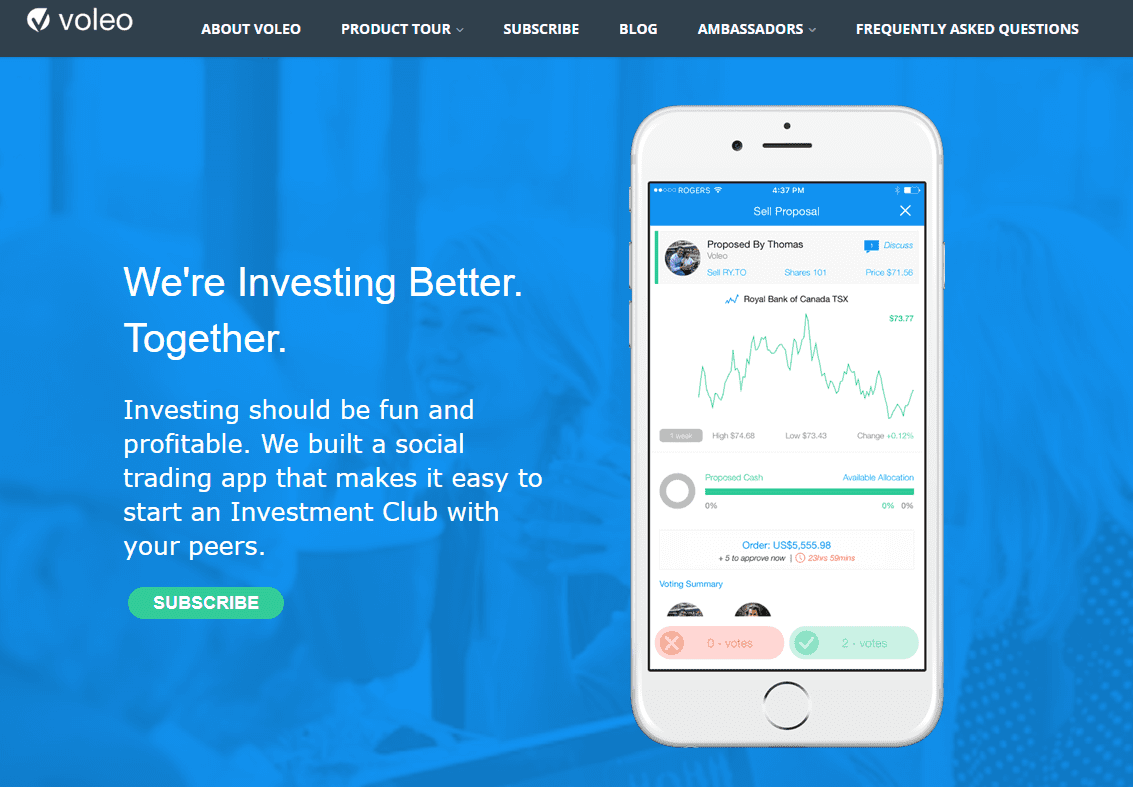

By harnessing the collective wisdom of networked investors, social trading app Voleo helps individuals pursue market-beating returns. Voleo makes it easy for users to form and join investment clubs, contribute equally to the club portfolio, and make investments to grow the account.

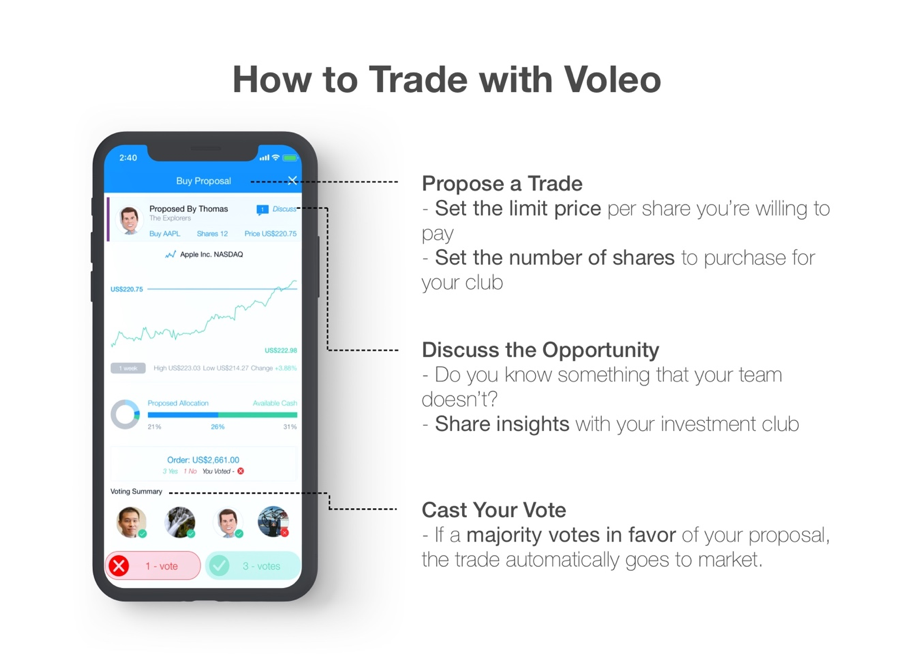

The solution uses chat technology to enable club members to propose, debate, and ultimately vote on new investment proposals. Those new to trading and investing can take advantage of Voleo’s SimuTrader app, which allows investors to practice trading without risking actual money.

Awarded Best of Show at FinovateFall 2017, Voleo announced last month that it was partnering with OP Financial Group to help the Helsinki, Finland-based company develop a new social trading platform for the European market. Voleo also bolstered its advisory ranks in January, appointing B2B digital marketing executive Nicky Senyard to its board of directors. And last fall, the company launched its 2nd annual equity trading competition, in collaboration with Nasdaq.

Most recently, Voleo introduced a number of new features including advanced order types to enable investors to place and specify the date range for both limit and stop orders.

We caught up with company CEO Thomas Beattie (pictured) to talk about Voleo, the power of social trading and investing, and what to expect from the company in 2019 and beyond.

We caught up with company CEO Thomas Beattie (pictured) to talk about Voleo, the power of social trading and investing, and what to expect from the company in 2019 and beyond.

Finovate: What does Voleo do and how does it do it?

Thomas Beattie: Voleo is the first social trading app that makes it possible to team up and invest in the stock market with your friends.

Our patent-pending trading technology allows users to leverage the collective knowledge of their peers, and has revolutionized the way individuals trade stocks, ETFs, and proprietary products offered by partner financial institutions. Vancouver-based Voleo gamifies the investing experience and motivates users to collaborate through its community-building user experience. Voleo has established itself in the U.S. as a registered broker-dealer with FINRA and SEC, and now offers its social trading technology white-label to financial institutions.

Finovate: Who are Voleo’s primary customers and how does Voleo attract them?

Beattie: Our primary customers are career-oriented and ambitious individuals in their mid-30s. Current research shows that they have typically built some wealth, in the form of savings, but do not yet have self-directed trading accounts. Voleo’s target market socializes well in digital, mobile environments. They value the opinions of those in their network, and they are digital natives who learn, communicate and bank with their smartphones.

Firstly, we plan to reach this target market through strategic partnerships with U.S. banks and credit unions. These financial institutions have established brands that resonate with Voleo’s target market. This enables Voleo to naturally synergize and deepen relationships with current customers and acquire new ones.

Secondly, we have seen consistent and organic growth through our own iOS, Android, and Web platforms, which we thank the Voleo community for. On average, each club founded on Voleo’s platform has led to 13 members of their social circle being invited to join, with team sizes averaging nine members and growing. As our user base grows further, we are making continuous progress on product development to encourage further collaboration between our users and make investing more accessible to the general public.

Finovate: How does Voleo solve the problem better?

Beattie: The reality is that traditional investment options are not meeting the needs of Millennials due to high costs, time constraints, and inaccessibility. Young investors usually face a trade-off for the two most popular options for taxable investment accounts. For one, investment advisors are not interested in clients with minimal assets, and for individuals with money, these same advisors can end up being costly. On the other hand, self-directed investing can seem risky to novices who don’t know the ins and outs of the stock market.

From a customer acquisition standpoint, Voleo creates opportunities for financial institutions by merging the best of self-directed trading and social media platforms. We help reach new prospects by providing tangible value to customers, and authentic communication channels to financial institutions.

Finovate: Tell us about your favorite implementation of Voleo’s technology.

Beattie: Four years of R&D has gone into the development of its iOS and Android apps, which have seen steady user growth since the soft launch in early 2017. As of December 2018, Voleo has earned the opportunity to pilot with OP Financial Group, Finland’s largest bank with total assets of €140bn. This partnership came to fruition from OP’s Wealthtech Program, which serves to expose top international fintech companies to the Finnish market, and for OP Financial Group to stay at the forefront of innovation and adopt new technologies for their client base.

Our mission for this partnership is to help OP Financial Group convert savers into investors and help them along the way as they kickstart their wealth journey. Our white-label product will integrate the social sharing capabilities of Voleo’s platform with OP Financial Group’s product line. By creating a community around personal finance, we believe that we can increase activity among existing OP users and acquire new prospects as well.

Finovate: What in your capital markets background gave you the confidence to tackle this challenge?

Beattie: I began my career 15 years ago and have devoted time across several sectors, leading projects in financial services and capital markets before taking on the role of CEO at Voleo. I’ve always had a passion for investing and education, and this aligned well with our mission of enabling the general public to reach their long-term financial goals.

Finovate: What can we expect from Voleo in 2019?

Beattie: I am excited for 2019 as Voleo is currently taking steps to become a publicly listed company on the TSX Venture Exchange.

In the past year of soft launch, we have continuously refined our product and grown our community organically. Voleo is now at the stage where we are ready to scale up.

To assist in the company’s strategic growth in 2019, Voleo has recently appointed Nicky Senyard as our first Independent Director. We are extremely excited to have Nicky join our group, as she is a veteran in the marketing technology space, having successfully founded Income Access which was acquired by Paysafe for $30M in 2016. We’re excited to have her provide her expertise in scaling fintech businesses to achieve our business goals for 2019.

To learn more about this unique platform and how you can be an early-adopter to this coming revolution, you can message me on LinkedIn or send us an e-mail at [email protected].

To help guide decision-making, Voleo provides a Definitive Return On Investment Decisions (DROID) score that helps users spot and follow along with the best performing investment clubs and individual investors on the platform. Designed to both lower the costs of and barriers to entry for less experienced investors, the app is available on both iOS and Android, as well as via the web.

To help guide decision-making, Voleo provides a Definitive Return On Investment Decisions (DROID) score that helps users spot and follow along with the best performing investment clubs and individual investors on the platform. Designed to both lower the costs of and barriers to entry for less experienced investors, the app is available on both iOS and Android, as well as via the web.

Envestnet | Yodlee

Envestnet | Yodlee Finn.ai

Finn.ai Jiffee

Jiffee

Presenters

Presenters Mark Morabito, Executive Chairman

Mark Morabito, Executive Chairman