Ask FundAmerica founder and CEO Scott Purcell what his company’s services are and who they are for, and his answer is refreshingly simple: “Anyone raising money online needs to use our services,” Purcell says with a smile. “We’re the guys that keep you from going to jail.”

Put a little less colorfully, FundAmerica provides an API- and browser-based compliance platform for crowdfunders. FundAmerica’s back-end compliance solutions include everything from AML and escrow services, to payment processing and state dealer representation; in short, all that is needed by investment advisers, broker-dealers and others to raise capital pursuant to 506(c), 506(b), Reg A+, and rule 4(a)(6) crowdfunding regulations.

FundAmerica founder and CEO Scott Purcell demonstrated FundAmerica’s API for crowdfunding platform compliance at FinovateSpring 2015.

At FinovateSpring 2015, FundAmerica demonstrated its API for crowdfunding platform compliance. Purcell noted that in a few years “every business, every real estate developer, anyone looking for capital will be doing so online. And that presents a very complex set of problems so it can be done effectively and safely.”

Fortunately for crowdfunders, there’s FundAmerica.

Company facts:

- Founded in November 2011

- Headquartered in Las Vegas, Nevada

- Raised $2.25 million in angel investment

- Signed 125 crowdfunding platforms

- Opened more than 40 escrows in the first three months

- Scott Purcell is founder and CEO

How it works

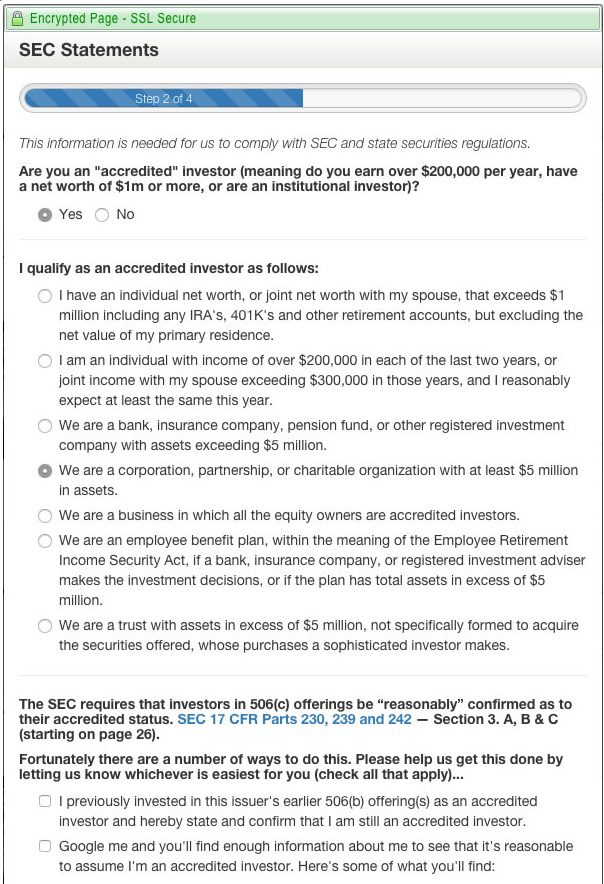

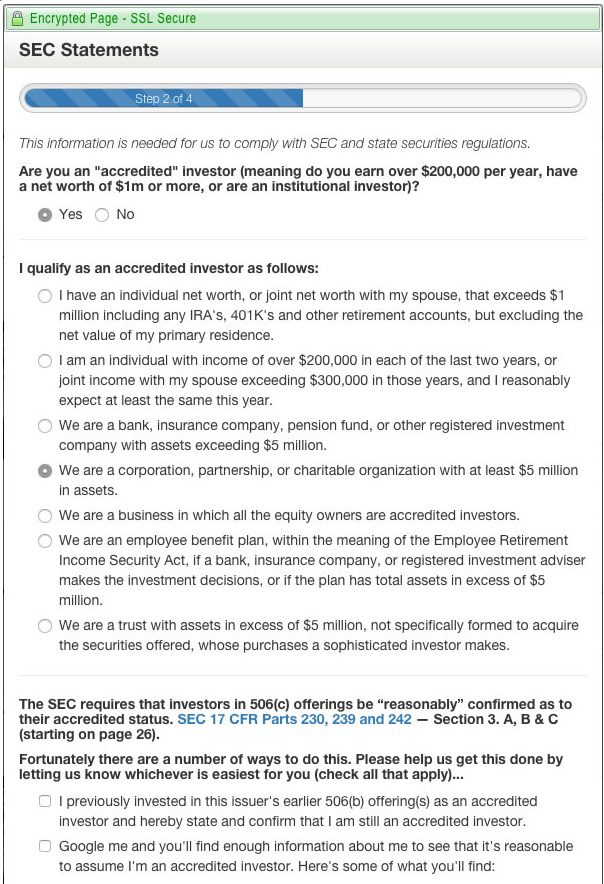

FundAmerica’s platform ensures that crowdfunders are doing everything correctly and in a compliant manner. This begins with collecting issuer information, and associated persons such as executive officers, directors and major shareholders. This ensures that the AML process is off to a compliant-start, including background “bad-actor checks” with the SEC.

Details of the offering can be recorded on the platform for ready provision to the registered transfer agent. This takes account of both basic information, legends or restrictions, as well as whether the offering is equity or debt.

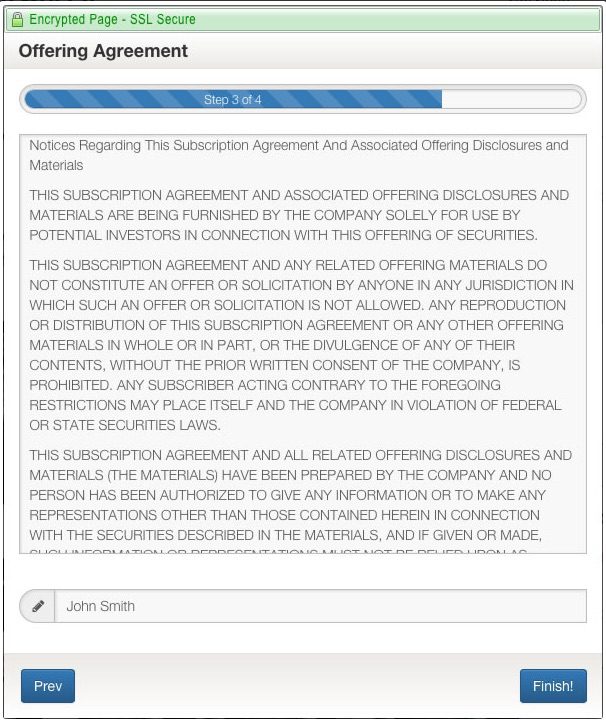

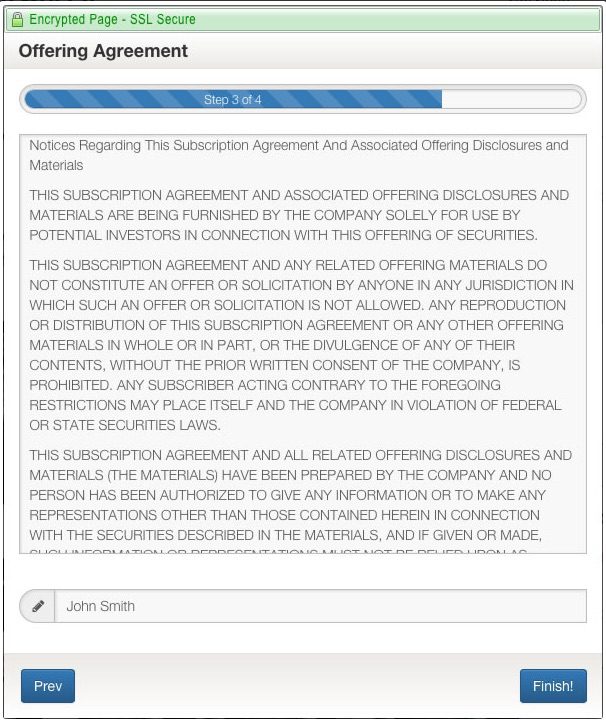

Once all the information is entered into the system, the subscription and escrow agreements are generated for investors to sign. At this point, Purcell explained, “The transaction is in the system, it’s registered, AML has been run, due diligence has been looked at. Everything is ready for this issuer to now conduct a compliant online fund-raise—either by themselves or through a crowdfunding platform.”

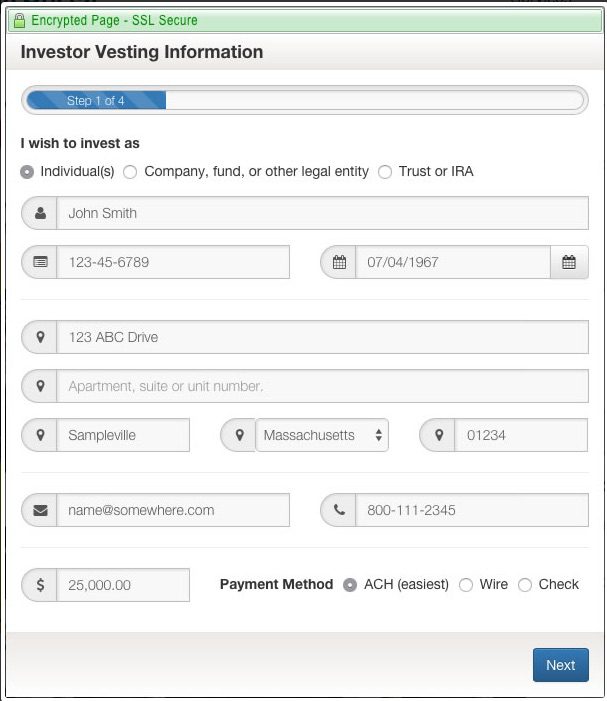

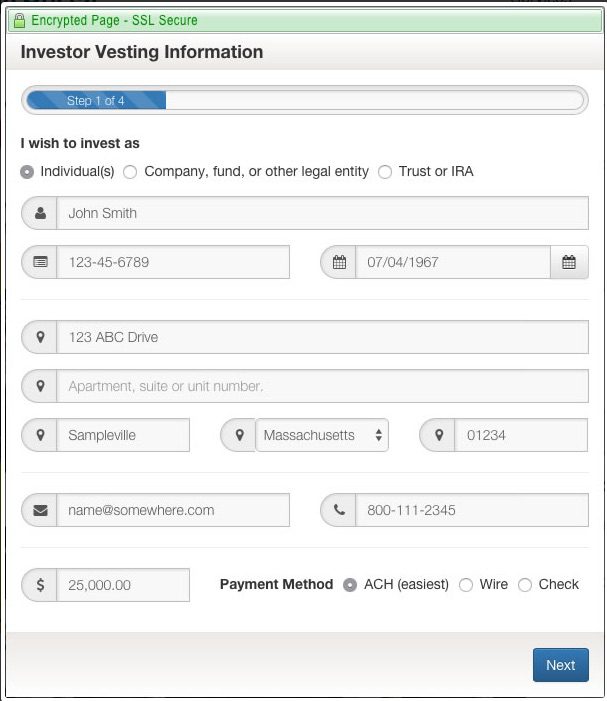

Potential investors visiting the crowdfunding platform see information about the company, its leadership, background, metrics, and so on. The difference is that with FundAmerica, each offering will include an “Invest Now” button that, when pressed, fast-tracks the process.

A pop-up menu allows investors to enter in their name, contact details, amount of investment and payment method. Then, relevant documents to facilitate the transfer, such as an electronic ACH debit-authorization form and a substitute 1099 form, appear automatically for completion and electronic signing.

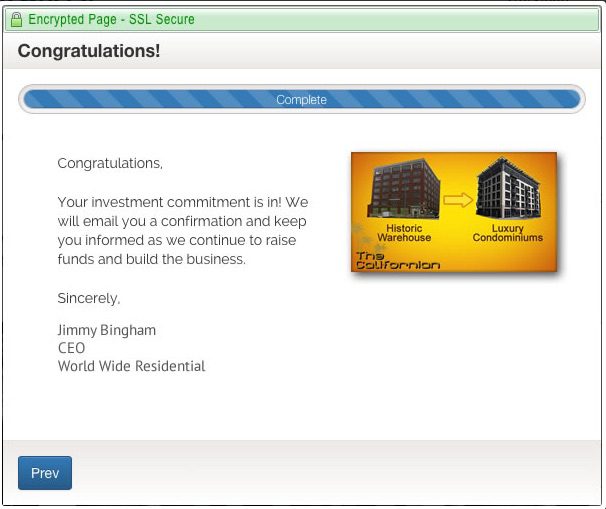

All completed documents are stored online for compliance and emailed to the investor for their records.

“The idea is to make it as easy and as friction-free as possible for the issuer to get the money into escrow,” said Purcell. “For the back-end service providers to do the AML checks [necessary] on the issuer; to [ensure] the funds that are going to transfer, are settled and cleared; and that all of the blocking and tackling on the banking ecosystem is able to happen.”

On the issuer side, the system provides an alert that lets him or her know both when new funds have been pledged as well as when they actually arrive in escrow. Simultaneously, the back-end processes ensure everything is happening in the proper sequence: AML is conducted before the securities are actually sold, and funds are settled and cleared before anything is released from escrow and transferred to the issuer.

“That’s what FundAmerica does,” Purcell said. “We package the ecosystem—the plumbing—for the crowdfunding industry.”

The future

“People are excited that someone is doing what FundAmerica is doing,” Purcell said. “There’s no one else doing it.” FundAmerica combines technical knowledge with a strong compliance-oriented management team, a good place to be “when a company’s security attorneys come to us,” Purcell says. “We’re good, authoritative people for them to talk to. We give out a lot of free advice.”

Since its Finovate debut, FundAmerica launched its “flex” payment-processing feature, which allows platforms to separate their share from an issuer payment and forward the rest to investors. The feature is available through both the online portal as well as the API, and serves as a boon for platforms that earn revenues from the difference between the rate a sponsor or developer pays and the rate paid out to investors.

June 2015 marked the month FundAmerica unveiled its FundAmerica Stock Transfer (“FAST”) service, a registered transfer agent for Reg A+ and 506b/c. Using RESTful APIs to make it easy to integrate into crowdfunding platforms, FAST helps with investor records management and other tools to manage changes in ownership, payment histories, vesting details, and more.

New initiatives aside, FundAmerica has just begun a Series A funding round, so the company is actively looking for and talking with investors. Beyond that FundAmerica is eager to make strategic partners. “We are the Intel Inside for crowdfunding platforms,” Purcell said. “We build solutions to help crowdfunders conduct a compliant operation with the least amount of investor friction.”

Check out the FinovateSpring 2015 demo video for FundAmerica below