After two days of live demonstrations of some of the most novel innovations in fintech, our FinovateEurope audience has made its voice heard as to which technologies represent the Best of Show.

This year’s award winners are a fascinating mix of Finovate veterans like Backbase, eToro, SaleMove, and Tink, all of whom have been honored with Best of Show trophies in the past, as well as newcomers like Dorsum and Memento, which accompanied their Finovate debuts with Best of Show awards of their own. And how fun is it to celebrate a company like CREALOGIX, a Finovate alum since 2011, that picked up its very first Best of Show honors this week?

A hearty congratulations to all seven of FinovateEurope 2017’s Best of Show winners – and to all of the companies that demonstrated their technologies at our London conference this year. From artificial intelligence and chatbots to technologies that make it easier for us to earn, save, and invest, yours are the innovations that remind us how valuable the relationship between finance and technology can be.

Backbase for showing how artificial intelligence and PSD2 can turn a mobile app into a smart virtual assistant.

Backbase for showing how artificial intelligence and PSD2 can turn a mobile app into a smart virtual assistant.

CREALOGIX for its predictive banking in virtual reality technology that transcends complex interfaces to provide a user experience that accommodates emotion, creativity, and logic when it comes to making financial decisions.

CREALOGIX for its predictive banking in virtual reality technology that transcends complex interfaces to provide a user experience that accommodates emotion, creativity, and logic when it comes to making financial decisions.

Dorsum for its chatbot factory and botboarding platform that creates chatbots that combine human-like, natural language communication with traditional customer data collection and profiling.

Dorsum for its chatbot factory and botboarding platform that creates chatbots that combine human-like, natural language communication with traditional customer data collection and profiling.

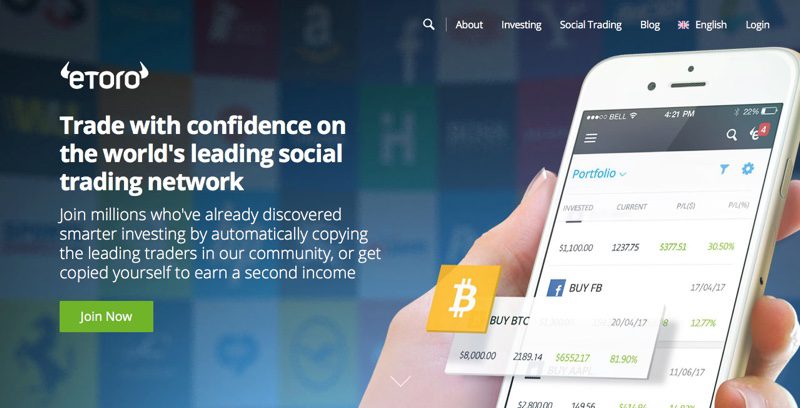

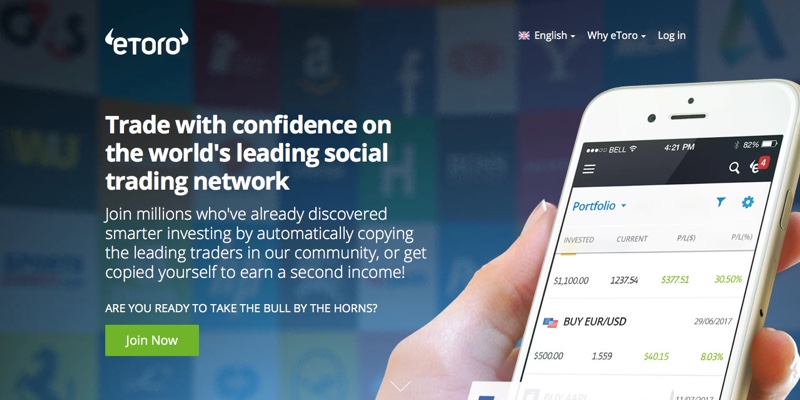

eToro for its worldwide social trading network of more than five million members that makes the trading and investing environment more social, more enjoyable, and more transparent.

eToro for its worldwide social trading network of more than five million members that makes the trading and investing environment more social, more enjoyable, and more transparent.

Memento for its Bank-to-Social Relationship platform and next generation mobile money app that helps banks deepen engagement with current customers and better attract and acquire new customers, as well.

Memento for its Bank-to-Social Relationship platform and next generation mobile money app that helps banks deepen engagement with current customers and better attract and acquire new customers, as well.

SaleMove for its Engagement Platform that enables FIs and other companies to communicate with online visitors via chat and dual-cursor guided cobrowsing, as well as video and voice.

SaleMove for its Engagement Platform that enables FIs and other companies to communicate with online visitors via chat and dual-cursor guided cobrowsing, as well as video and voice.

Tink for its independent, consumer PFM app that brings together aggregation, account information, and payment initiation services to provide a truly PSD2-compliant, virtual bank experience.

Tink for its independent, consumer PFM app that brings together aggregation, account information, and payment initiation services to provide a truly PSD2-compliant, virtual bank experience.

We had a great time this year at FinovateEurope and hope you enjoyed getting to know our presenting companies and the unique ways they leverage technology to solve problems. Thanks and gratitude to all of our sponsors, partners, presenters, and – of course – our attendees, for making this celebration of financial technology possible. We’ll see you next year!

Notes on methodology:

1. Only audience members NOT associated with demoing companies were eligible to vote. Finovate employees did not vote.

2. Attendees were encouraged to note their favorites during each day. At the end of the last demo, they chose their three favorites.

3. The exact written instructions given to attendees: “Please rate (the companies) on the basis of demo quality and potential impact of the innovation demoed.”

4. The six companies appearing on the highest percentage of submitted ballots were named “Best of Show.”

5. Go here for a list of previous Best of Show winners through 2014. Best of Show winners from our 2015 and 2016 conferences are below:

eToro

eToro Memento

Memento