San Francisco-based debt-management platform ReadyForZero has been acquired by newly rebranded Avant, a direct personal lender out of Chicago. Terms of the deal were not disclosed.

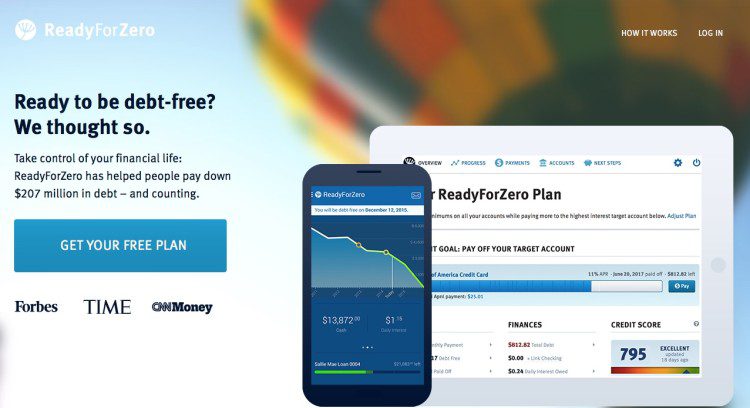

A FinovateFall 2011 alum, ReadyForZero specializes in helping people pay down personal debt, and includes debt from credit cards, student loans, and mortgages. The company’s platform aggregates the user’s debts, and then recommends a repayment plan. Alerts help debtors stay on track with payment due-date reminders, spend-or-save comparisons, and other notifications. And with regular reporting of on-time payments, the technology helps users bolster their credit scores.

Above: ReadyForZero CEO Rod Ebrahimi presented at FinovateFall 2011 in New York.

ReadyForZero says it has helped users pay down more than $240 million in debt since inception. The service is free, although there are paid premium options that provide features such as credit monitoring and automation. The company partners with Yodlee, Experian and others for data, and has lending partnerships with both Lending Club and Prosper. ReadyForZero was founded in 2010 by Rod Ebrahimi, CEO, and Ignacio Thayer, CTO, and is headquartered in San Francisco. The company has raised a total of $4.8 million in capital as of its latest completed round in 2011.

The acquisition will enable Avant to add ReadyForZero’s debt-management technology to its own big data credit-scoring platform, and move beyond lending toward a more complete consumer finance company. Founded in 2012 as AvantCredit, Avant has funded more than 175,000 personal loans worth more than $400 million, and earned a #6 ranking in Forbes’ America’s Most Promising Company’s list in January. The company has been a magnet for investor capital, raising $225 million from Tiger Global Management and PayPal co-founder Peter Thiel last December, giving Avant more than $330 million in equity financing, plus more than $700 million in debt financing.