What was the most difficult component?

Parsells: The main challenges are human rather than technical. Secure cloud based technology enables large volumes of data to be stored, analyzed, shared, and managed more efficiently than ever. The challenges fall across the whole industry, requiring collaboration and leadership across banks, the debt buying and collection industry. Some parties support the absence of transparency and governance that manual processes facilitate. Convincing a siloed, paper based ecosystem to adopt technology requires patience.

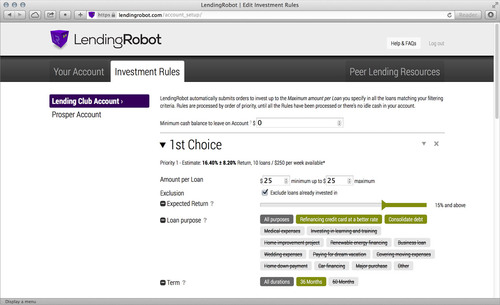

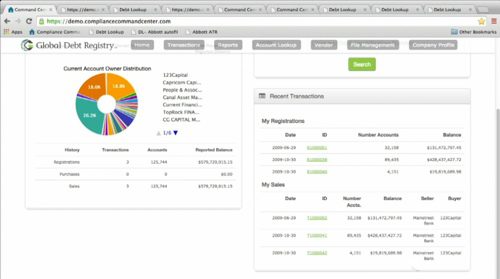

(Global Debt Registry on stage at FinovateFall 2014, left to right: Todd Veale, Chief Marketing and Product Officer; Charles Moore, Chief Commercial Officer)

Finovate: What is the range of services that Global Debt Registry provides to FIs?

Parsells: Global Debt Registry believes there is a better way to manage charged off accounts. Consumer debt is one of the last remaining financial asset classes not to systematically electronically record transactions, leading to inefficiencies, risk, consumer confusion, and increasingly regulatory attention.

We enable large enterprises to securely store and grant access to data and documents on charged off accounts to facilitate better collection outcomes, whether placed with collection agencies or sold. Extending the customer lifecycle to embrace charged off customers will become an increasingly important area for FIs over the next few years as a result of both regulation and brand impact. We solve this problem for them with Debt Lookup, our free debt validation application.

Finovate: What’s next for Global Debt Registry? What new initiatives are in the pipeline?

Parsells: We are planning to launch new Global Debt Registry services this year to continue enhancing how the organizations we work with track and manage debt. We are also planning on adding new asset classes, support and services that will anticipate increasingly complex regulatory standards. The OCC now requires banks to coordinate debt sales and placements across asset classes, representing integration and coordination complexities we are helping with. The line between debt sales and placement with collection agencies will continue to blur, hence the need to support both. We are very excited about the stage of evolution in the market and the growing appetite for digital evolution and governance.

Kreditech secures $200 million credit line from Victory Park Capital.

Kreditech secures $200 million credit line from Victory Park Capital.