Global payments company Worldpay and online payments innovator Klarna are joining forces this week. Starting today, Worldpay clients in Austria, Finland, Germany, the Netherlands, Norway, Sweden, and the U.K. will be able to use Klarna’s invoice and credit-based payments.

The new capabilities will enable Worldpay’s ecommerce business clients to offer shoppers new payment options that will allow consumers to decide how and when to pay for the goods after they receive them. Consumers can manage the terms of their payment, opting for a 14-day payment by invoice, fixed, or flexible installments, or choosing to spread the cost over several months. The new checkout experience does not request payment credentials at the point of checkout, but rather requests only their email address and postal code. This offers a faster checkout experience and helps retailers improve conversion rates by 20%.

With consumers turning to online shopping to fulfill not only their gadget and clothing needs but also for daily grocery and sundry items, ecommerce is more popular than ever. And with so many players flooding the market, retailers are facing increased competition. Implementing Klarna’s fast and flexible payments options allows ecommerce players to differentiate themselves and compete on more than just free shipping.

Worldpay is one of the first companies piloting Klarna’s new payment technology. The company notes that, because there is no plug-in, the service is easy to integrate and results in faster time-to-market. Additionally, risk management is taken care of. According to Michael Rouse, Klarna’s Chief Commercial Officer, “Klarna assumes responsibility for managing credit and fraud risks, allowing companies to quickly receive payment for orders, and allowing consumers to pay only if they’re happy with their purchase.”

Dave Glaser, Chief Product Officer of Global eCom at Worldpay said that the company is “seeing increased demand from customers wishing to create more reasons to shop with them over their competitors.” Because some merchants consider accepting credit card payments “risky” and “old fashioned,” Glaser noted that “being able to adapt to new and local payment preferences is a way to rectify this.” He added, “We believe that this solution will empower companies to see a real increase in sales.”

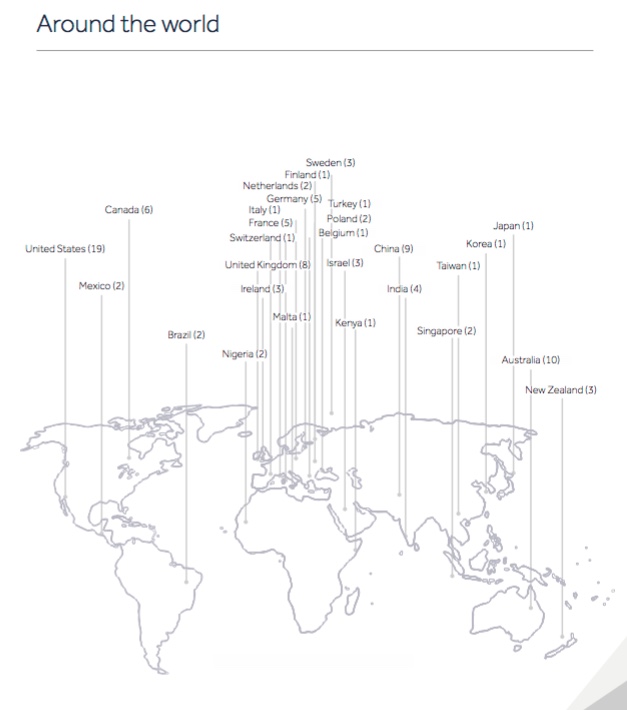

Founded in 1989, Worldpay presented at FinDEVr Silicon Valley 2016 about the payment journey. The company offers payment products and services to a client base of 400,000. Worldpay’s technology can process payments from 146 countries and 126 currencies, enabling customers to accept more than 300 different payment types. Earlier in the fall, the company built an SDK for IoT shopping and this summer Worldpay agreed to merge with U.S. credit card processor Vantiv in a $10 billion deal.

Klarna demonstrated its online payment-processing service at FinovateSpring 2012. In August, the company launched a free P2P payments service called Wavy. Earlier this year, Klarna acquired online payment provider BillPay from Wonga for $75 million.