Are you building new financial technology? Be sure to check out coverage from our recent developers conference in San Francisco. We’re taking the fintech developer tool showcase to New York, 29/30 March 2016. Stay tuned for details.

Developer news

- “Hack (Make!) the Bank London tickets now on sale for 7/8 November 2015″

- Check out notes from API Days London all sketched out.

The latest from FinDEVr San Francisco 2015 presenters

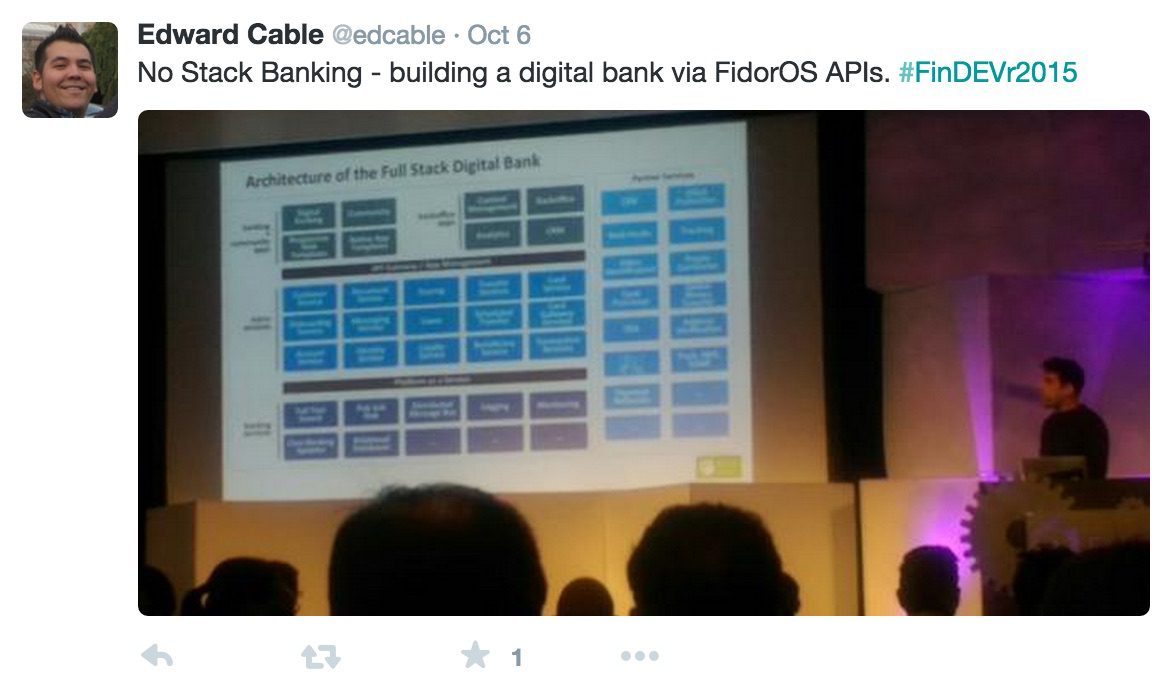

- Fidor Bank wins in two categories at BAI Retail Delivery’s Global Banking Innovation Awards.

- WSJ features BehavioSec and Nymi in its piece, The Next Security Frontier: The Human Body.

- PYMNTS.com takes a look at Currency Cloud and the latest update to its API, Payment Engine Two.

- Worldpay’s IPO on London Stock Exchange is the U.K.’s largest IPO of the year, at a market cap of £4.8 billion ($7.3 billion).

- Self Lender names MX one of three startups “absolutely crushing it” in fintech.

- “Kabbage’s Fresh $135 Million to Help Grow Karrot Consumer Lending Platform”

Alumni updates

- PocketSmith launches in Xero Add-On Marketplace.

- Expensify launches new integration features for Xero.

- Nymi recruits CEO John Haggard; Karl Martin will now serve as CTO.

Stay up to date on daily developments by following FinDEVr on Twitter.