It’s hard to believe FinovateSpring 2015 is just two weeks away. We’re getting excited about greeting familiar faces in the fintech community and eager to see the wide variety of fintech to be demoed 12/13 May. Register here to join us.

Today’s Sneak Peek introduces 15 more presenters.

Here’s a catalogue of the entire Sneak Peek series:

- Sneak Peek Part 1: Alpha Payments Cloud, CUneXus, DRAFT, FundAmerica, SayPay, StockViews, and TrueAccord

- Sneak Peek Part 2: Bento for Business, DoubleNet Pay, Karmic Labs, SizeUp, Stratos, TickerTags, and Trulioo

- Sneak Peek Part 3: 3E Software, Corezoid, Malauzai Software, PayActiv, PsychSignal, Someone With Group, and Trizic

- Sneak Peek Part 4: Currency Cloud, Dream Payments, Hip Pocket, INETCO Systems, LoanNow, WealthForge, and Yodlee

- Sneak Peek Part 5: DarcMatter, Digital Insight, Emailage, Hedgeable, Moven, RAGE Frameworks, Shoeboxed

- Sneak Peek Part 6: Credit Sesame, Hip Pocket, itBit, Kofax, Mitek, NAMU Systems, Persistent Systems

- Sneak Peek: Aurora Financial Systems and Mistral Mobile

Avoka’s frictionless digital engagement platform eases the pain of online transactions for financial organizations.

Avoka’s frictionless digital engagement platform eases the pain of online transactions for financial organizations.

Why it’s great

Avoka gets real-world results.

- Founded: 2002

- HQ: Broomfield, CO

![]() CBW Bank will show Yantra’s ONE Card platform that provides a secure and convenient alternative to traditional bank accounts for financial institutions, program managers and corporate clients.

CBW Bank will show Yantra’s ONE Card platform that provides a secure and convenient alternative to traditional bank accounts for financial institutions, program managers and corporate clients.

Why it’s great

Yantra rebuilds plumbing, standardizes and normalizes data across channels, and embeds compliance.

- Founded: 1892

- HQ: Weir, Kansas

Cloud Lending Solutions‘ CL Exchange increases the volume of loans for all non-bank lenders.

Cloud Lending Solutions‘ CL Exchange increases the volume of loans for all non-bank lenders.

Why it’s great

Cloud Lending Solutions uses an auction marketplace to bring borrowers and lenders together.

- Founded: 2012

- HQ: San Mateo, CA

![]() Context Relevant’s automated behavioral predictive analytics software is solving Wall Street’s most daunting challenges for large financial institutions.

Context Relevant’s automated behavioral predictive analytics software is solving Wall Street’s most daunting challenges for large financial institutions.

Why it’s great

Context Relevant works in real time.

- Founded: 2012

- HQ: Seattle, WA

![]() Dealstruck’s web and mobile managed-asset-based line of credit offers flexible capital to small businesses.

Dealstruck’s web and mobile managed-asset-based line of credit offers flexible capital to small businesses.

Why it’s great

Dealstruck uses intuitive interfaces, advanced integration with existing technologies, strategic financial institution partnerships and easy-to-understand functionality.

- Founded: 2013

- HQ: Carlsbad, California

![]() DriveWealth’s Brokerage-as-a-Service offers mass retail investors low cost access to the world’s most desired asset class.

DriveWealth’s Brokerage-as-a-Service offers mass retail investors low cost access to the world’s most desired asset class.

Why it’s great

DriveWealth offers a full-stack investing platform.

- Founded: 2012

- HQ: Chatham, New Jersey

![]() Dwolla’s platform of innovation, authentication and directory tools offer government, businesses, and consumers the ability to disseminate personal information when sending or receiving payments.

Dwolla’s platform of innovation, authentication and directory tools offer government, businesses, and consumers the ability to disseminate personal information when sending or receiving payments.

Why it’s great

Dwolla charges just $0.25 per transaction or is free for transactions $10 or less.

- Founded: 2008

- HQ: Des Moines, Iowa

Dynamics produces and manufactures intelligent, powered payment cards.

Dynamics produces and manufactures intelligent, powered payment cards.

Why it’s great

Dynamics’ intelligent payment cards enable users to earn exclusive rewards faster than traditional cards.

- Founded 2007

- HQ: Cheswick, Pennsylvania

Encap Security ‘s strong authentication solution powers user verification and transaction security.

Encap Security ‘s strong authentication solution powers user verification and transaction security.

Why it’s great

Encap Security works with any and every access point of any bank.

- Founded: 2013

- HQ: Palo Alto, California

![]() EyeBuy’s TV and video monetization platform enables consumers to purchase products on impulse that they see on TV.

EyeBuy’s TV and video monetization platform enables consumers to purchase products on impulse that they see on TV.

Why it’s great

EyeBuy’s technology recognizes products on TV and video.

- Founded: 2014

- HQ: Rancho Murieta, California

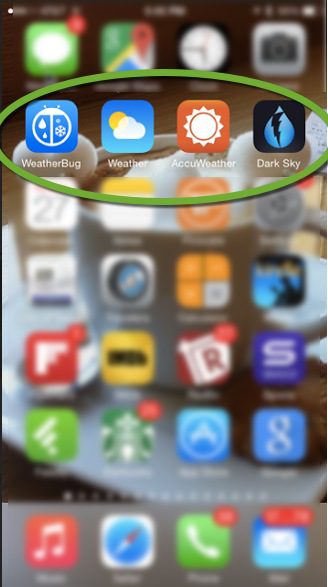

FIS Mobile’s mobile banking feature solves the mobile innovation gap for financial institutions.

FIS Mobile’s mobile banking feature solves the mobile innovation gap for financial institutions.

Why it’s great

FIS Mobile enables banks to expand their card services to consumers’ mobile devices.

- Founded: 2006

- HQ: Jacksonville, Florida

![]() Kabbage’s Kabbage Card offers access to working capital for small businesses.

Kabbage’s Kabbage Card offers access to working capital for small businesses.

Why it’s great

Kabbage gives small businesses immediate access to their funds.

- Founded: 2009

- HQ: Atlanta, Georgia

Knox Payments is a payment processing platform that uses customers’ bank account credentials, not their credit card.

Knox Payments is a payment processing platform that uses customers’ bank account credentials, not their credit card.

Why it’s great

Knox enables merchants to process payments across all platforms for just $0.18.

- Founded: 2014

- HQ: Richmond, Virginia

LendingTree is an intelligent personal finance platform that simplifies the complexities in loan shopping to save borrowers money.

LendingTree is an intelligent personal finance platform that simplifies the complexities in loan shopping to save borrowers money.

Why it’s great

LendingTree uses brand equity, proprietary technology and complex algorithms.

- Founded: 1996

- HQ: Charlotte, North Carolina

![]() LendKey is an online lending technology platform for consumers and financial institutions.

LendKey is an online lending technology platform for consumers and financial institutions.

Why it’s great

LendKey offers a transparent loan shopping experience.

- Founded: 2007

- HQ: New York City, New York

Stay tuned on Thursday when we’ll introduce the remaining presenters.

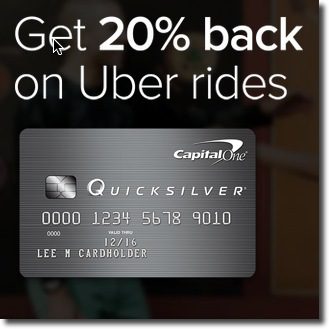

Last week, Capital One launched a national marketing promotion with Uber that provides a 20% rebate on rides for one year. And unlike many (most?) card offers, it’s good for both new and existing Capital One customers. However, the ride-rebate applies only to the bank’s Quicksilver cash-back card, so I’m out of luck with my Capital One Venture card.

Last week, Capital One launched a national marketing promotion with Uber that provides a 20% rebate on rides for one year. And unlike many (most?) card offers, it’s good for both new and existing Capital One customers. However, the ride-rebate applies only to the bank’s Quicksilver cash-back card, so I’m out of luck with my Capital One Venture card.

Aurora

Aurora Chris Melendez, Chief Strategy Officer

Chris Melendez, Chief Strategy Officer

Ludwig Schulze, CEO

Ludwig Schulze, CEO Paul Yoo, Chief Commercial Officer

Paul Yoo, Chief Commercial Officer

Adrian Nazari, CEO

Adrian Nazari, CEO Jesse Levey, Head of Product

Jesse Levey, Head of Product

Mark Zmarzly, CEO, Founder

Mark Zmarzly, CEO, Founder Todd Cramer, Head of Digital Experience & Design

Todd Cramer, Head of Digital Experience & Design itBit

itBit Charles Cascarilla, CEO, Co-founder

Charles Cascarilla, CEO, Co-founder Bobby Cho, Director of Institutional Client Group (ICG)

Bobby Cho, Director of Institutional Client Group (ICG) Drew Hyatt, Senior Vice President, Mobile Applications

Drew Hyatt, Senior Vice President, Mobile Applications Diane Morgan, Senior Business Development Manager

Diane Morgan, Senior Business Development Manager Mitek

Mitek Michael Nelson, Vice President for Business Development

Michael Nelson, Vice President for Business Development Sarah Clark, Vice President Product Owner

Sarah Clark, Vice President Product Owner

Thomas Ko, President, Co-founder

Thomas Ko, President, Co-founder Piotr Budzinski, CEO, Co-founder

Piotr Budzinski, CEO, Co-founder

Abhiram Modak, Principal Business Analyst & Industry Expert

Abhiram Modak, Principal Business Analyst & Industry Expert The alternative lending sector, especially in China, is soaking up funds at an unprecedented pace. This week alone, more than $750 million went to startup lenders, 80% earmarked to China (Lufax $485 million and Jimubox $84 million), while Funding Circle (London, $150 million), EZBob (London, $45 million), Smava (Germany, $16 million), and Assetz (London, $4.5 million) rounded out the sector’s inflow.

The alternative lending sector, especially in China, is soaking up funds at an unprecedented pace. This week alone, more than $750 million went to startup lenders, 80% earmarked to China (Lufax $485 million and Jimubox $84 million), while Funding Circle (London, $150 million), EZBob (London, $45 million), Smava (Germany, $16 million), and Assetz (London, $4.5 million) rounded out the sector’s inflow.