CPB Software began in 1996 as a spinoff from a private bank in Austria. The company has created numerous products for financial services companies across Europe. At FinovateEurope 2015, CPB debuted PROFOS, a product to help advisers overcome hurdles in customer relationships.

Company facts:

- $3.8 million in equity

- $18.3 million in revenue for 2014

- 130+ employees

- 700+ customers in 7 countries

- Founded 1996

The PROFOS platform, which works with any existing core banking system, integrates client data and combines it with consulting features. The result is an all-in-one tool to help advisers prepare for client meetings and connect with the client throughout the meeting.

To prepare for client meetings, the home screen shows daily appointments and financial market activity, and serves as a digital file cabinet that stores important documents.

It also contains a toolbox that houses both informational videos that explain complex topics, as well as negotiation tutorials, to assist advisers during the negotiation process.

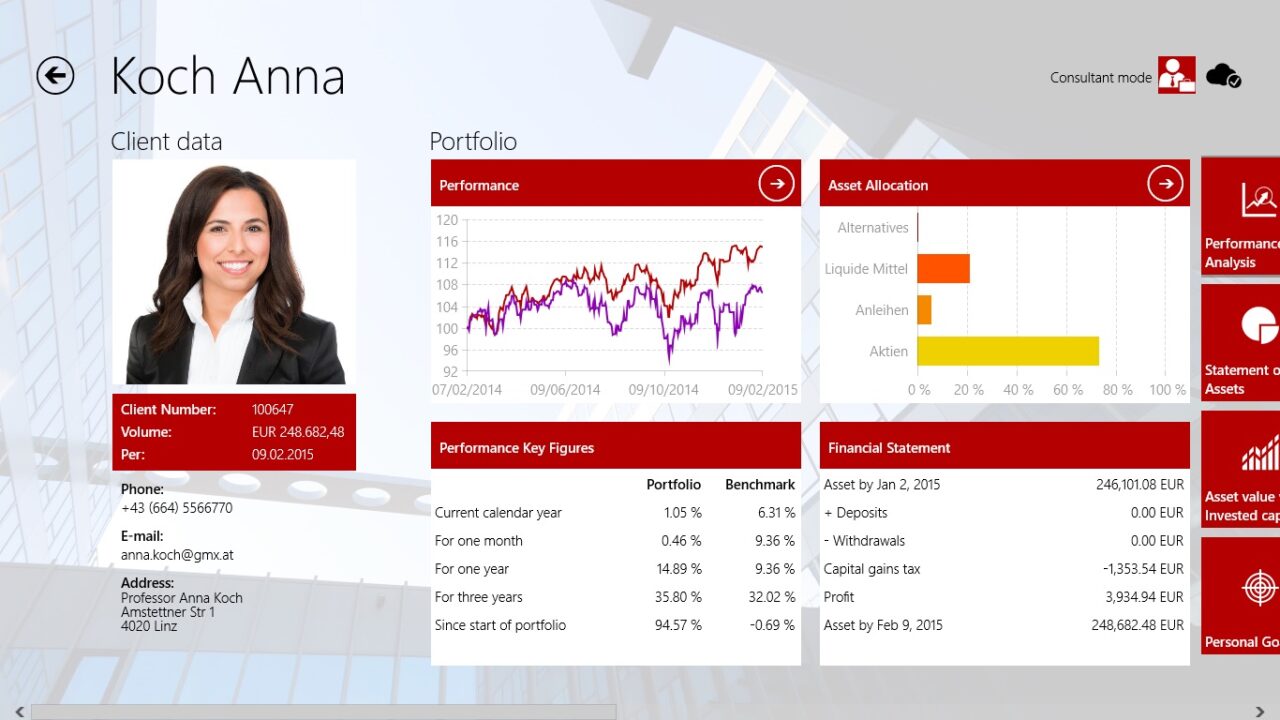

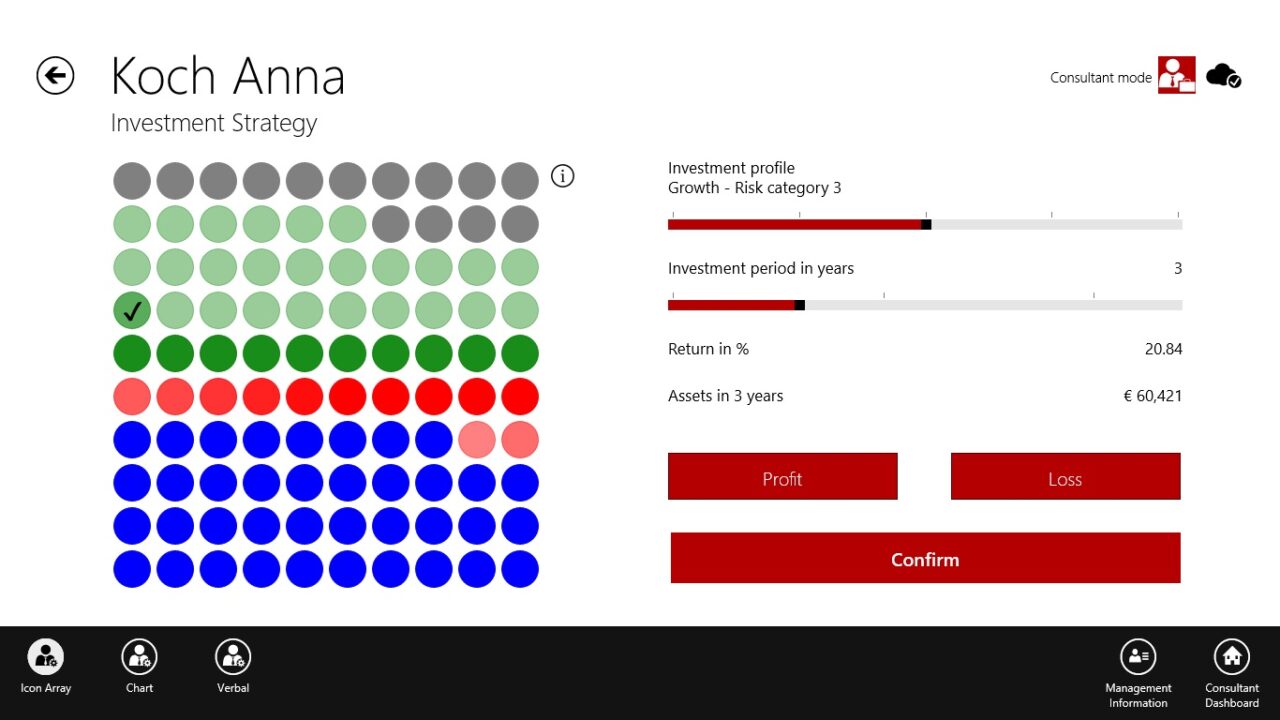

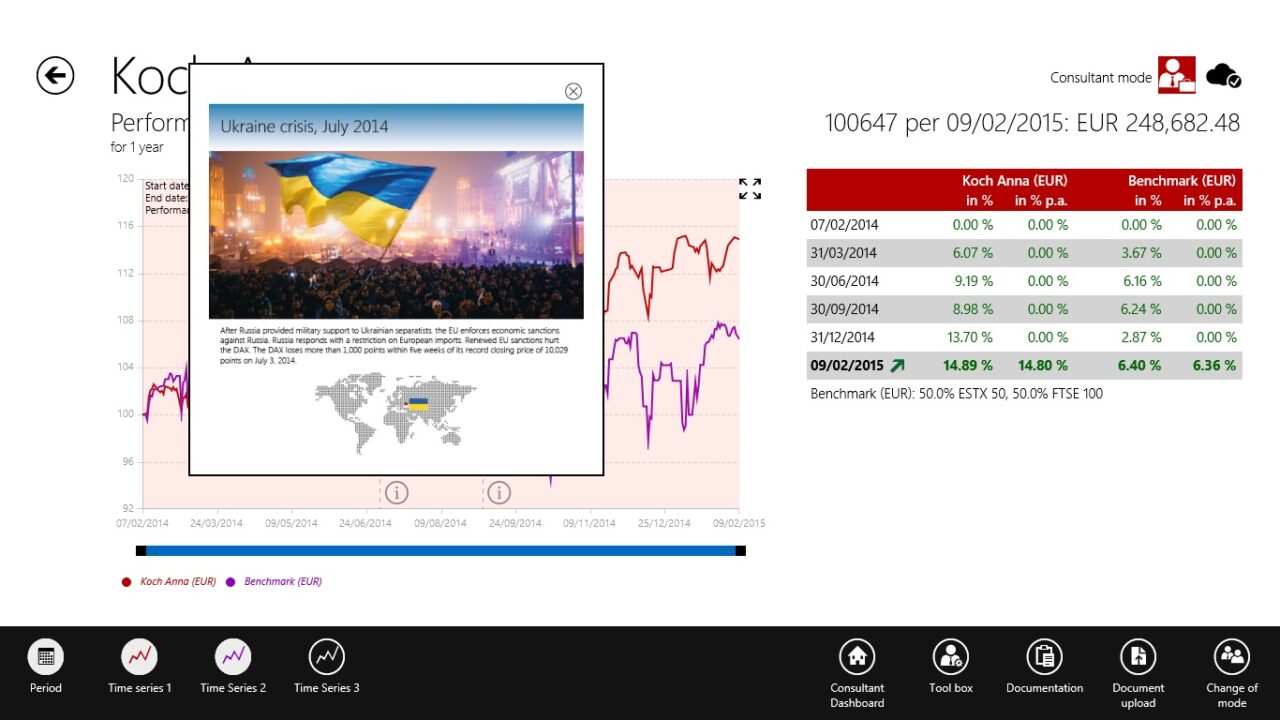

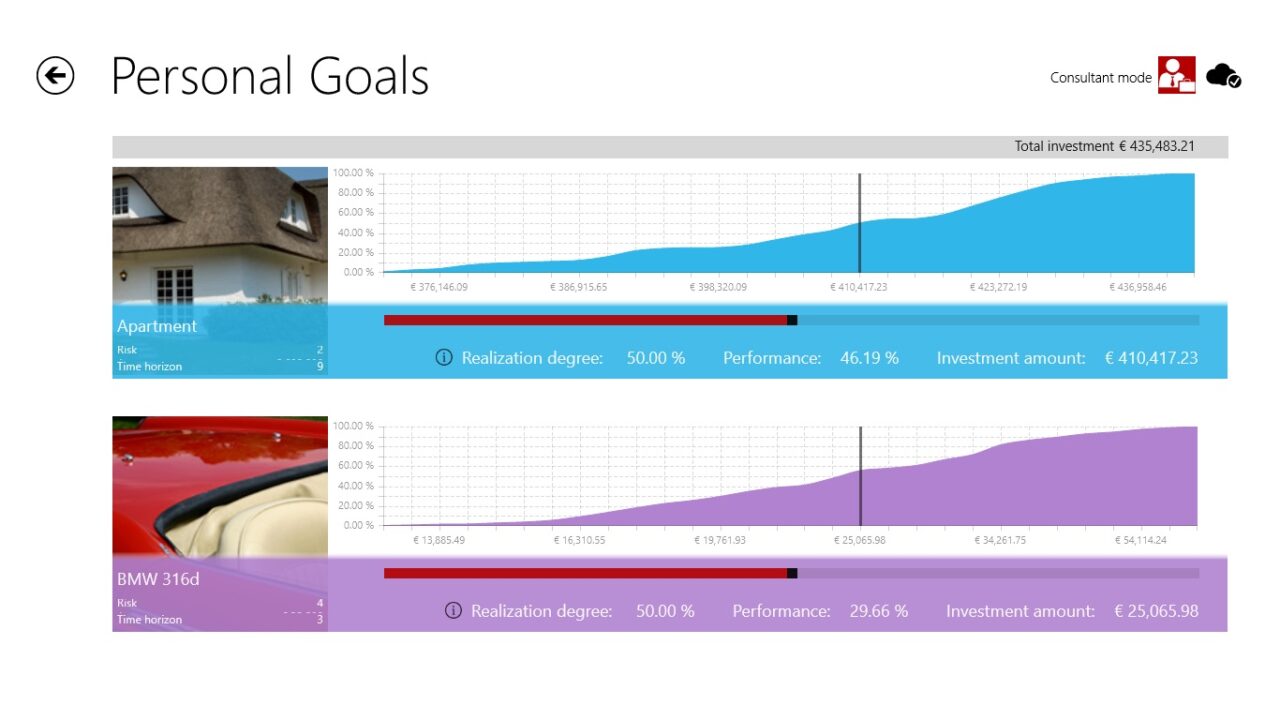

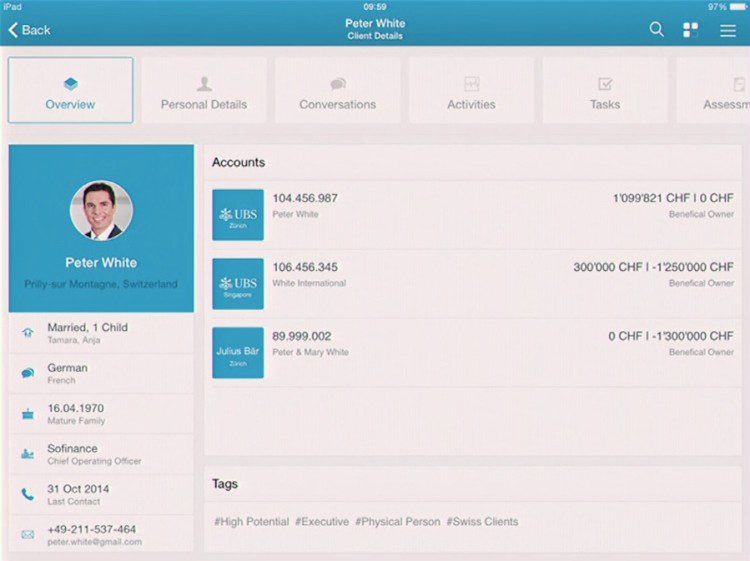

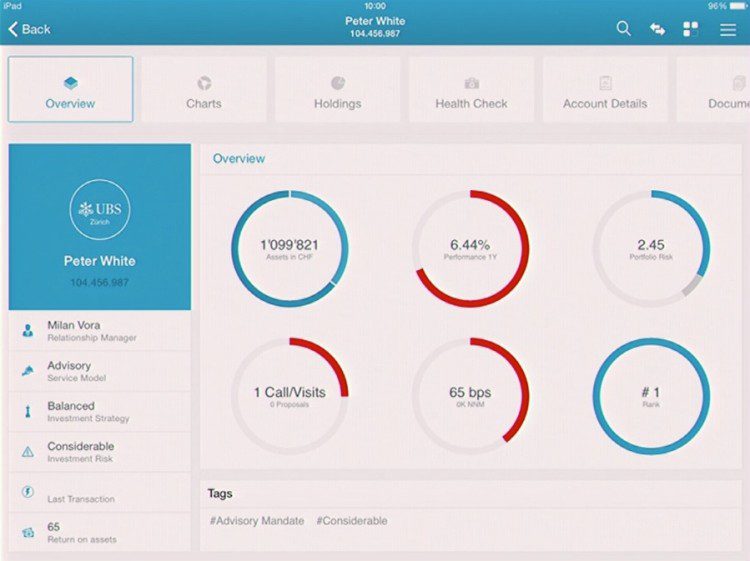

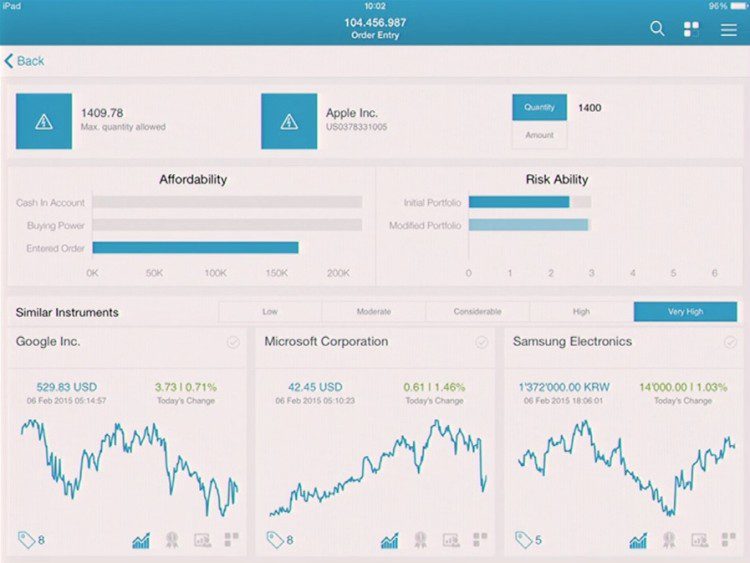

Screenshots below show a sample of features an adviser may use during a client meeting:

Client dashboard

On the tablet app, the clean interface provides an overview of the client’s portfolio performance, asset allocation, and key financial information.

Investment strategy

Since clients have different learning methods, PROFOS uses both pictures and graphs to aid advisers in explaining how decisions will affect a portfolio.

The example below uses a picture to depict how risk and time could affect the client’s earnings.

Current events performance

PROFOS generates stress tests that simulate the effect(s) resulting from a major event, such as the recent Ukrainian crisis, on a client’s portfolio. The snapshot enables clients to understand the impact of both positive and negative historical events.

Goal tracking

PROFOS helps advisers track multiple financial goals for clients. The graphs make it easy for the adviser to show clients their progress and the projected possibility for achieving each goal.

CPB Software debuted PROFOS at FinovateEurope 2015 in London. Check out the live demo video.