WealthForge’s online platform provides an efficient way for companies to raise private capital. It seeks to make the process faster, cheaper, and more compliant.

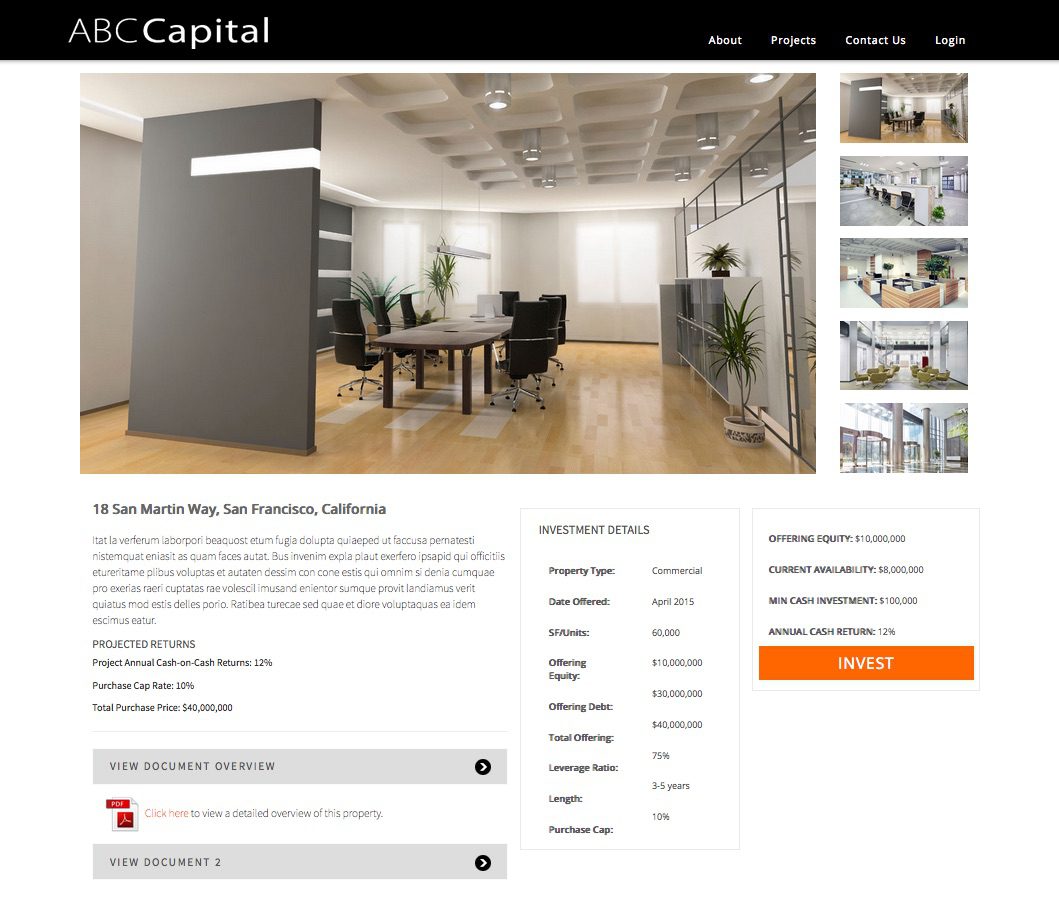

At FinovateSpring 2015, WealthForge launched its Invest Button, technology that compliantly processes private placements, which companies can then incorporate into their website.

WealthForge vitals:

- Founded 2011

- Headquartered in Richmond, Virginia

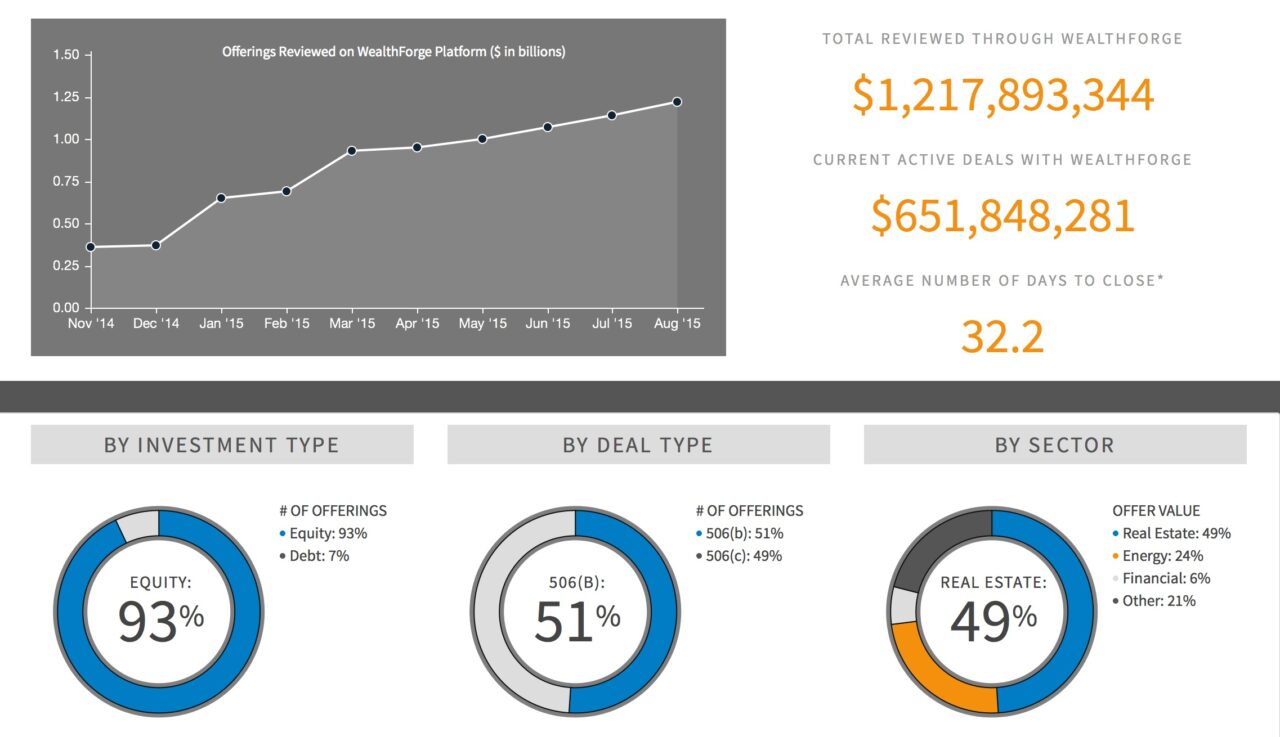

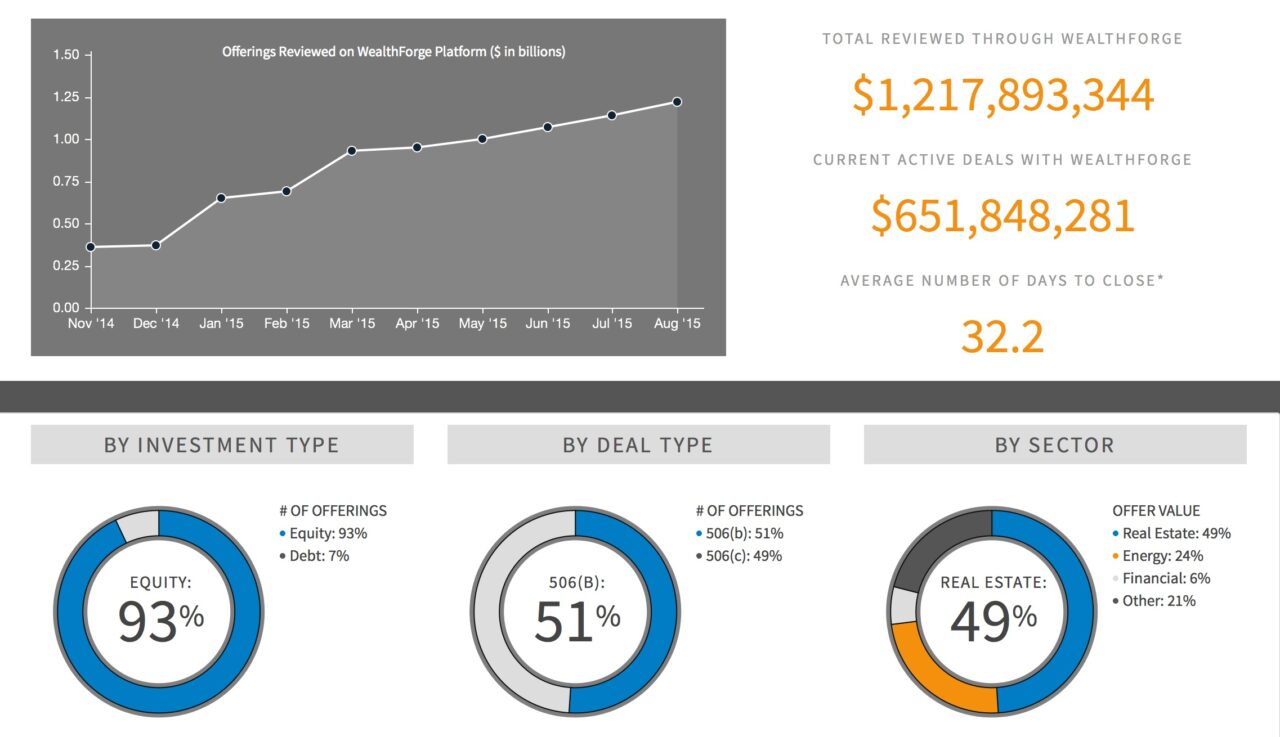

- Infographic below shows stats from the WealthForge platform:

Investor experience

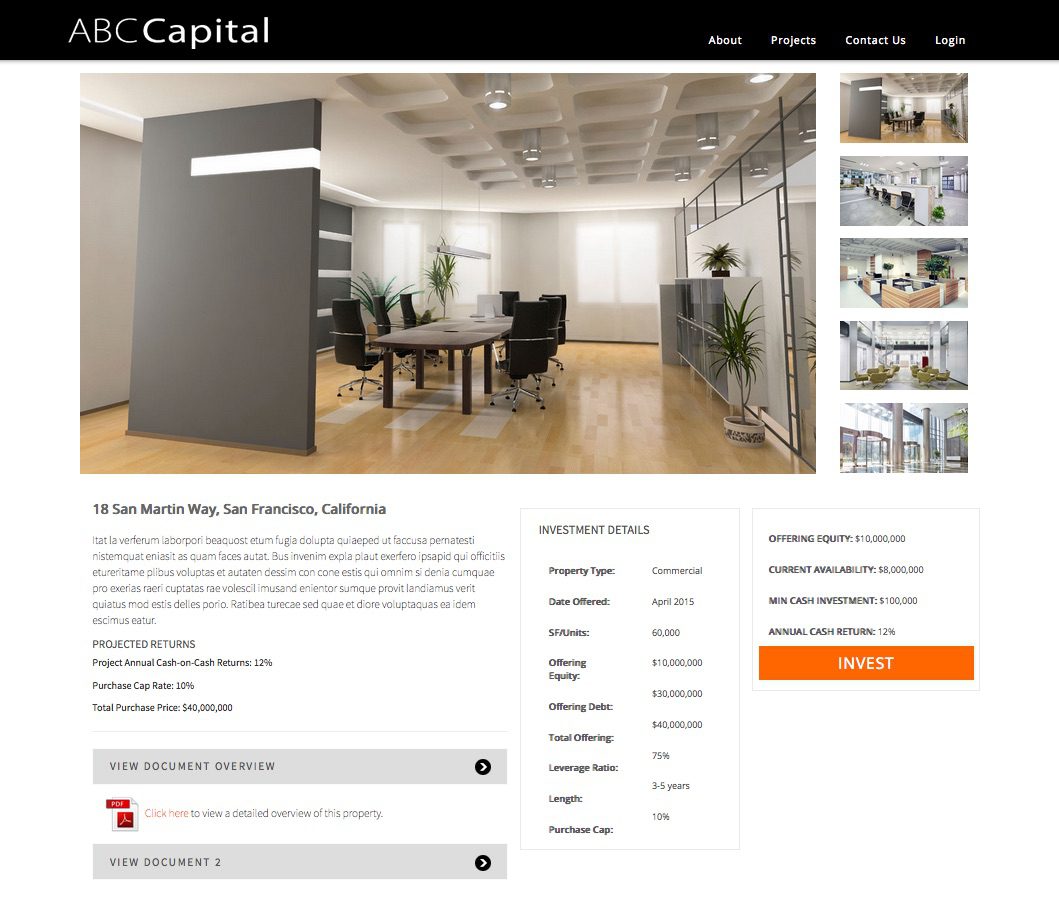

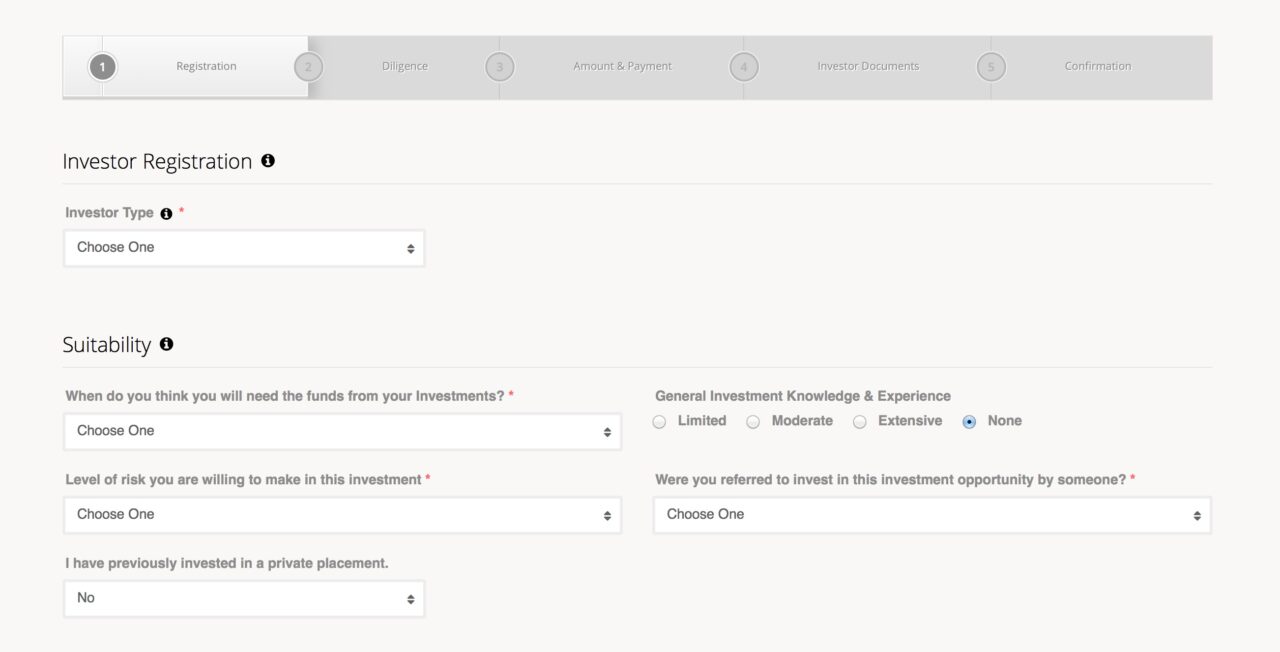

After clicking the Invest Button, investors are routed to a white-labeled page hosted on WealthForge’s servers, which are fully encrypted and secure.

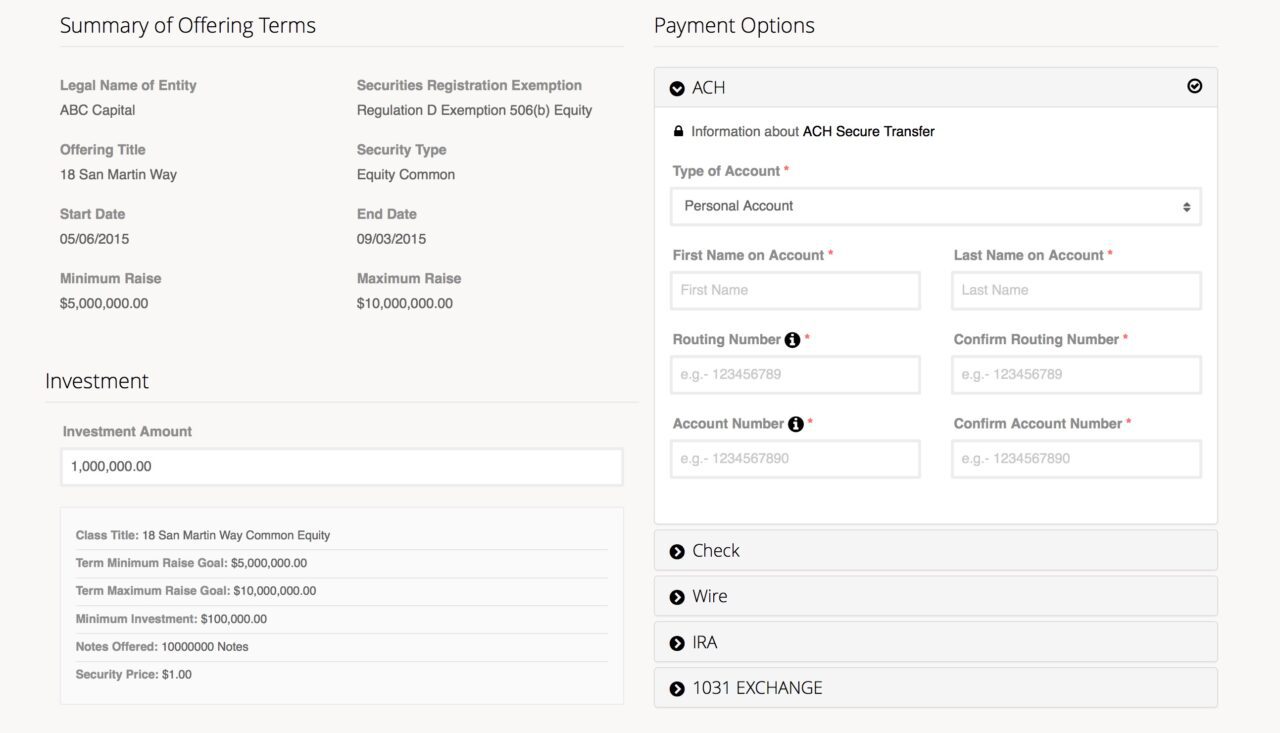

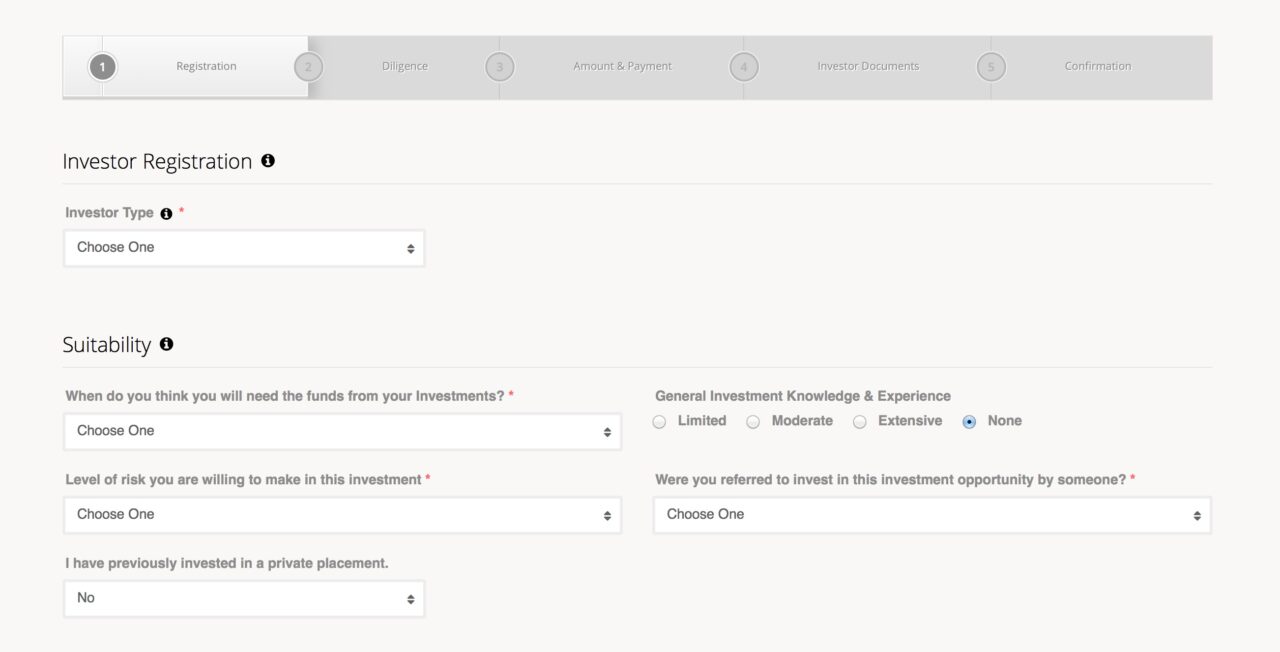

The investor, whether individual or institutional, fills in their desired investment amount, along with other information such as employment, accreditation, and suitability. To remain compliant, WealthForge stores investor information for up to seven years.

For every piece of investor information entered, WealthForge conducts third-party due diligence and bad-actor checks. Since WealthForge tracks investor keystrokes throughout the process, they ensure all necessary steps are taken and have visibility to any fields the investor may have failed to fill out or review.

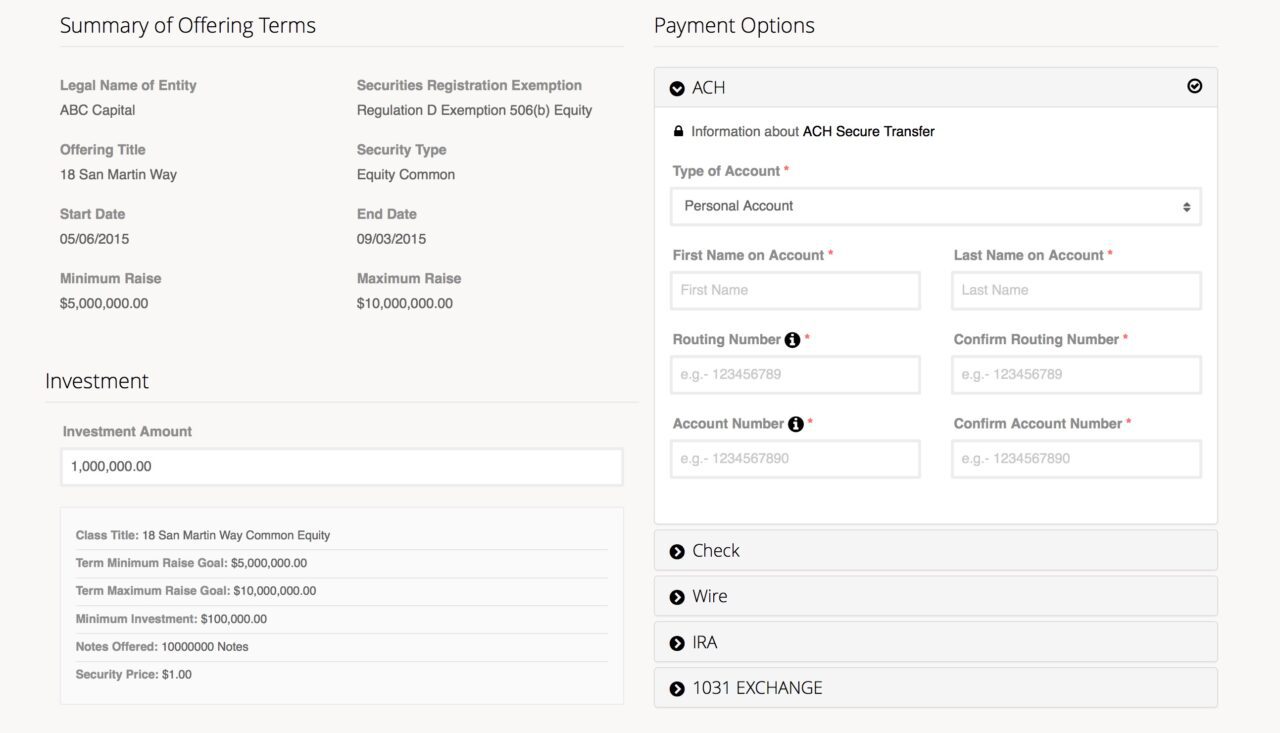

For fund transfers, WealthForge supports:

- ACH

- Wire transfer

- Check

- Self-directed IRA transfer

Once financing is confirmed, the investor e-signs the multiple federal and state-required documents, which are customized for each deal. After all documents are signed, WealthForge’s team of experts begin compliance verification of each offering and issuer.

Compliance

FINRA and SEC regulations are a large part of WealthForge’s platform.

Instead of using technology to circumvent regulation, WealthForge embraces it by increasing engagement with regulators and compliance measures. The company has scaled its technology to deal with increased regulation, and undergoes audits twice a year, exceeding regulators’ guidelines.

WealthForge keeps all the compliance, tracking, legality, and regulation verification in the background. WealthForge co-founder Mat Dellorso says its technology acts as a buffer that saves the client and their investor from having to “see how the sausage is made.”

Check out WealthForge’s live demo from FinovateSpring 2015 in San Jose.

improves transparency and efficiency, allowing more capital to be raised.

improves transparency and efficiency, allowing more capital to be raised. Arthur Weissman, Head of Sales

Arthur Weissman, Head of Sales