FinovateSpring 2015 is right around the corner. And with news this morning that attendance has already topped 1,000, now is a great time to register and save your spot at our annual spring event on May 12 and 13.

A total of 72 companies will be on stage at the City National Civic in San Jose, California, to demonstrate the latest in financial technology live in front of our audience of industry professionals, venture capitalists, bankers, media, and more. And along with more than 500 minutes of live demos, we make sure you’ve got plenty of time to meet, greet, and network with presenters, sponsors, and fellow attendees alike.

Today in our Sneak Peek Preview series, we’re featuring another seven companies to help you get to know a little more about the companies that will be presenting next month at FinovateSpring 2015.

Check out the previous installments of our Sneak Peek series below. And stayed tuned for more introductions to our FinovateSpring 2015 presenters next week.

- Sneak Peek Part 1: Alpha Payments Cloud, CUneXus, DRAFT, FundAmerica, SayPay, StockViews, and TrueAccord

- Sneak Peek Part 2: Bento for Business, DoubleNet Pay, Karmic Labs, SizeUp, Stratos, TickerTags, and Trulioo

- Sneak Peek Part 3: 3E Software, Corezoid, Malauzai Software, PayActiv, PsychSignal, Someone With Group, and Trizic

- Sneak Peek Part 4: Currency Cloud, Dream Payments, Hip Pocket, INETCO Systems, LoanNow, WealthForge, and Yodlee

- Sneak Peek Part 5: DarcMatter, Digital Insight, Emailage, Hedgeable, Moven, RAGE Frameworks, Shoeboxed

Credit Sesame helps millions of consumers access, monitor, and manage their credit, improve their finances and protect their credit and identity for free.

Credit Sesame helps millions of consumers access, monitor, and manage their credit, improve their finances and protect their credit and identity for free.

Features:

- Mobile integration combined with the power of voice control and TouchID

- Manage, monitor, and protect your credit and identity anytime, anywhere

- White label / turn-key solution

Why it’s great

Credit Sesame makes it easier than ever for mobile users to access, monitor, and manage their credit, improve their finances, and protect their identity on the go.

Presenters

Adrian Nazari, CEO

Adrian Nazari, CEO

Nazari is a serial entrepreneur, an acknowledged industry expert, and founder of Credit Sesame Inc.

LinkedIn

Jesse Levey, Head of Product

Jesse Levey, Head of Product

Levey is a product innovator and growth expert with more than 12 years experience in technology and financial services.

LinkedIn

Hip Pocket engages your mobile and website visitors by using social influence and personalized consultation to generate new, qualified mortgage leads.

Features:

- Unique peer-group comparisons

- Real-time integration and personalization savings estimates

- Results and call-to-action are customized to each user’s situation

Why it’s great

Hip Pocket allows your institution to provide an engaging, intuitive user experience that marries the emotional and logical decision-making processes.

Presenters

Mark Zmarzly, CEO, Founder

Mark Zmarzly, CEO, Founder

Zmarzly is a passionate innovator and thought leader in the financial industry. He has delivered multiple TEDx talks and presented for the ABA, BAI, and JD Power & Associates.

LinkedIn

Todd Cramer, Head of Digital Experience & Design

Todd Cramer, Head of Digital Experience & Design

Cramer is a MBA with more than five years of experience in branding, user experience and eCommerce for a $5B bank enterprise.

LinkedIn

itBit is a global bitcoin exchange offering institutional and retail investors a powerful platform to buy and sell bitcoin.

itBit is a global bitcoin exchange offering institutional and retail investors a powerful platform to buy and sell bitcoin.

Features:

- Trusted, institutional-grade exchange

- Available around the clock

- Offers the best security, privacy, and asset protection

Why it’s great

itBit is the most trusted and secure platform for trading bitcoin.

Presenters

Charles Cascarilla, CEO, Co-founder

Charles Cascarilla, CEO, Co-founder

As a bitcoin early adopter with more than 15 years’ experience in financial services, Cascarilla has a unique perspective and interest in integrating bitcoin with traditional systems.

LinkedIn

Bobby Cho, Director of Institutional Client Group (ICG)

Bobby Cho, Director of Institutional Client Group (ICG)

As the head of itBit’s ICG team, Cho provides tailored client relationships trading services to itBit’s global network of institutional clients.

LinkedIn

Anyone can hit a baseball thrown straight down the middle, but Kofax’s robust mobile new account opening platform can accommodate curveballs, screwballs, and the off-speed pitches in life.

Anyone can hit a baseball thrown straight down the middle, but Kofax’s robust mobile new account opening platform can accommodate curveballs, screwballs, and the off-speed pitches in life.

Features:

- Mobile capture of IDs and supporting documents

- Intelligent decisioning allows complex exception and compliance management

- Seamless multichannel customer experience

Why it’s great

Paramount to mobile onboarding is giving customers the right product at the right time with the right risk-assessment profile in a completely automated fashion.

Presenters

Drew Hyatt, Senior Vice President, Mobile Applications

Drew Hyatt, Senior Vice President, Mobile Applications

Hyatt is a leading domain expert in mobile image-capture and is responsible for Kofax’s mobile product roadmaps, go-to-market strategies, and product positioning.

LinkedIn

Diane Morgan, Senior Business Development Manager

Diane Morgan, Senior Business Development Manager

As Senior Mobile Business Development Manager at Kofax, Morgan partners with financial institutions to identify, develop, and execute their mobile capture and imaging strategies.

LinkedIn

Mitek, the leading innovator of mobile imaging for financial transactions and identification, will demonstrate how to optimize mobile for secure customer acquisition.

Mitek, the leading innovator of mobile imaging for financial transactions and identification, will demonstrate how to optimize mobile for secure customer acquisition.

Features:

- Increase mobile form completion by 30-50%

- Double number of accounts booked via mobile

- Meet KYC requirements and complete ID check in mobile channel

Why it’s great

Mobile account opening starts are dramatically increasing while desktop is declining. Mitek’s next innovations will do for account opening what it did for check deposits.

Presenters

Michael Nelson, Vice President for Business Development

Michael Nelson, Vice President for Business Development

Nelson leads the business-development team focused on expanding mobile-imaging usage within banking and beyond.

LinkedIn

Sarah Clark, Vice President Product Owner

Sarah Clark, Vice President Product Owner

Clark directs product strategy and the roadmap for our mobile-imaging platform and suite of products including mobile deposit, our market leading MiSnap SDK and Mobile Identity product line.

LinkedIn

With the growing importance of the user experience and customer intelligence in digital channels, NAMU Systems sets a new standard in mobile banking.

With the growing importance of the user experience and customer intelligence in digital channels, NAMU Systems sets a new standard in mobile banking.

Features:

- Highly visual user experience—connecting money with memories

- Targeted advertising based on social spending patterns

- Google-like search in banking

Why it’s great

NAMU helps your customer to have joyful banking experiences with relevant connection to memories and a beautiful user interface backed by NAMU’s patent-pending platform.

Presenters

Thomas Ko, President, Co-founder

Thomas Ko, President, Co-founder

Ko is ex-global head of mobile banking at Citibank, developing the most successful corporate mobile banking solution worldwide.

LinkedIn

Piotr Budzinski, CEO, Co-founder

Piotr Budzinski, CEO, Co-founder

Prior to NAMU, he led strategic technology projects for European banks and U.S. asset managers, including UniCredit and Franklin Templeton.

LinkedIn

BuddyPay from Persistent Systems is a real-time payment-switching mechanism. The control of payment is shifted from buyer to payer for online/in-store purchases of products and services in real-time.

BuddyPay from Persistent Systems is a real-time payment-switching mechanism. The control of payment is shifted from buyer to payer for online/in-store purchases of products and services in real-time.

Features:

- The Payment Switching Mechanism can be used while selling/fulfilling literally anything

- Sell physical goods, insurance, billpay, flight and hotel booking

- Intuitive mobile app

Why it’s great

You can “sell” products/services to people who don’t have money to “buy” it!

Presenters

Abhiram Modak, Principal Business Analyst & Industry Expert

Abhiram Modak, Principal Business Analyst & Industry Expert

Modak has multiple years of diverse experience and is an innovator at heart. He can come up with solutions to most complex business problem with his domain knowledge and technology understanding.

LinkedIn

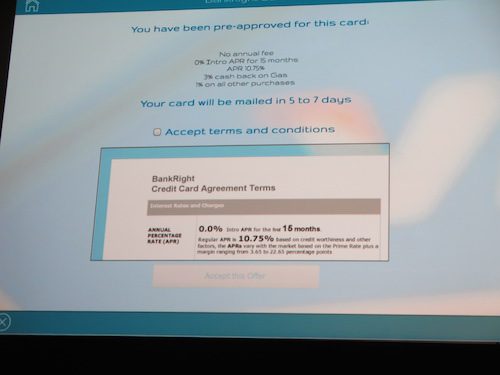

![]() Kofax showed how its Mobile Capture Platform onboards customers in real time:

Kofax showed how its Mobile Capture Platform onboards customers in real time:

Adrian Nazari, CEO

Adrian Nazari, CEO Jesse Levey, Head of Product

Jesse Levey, Head of Product

Mark Zmarzly, CEO, Founder

Mark Zmarzly, CEO, Founder Todd Cramer, Head of Digital Experience & Design

Todd Cramer, Head of Digital Experience & Design itBit

itBit Charles Cascarilla, CEO, Co-founder

Charles Cascarilla, CEO, Co-founder Bobby Cho, Director of Institutional Client Group (ICG)

Bobby Cho, Director of Institutional Client Group (ICG) Drew Hyatt, Senior Vice President, Mobile Applications

Drew Hyatt, Senior Vice President, Mobile Applications Diane Morgan, Senior Business Development Manager

Diane Morgan, Senior Business Development Manager Mitek

Mitek Michael Nelson, Vice President for Business Development

Michael Nelson, Vice President for Business Development Sarah Clark, Vice President Product Owner

Sarah Clark, Vice President Product Owner

Thomas Ko, President, Co-founder

Thomas Ko, President, Co-founder Piotr Budzinski, CEO, Co-founder

Piotr Budzinski, CEO, Co-founder

Abhiram Modak, Principal Business Analyst & Industry Expert

Abhiram Modak, Principal Business Analyst & Industry Expert

Smartphone checkbook app MagicMony

Smartphone checkbook app MagicMony