Buoyed by 7 Startupbootcamp Insurance entrants—each grabbing $17,000—a record 30 fintech companies raised money this week for a total of just under $100 million ($95.8 million). Only two companies topped 7 figures: real estate specialist EasyProperty ($37.6 million) and Lemonade, a P2P insurance play ($13 million).

Buoyed by 7 Startupbootcamp Insurance entrants—each grabbing $17,000—a record 30 fintech companies raised money this week for a total of just under $100 million ($95.8 million). Only two companies topped 7 figures: real estate specialist EasyProperty ($37.6 million) and Lemonade, a P2P insurance play ($13 million).

Four Finovate alums were among the bunch:

With just two weeks remaining in the year, the total invested in private fintech companies YTD is $18.1 billion.

Here are the deals by size from 5 Dec to 11 Dec 2015:

EasyProperty

Residential and commercial property search

Latest round: $37.6 million Series C

Total raised: $47.9 million

HQ: London, England, United Kingdom

Tags: Consumer, SMB, home buying, rental, mortgage

Source: Crunchbase

Lemonade

Peer to peer insurance

Latest round: $13 million Seed

Total raised: $13 million

HQ: New York City, New York

Tags: Consumer, P2P, insurance

Source: Crunchbase

Clip (PayClip)

Mobile payments and point-of-sale platform

Latest round: $8 million Series A

Total raised: $16.4 million

HQ: Mexico City, Mexico

Tags: Consumer, SMB, merchants, mPOS, credit/debit card acquiring, payments

Source: Crunchbase

GroundFloor

Real estate lending marketplace

Latest round: $5 million Series A

Total raised: $6 million

HQ: Atlanta, Georgia

Tags: Consumer, P2P lending, credit, underwriting, mortgage, investing, commercial real estate

Source: Crunchbase

KeyPair Inc

NFC hardware for mobile payments

Latest round: $5 million Series B

Total raised: Unknown

HQ: Seongnam, Korea

Tags: Consumer, mobile, security, authentication, identification

Source: Crunchbase

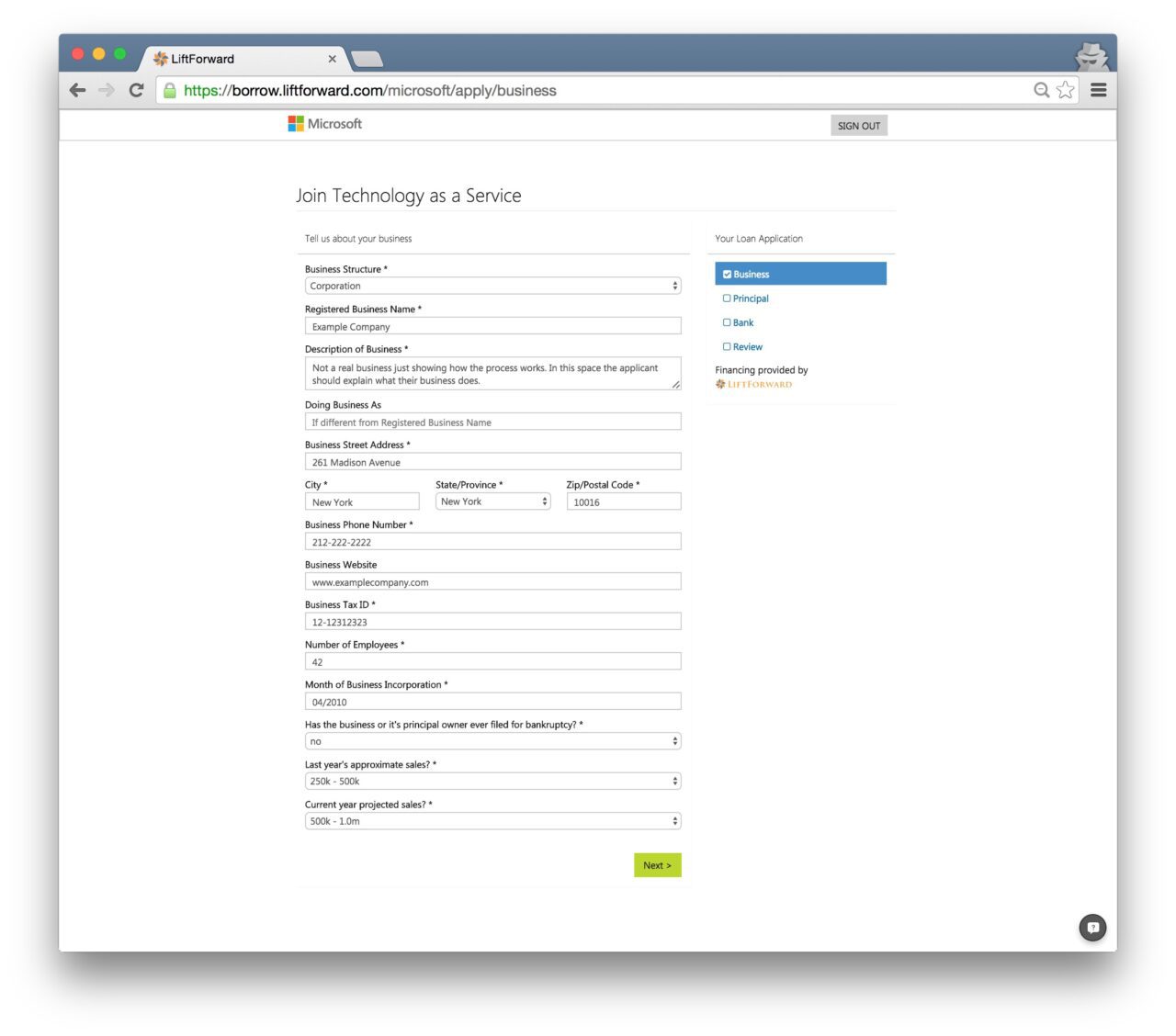

CBANC Network

Community financial institution research network

Latest round: $4 million Series B

Total raised: $5.7 million

HQ: Austin, Texas

Tags: Enterprise, B2B, networking, compliance, policies, Finovate alum

Source: Finovate

Aye Finance

Alt-lender to micro and small businesses

Latest round: $3 million

Total raised: $4 million

HQ: New Delhi, India

Tags: SMB, loans, commercial lending, credit, underwriting

Source: Crunchbase

Income&

Mortgage-based investment vehicle

Latest round: $2.9 million Seed

Total raised: $2.9 million

HQ: San Francisco, California

Tags: Consumer, investing, mortgage, REIT

Source: Crunchbase

Paynear

Mobile point-of-sale solution

Latest round: $2.5 million Seed

Total raised: $2.5 million

HQ: Hyperabad, India

Tags: SMB, merchants, acquiring, payments, mPOS, point of sale, hardware

Source: Crunchbase

Curve

Stealth mobile payments company

Latest round: $2 million Seed

Total raised: $2 million

HQ: London, England, United Kingdom

Tags: Consumer, mobile, payments, debit/credit cards

Source: Crunchbase

Melody Health Insurance

Health insurance startup

Latest round: $2.0 million ($2 million + $1.8 million option)

Total raised: $2.0 million

HQ: Denver, Colorado

Tags: Consumer, SMB, insurance, health care

Source: Crunchbase

TabbedOut

Mobile POS system for restaurants and bars

Latest round: $2 million Series C add-on

Total raised: $41 million

HQ: Austin, Texas

Tags: SMB, merchants, acquiring, payments, mPOS, point of sale

Source: Crunchbase

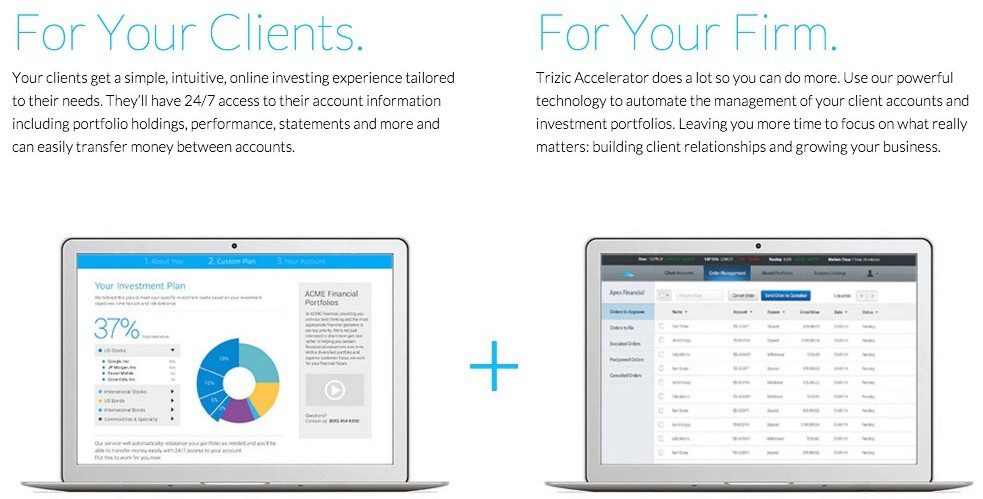

Trizic

Wealth-management platform for financial advisers

Latest round: $2 million

Total raised: $5 million

HQ: San Francisco, California

Tags: Advisers, investing, wealth management, Finovate Alum

Source: Finovate

Cookies Labs

P2P payments

Latest round: $1.6 million

Total raised: $1.6 million

HQ: Berlin, Germany

Tags: Consumer, person to person, payments, transfers

Source: FT Partners

Backed

Alt-lender specializing in credit with co-borrowers

Latest round: $1.5 million Seed

Total raised: $1.5 million

HQ: New York City, New York

Tags: Consumer, lending, personal loans, co-borrower, joint application, underwriting

Source: Crunchbase

TRData

Market data communications platform

Latest round: $1.3 million

Total raised: $1.3 million

HQ: London, England, United Kingdom

Tags: Investing, advisers, enterprise, trading, information

Source: FT Partners

Rippleshot

Credit and debit card security

Latest round: $1.2 million Seed

Total raised: $1.2 million

HQ: California

Tags: Consumer, security, big data, Finovate alum

Source: Finovate

Purse.io

Bitcoin payments

Latest round: $1 million Seed

Total raised: $1.3 million

HQ: San Francisco, California

Tags: Consumer, cryptocurrency, payments, remittances, P2P payments

Source: FT Partners

MoneyRemaid

Financial platform for underbanked

Latest round: $100,000 Prize

Total raised: Unknown

HQ: Malaysia

Tags: Remittances, PFM, financial literacy, MasterCard (sponsor)

Source: MasterCard

Rightindem

Insurance claim processing technology

Latest round: $17,000 Accelerator

Total raised: Unknown

HQ: London, England, United Kingdom

Tags: Insurance, enterprise, Startupbootcamp (accelerator)

Source: FT Partners

BimAfya

Mobile micro-insurance platform

Latest round: $17,000 Accelerator

Total raised: Unknown

HQ: Dar es Salaam, Tanzania

Tags: Insurance, underbanked, mobile, Startupbootcamp (accelerator)

Source: FT Partners

Covi Analytics

Analytics tool for insurance companies

Latest round: $17,000 Accelerator

Total raised: Unknown

HQ: California

Tags: Insurance, analytics, big data, underwriting, Startupbootcamp (accelerator)

Source: FT Partners

FitSense

Wearables analytics platform for insurance companies

Latest round: $17,000 Accelerator

Total raised: Unknown

HQ: Singapore

Tags: Insurance, enterprise, mobile, Startupbootcamp (accelerator)

Source: FT Partners

massUp

White-label platform for niche insurance sales

Latest round: $17,000 Accelerator

Total raised: Unknown

HQ: Germany

Tags: Insurance, mobile, underwriting, Startupbootcamp (accelerator)

Source: FT Partners

Quantifyle

Personal health monitoring for insurance rebates

Latest round: $17,000 Accelerator

Total raised: Unknown

HQ: London, England, United Kingdom

Tags: Insurance, Startupbootcamp (accelerator)

Source: FT Partners

Safer

Personal risk analyzer for insurance selection

Latest round: $17,000 Accelerator

Total raised: Unknown

HQ: London, England, United Kingdom

Tags: Consumer, insurance, lead gen, Startupbootcamp (accelerator)

Source: FT Partners

BankersLab

Lending training and compliance platform

Latest round: Undisclosed

Total raised: Unknown

HQ: San Francisco, California

Tags: Enterprise, training, commercial lending, benchmarking, gamification, Finovate alum

Source: Finovate

Bitx

Bitcoin exchange

Latest round: Unknown

Total raised: $8.8 million

HQ: Singapore

Tags: Consumer, payments, cryptocurrency, blockchain

Source: Crunchbase

eCurrency Mint (eCM)

Digital currency platform for central banks

Latest round: Undisclosed Series C

Total raised: Unknown

HQ: Dublin, Ireland

Tags: Central bank, cryptocurrency, bitcoin

Source: Crunchbase

Lenny

Credit-building microloans for college students

Latest round: Undisclosed

Total raised: Unknown

HQ: Santa Monica, California

Tags: Consumer, lending, student loan, youth market, credit, Dwolla (partner)

Source: Crunchbase, Finovate

Buoyed by 7 Startupbootcamp Insurance entrants—each grabbing $17,000—a record 30 fintech companies raised money this week for a total of just under $100 million ($95.8 million). Only two companies topped 7 figures: real estate specialist EasyProperty ($37.6 million) and Lemonade, a P2P insurance play ($13 million).

Buoyed by 7 Startupbootcamp Insurance entrants—each grabbing $17,000—a record 30 fintech companies raised money this week for a total of just under $100 million ($95.8 million). Only two companies topped 7 figures: real estate specialist EasyProperty ($37.6 million) and Lemonade, a P2P insurance play ($13 million).

Parrish, who also served as SVP for worldwide channels sales at NetApp, pointed to Check Point’s “20-year track record” of innovation and said she looked forward to having “the opportunity to extend Check Point’s lead in the market.”

Parrish, who also served as SVP for worldwide channels sales at NetApp, pointed to Check Point’s “20-year track record” of innovation and said she looked forward to having “the opportunity to extend Check Point’s lead in the market.”