Wealth management is a people business. The biggest evidence of that is the amount of technology devoted not only to managing assets, but also managing people.

That’s one of the biggest takeaways from the new platform for wealth managers demonstrated by mydesq during its Finovate debut in February. By putting more information at the fingertips of wealth managers—no simple task—mydesq makes it easy for managers to know more about their clients, their investments, their financial behavior, their goals, and ultimately, what it will take to build the strongest, most valuable client/manager relationship possible.

The stats

- Founded in July 2014

- Headquartered in Zurich, Switzerland

- $1 million in funding raised

- Milan Vora is CEO

The story

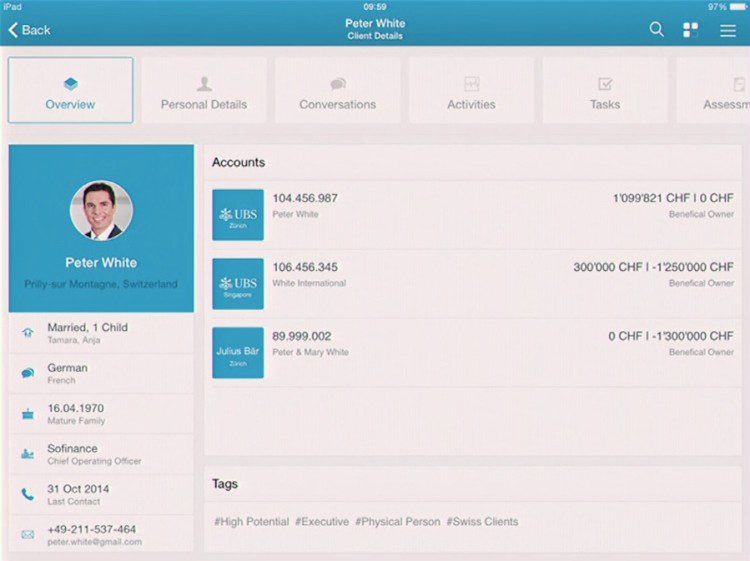

mydesq makes available on tablet everything a professional wealth manager needs to work with a client. This gives wealth managers the ability to do their jobs on the go. But the real value of the technology lies in the speed and ease at which it delivers relevant information.

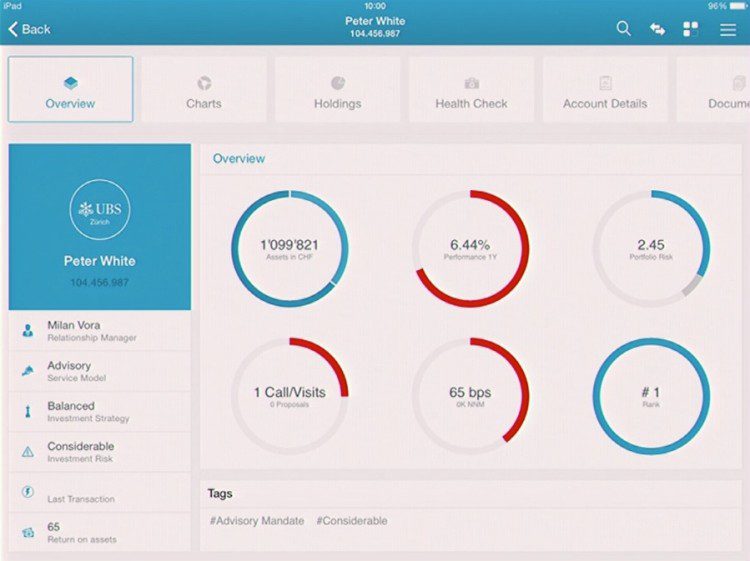

What’s relevant can range from a client’s current investments to the weather forecast at the client’s location. Whatever it takes for a wealth manager to get up to speed quickly with a given client—for example, handling an unexpected phone call from an old client eager to do business—can be easily seen: Each account is divided into six key areas displayed graphically with donut charts. These areas, including assets, account performance, risk profile, even customer-engagement metrics like frequency of contacts from the manager, are located at the top of the account page and can be analyzed further individually. mydesq even displays how much the manager is earning from the client’s business.

And because it’s built on a tablet, navigation is a matter of simply tapping the screen.

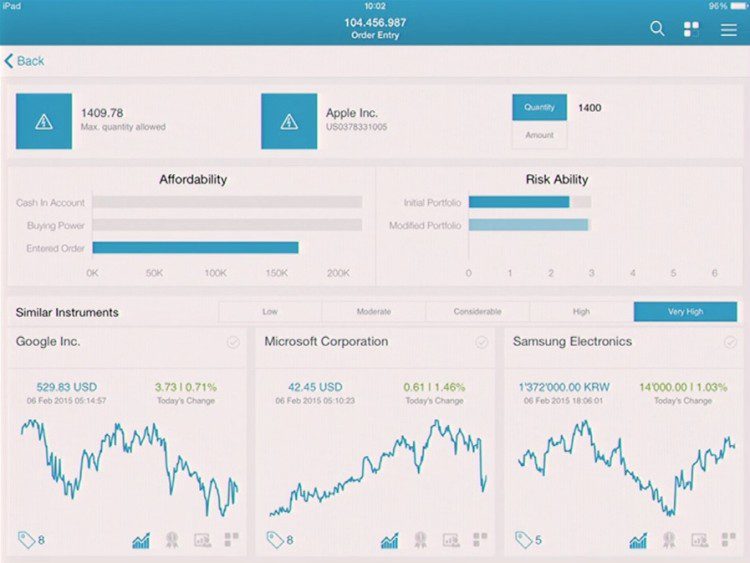

The platform helps wealth managers handle the basic tasks of handling wealth as well. The technology’s investment-suitability engine makes sure that proposed trades and investments are consistent with the client’s assets, investment risk profile versus product risk, and other factors. For compliance, the disclosure documents, educational materials and suitability letters are all available due to the platform’s proprietary rule engine. And location is no obstacle: “Any regulations in any combination,” Vora said. “We timed at a Swiss bank how long it took a wealth manager to do this trade and all these other things manually. It took them 17 minutes. Here you can do it in 30 seconds.”

The technology also allows wealth managers to show their clients walk-forward, risk analysis models of how the portfolio will be affected by various stressors and potential market conditions.

The future

Reflecting on mydesq’s Finovate debut, Francis Groves of MyPrivateBankingResearch was especially impressed by the platform’s ability to keep wealth managers compliant. “This not only enables advisors to keep up-to-date with regulations in multiple jurisdictions, but also seamlessly introduces all necessary compliance-related changes to the adviser’s work processes,” Groves wrote. The technology was also among the FinovateEurope 2015 favorites of DataMonitor Financial Senior Analyst Bartosz Golba.

Adding new features, such as Liquidity Projections and KYC is among mydesq’s top priorities, as is keeping the brand visible via participation in events like the recently held Digital Banking Summit in Barcelona.

From the Finovate stage, mydesq CEO Vora explained his company’s technology as more than just putting a wealth manager’s Bloomberg, CRM, portfolio analysis, MIS, and more all in one place and “fit it onto an iPad.” The goal is to make wealth managers more proactive, more compliant with regulations, and more efficient through automation and other technologies. For wealth managers who share this goal, mydesq may be a worthwhile first step.

See mydesq demo its technology live at FinovateEurope 2015.